Three major MNCs suffer consecutive setbacks, heralding dramatic changes in the billion-dollar market

Currently, beneath the seemingly thriving GLP-1 weight-loss drug market, undercurrents are stirring.

Shortly after Novo Nordisk lowered its full-year 2025 earnings forecast and its stock price plunged over 20% overnight, Eli Lilly fell 14% in a single night on the U.S. stock market on August 7, wiping out hundreds of billions in market value. Unlike Novo Nordisk, Eli Lilly delivered a strong Q2 2025 earnings report: revenue reached $15.56 billion, a 38% year-on-year increase, and the company raised its full-year revenue guidance to $60–62 billion, up from the previous $58–61 billion. However, the market reacted with panic selling due to disappointing clinical data from its oral weight-loss drug Orforglipron.

And not long ago, Pfizer also abandoned the development of its oral GLP-1 receptor agonist PF-06954522 due to poor data and market competition, leaving it with no remaining GLP-1 pipeline in the obesity treatment field.

The recent consecutive setbacks faced by multinational giants reflect a growing caution in the capital market toward this sector.

1Novo Nordisk faces challenges

Currently, the global GLP-1 market remains a duopoly, with Novo Nordisk and Eli Lilly holding an absolute dominant position, collectively occupying nearly 90% of the market, but competition between the two is becoming increasingly intense.

In its recently released financial report, Novo Nordisk disclosed that the total sales of semaglutide in the first half of 2025 amounted to approximately 16.632 billion USD. Currently, semaglutide has been developed into three products: Ozempic (an injectable for diabetes), Rybelsus (an oral for diabetes), and Wegovy (an injectable for weight loss). In the first half of this year, sales of these three products were 9.517 billion USD, 1.674 billion USD, and 5.441 billion USD, respectively, with year-on-year growth rates of 15%, 5%, and 78%. The data shows that sales growth of the injectable and oral diabetes treatments has clearly slowed, while the weight-loss injectable continues to maintain high growth.

Semaglutide was initially used to treat diabetes and was later found to significantly reduce body weight with manageable side effects, leading to rapidly growing market demand for the drug. Now, as the growth of two products for blood glucose control slows down, the weight-loss product Wegovy is facing increasing challenges. These challenges mainly come from two aspects: one is the erosion from semaglutide generics in the U.S. market, and the other is strong competition from Eli Lilly's tirzepatide.

Stimulated by the huge demand for semaglutide, various compounded drugs with "the same efficacy" as semaglutide have emerged on the U.S. market. These drugs use semaglutide as the base ingredient mixed with other substances, and are sold at prices far below the branded semaglutide, with the monthly treatment cost being about 20% of the genuine product.

Compounded medications are drugs manually prepared by pharmacists or physicians in pharmacies according to individual patient needs. They are typically used to adjust dosage forms and strengths, remove ingredients that cause patient allergies, provide special formulations not available in commercial drugs, and supplement supply shortages of commercial medications. Compounded drugs are not subject to FDA regulation or approval. These medications exist in a commercial gray area and are encroaching on the market space of legitimate semaglutide products.

To counter the impact of generic drugs, Novo Nordisk attempted to expand its drug distribution channels through several telemedicine platforms, including Hims & Hers. However, in June this year, Novo Nordisk announced it would terminate its partnership with Hims and cease supplying the FDA-approved weight-loss drug Wegovy, abruptly ending a commercial alliance that had lasted only 58 days. Novo Nordisk accused Hims of large-scale compounding, disguising it as personalized treatment, and engaging in deceptive marketing practices that jeopardize patient health. In its latest financial report, Novo Nordisk stated that such unsafe and illegal large-scale compounding continues to occur.

While facing generic semaglutide eroding its market share, Novo Nordisk is also encountering strong competition from Eli Lilly's tirzepatide.

2Eli Lilly faces setbacks in next-generation product development

Tirzepatide is a dual receptor agonist that improves glycemic control in patients with type 2 diabetes by activating both GLP-1 and GIP receptors. After binding to the GLP-1 receptor, tirzepatide enhances glucose-dependent insulin secretion, suppresses postprandial glucagon release, and slows gastric emptying, helping to reduce food intake and control body weight. Simultaneously, tirzepatide activates the glucose-dependent insulinotropic polypeptide (GIP) receptor, further promoting insulin secretion and regulating appetite through the central nervous system, thereby enhancing glycemic control. The dual activation of these two receptors produces a strong synergistic effect.

Results from a head-to-head clinical trial showed that tirzeptide, a GLP-1/GIP dual receptor agonist, outperformed Novo Nordisk's GLP-1 single receptor agonist semaglutide in weight loss efficacy. Driven by superior weight reduction, Eli Lilly's tirzeptide has rapidly gained market share. According to Eli Lilly, prescriptions for tirzeptide have now surpassed those for semaglutide.

Under the dual pressure of generic semaglutide eroding market share and Eli Lilly's tirzepatide, Novo Nordisk's revenue growth has begun to slow. Given this situation, Novo Nordisk has again lowered its full-year 2025 financial outlook, now expecting sales growth of 8%-14%. Affected by this news, Novo Nordisk's stock price fell over 20% in the U.S. market on July 29.

And as the current party with competitive advantage, the market also has considerable doubts about Lilly's prospects.

Lilly's Q2 financial report this year showed that the company's revenue reached $15.56 billion, up 38% year-on-year and exceeding the market expectation of $14.7 billion, primarily driven by increased sales of Mounjaro and Zepbound. Both Mounjaro and Zepbound contain the active ingredient tirzepatide but are approved for different indications—Mounjaro for diabetes and Zepbound for obesity. Data showed that Mounjaro, Lilly's diabetes treatment, generated nearly $5.2 billion in revenue this quarter, a 68% year-on-year increase, significantly surpassing expectations. Zepbound, the weight-loss drug, performed even more impressively, achieving sales of $3.38 billion in the quarter, a staggering 172% year-on-year growth. Together, these two tirzepatide-based products contributed $8.6 billion in revenue, accounting for 55% of the company's total revenue and serving as the main driver of Lilly's Q2 performance growth this year. Based on this strong performance, Lilly has raised its full-year revenue guidance to $60–62 billion, up from the previous estimate of $58–61 billion.

However, such impressive financial results did not receive positive market feedback. After Eli Lilly released its earnings report on August 7, the company's stock price continued to decline in the U.S. market, closing down more than 14%. Behind this stark contrast was the Phase III data of the oral small-molecule GLP-1 drug Orforglipron, which failed to meet market expectations.

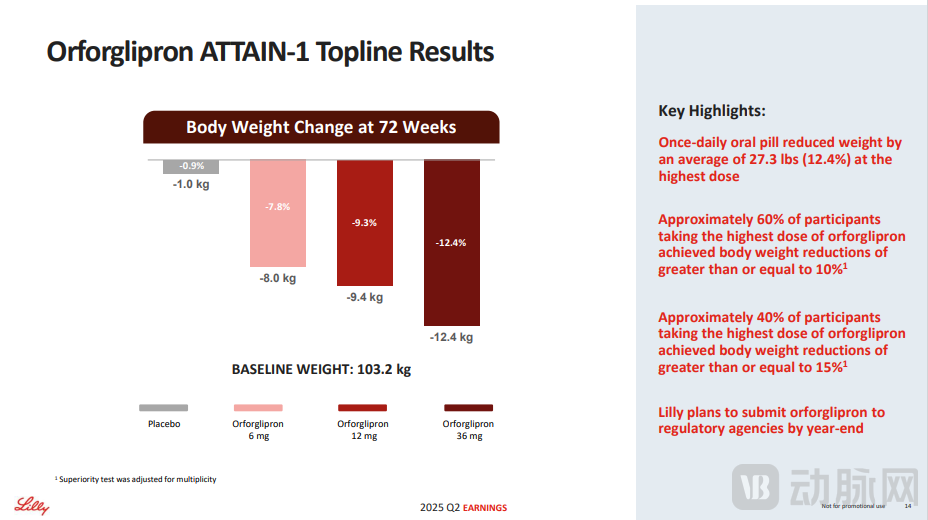

Eli Lilly's公布的 clinical trial data showed that the oral weight-loss drug Orforglipron achieved an average weight reduction of 12.4% at the highest dose over 72 weeks, but the market had previously expected a reduction of around 15%. Moreover, 25% of patients in the highest dose group discontinued the trial early, leading some investors to question the design of the study.

Figure 1. Clinical trial results of the oral weight-loss drug Orforglipron (disclosed by Eli Lilly and Company)

Market expectations for Orforglipron becoming the next-generation GLP-1 weight-loss drug have vanished. In contrast, Novo Nordisk, which owns the oral semaglutide formulation, saw its stock rise 7.45% in the U.S. market that day, marking its largest gain recently.Investors' attention has once again returned to oral peptide drugs.。

Behind the repeated shifts in market expectations lies the fact that competition in the GLP-1 market has reached a fever pitch. Oral GLP-1 drugs, once expected by the market to become the next generation of weight-loss medications due to better patient adherence, have now fallen silent. In fact, not only Eli Lilly, but also Novo Nordisk and Pfizer, are all encountering difficulties in the development of their oral GLP-1 drugs.

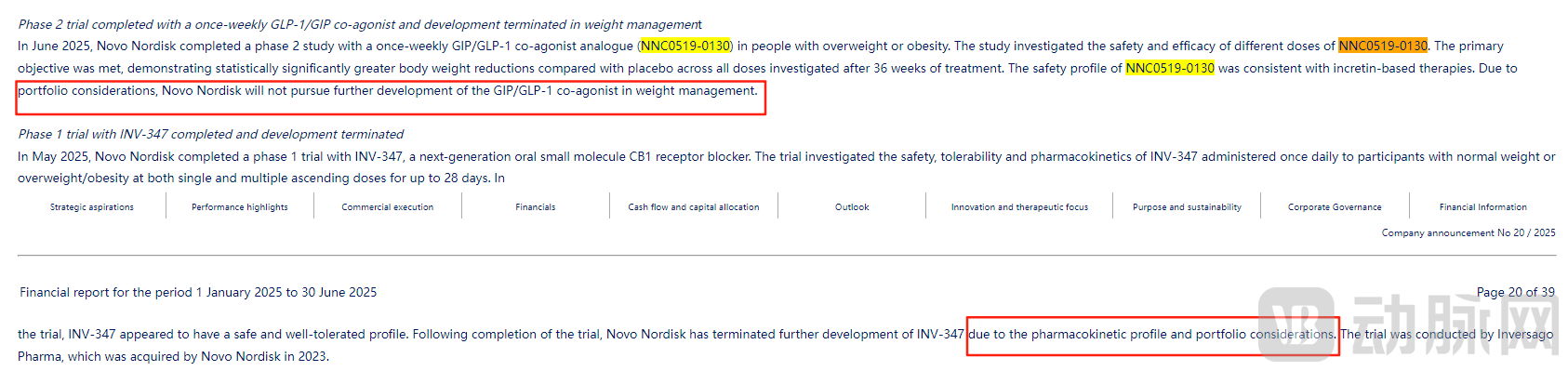

Alongside the release of its Q2 2025 results, Novo Nordisk updated its pipeline information, discontinuing clinical trials for two weight-loss drugs.

NNC0519-0130 is a GLP-1/GIP dual receptor agonist, and its Phase II clinical trial in patients with overweight or obesity was completed in June 2025. The study evaluated the safety and efficacy of different doses of NNC0519-0130, achieving its primary objectives. Data showed that after 36 weeks of treatment, weight reduction was statistically significant across all dose groups. Although the trial results were positive, Novo Nordisk has decided not to further develop NNC0519-0130 for weight management due to portfolio considerations.

In addition, Novo Nordisk has disclosed the discontinuation of the development of INV-347, a next-generation oral small-molecule CB1 receptor antagonist. In May 2025, Novo Nordisk completed a Phase I clinical trial of INV-347, which aimed to evaluate the safety, tolerability, and pharmacokinetic profile of once-daily INV-347. The trial demonstrated that INV-347 was safe and well-tolerated. Following completion of the trial, Novo Nordisk stated that further development of INV-347 would be discontinued due to considerations regarding its pharmacokinetic properties and portfolio strategy.

Figure 2. Clinical trials for two Novo Nordisk weight-loss drugs were discontinued (Source: Novo Nordisk financial report)

Pfizer has suffered three consecutive setbacks in the oral GLP-1 market.

3Pfizer's GLP-1 pipeline in the obesity treatment field has been completely eliminated

Recently, Pfizer discontinued the development of its oral GLP-1 receptor agonist PF-06954522 due to poor data and changes in the competitive landscape, leaving it with no remaining GLP-1 pipeline in the obesity treatment field.

At the end of 2023, the oral GLP-1 candidate drug Lotiglipron was discontinued due to liver injury risks observed in clinical trials. In April 2025, the development of Danuglipron was also halted. Pfizer stated that in a dose-ranging study, one participant experienced potential drug-induced liver injury. Although symptoms resolved after discontinuation, Pfizer decided to stop the development of Danuglipron after reviewing all available information.

PF-06954522 was acquired by Pfizer in November 2015 from Sosei Heptares. Unlike the first two GLP-1 candidates that were discontinued due to safety concerns, Pfizer abandoned the development of PF-06954522 because its Phase I trial data did not meet expectations and based on an assessment of the GLP-1 market landscape.

Thus, Pfizer's GLP-1 research pipeline has been reduced to zero. In the future, Pfizer will place greater hopes on seeking external collaborations.

From the progress of multinational pharmaceutical companies in the GLP-1 field, it is evident that this sector has now become a highly competitive market, and the era of "exorbitant profits" in the GLP-1 weight-loss drug market has ended.Meanwhile, domestic pharmaceutical companies continue to flood into this market.

4Domestic enterprises are competing in terms of efficacy and safety.

Although major multinational giants are already fiercely competing in the GLP-1 weight-loss drug market, domestic companies now entering the battlefield still have their own calculations—grabbing a share of the huge weight-loss drug market would be enough for domestic firms to enjoy a substantial feast.

According to statistics, as of August 8, a total of five GLP-1 drugs for weight-loss indications have been approved for marketing in the domestic market.

Figure 3. Currently marketed GLP-1 drugs for weight-loss indication (Arterial Network chart)

The domestically developed drug currently highly anticipated by the market is Innovent's Mazdutide. Mazdutide is a GCG/GLP-1 dual receptor agonist that reduces appetite and promotes weight loss by activating the GLP-1 receptor, while increasing energy expenditure through activation of the GCG receptor.

The results of the Phase III GLORY-1 clinical trial for masidenafil showed that, at week 48, the mean change in body weight from baseline was -12.05%, -14.84%, and -0.47% in the masidenafil 4 mg, 6 mg, and placebo groups, respectively. Additionally, masidenafil significantly reduced liver fat content in overweight or obese subjects and demonstrated good overall tolerability and safety.

Following Xinda are a larger group of domestic pharmaceutical companies chasing closely behind.

According to Arterial Network, as of August 8, there are 212 GLP-1 drugs in China undergoing Phase I to Phase III clinical trials targeting weight loss/obesity indications. Faced with such intense competition, domestic companies have begun implementing their own differentiated strategies.

Currently, the core demands for weight-loss drugs are more significant weight reduction effects and better patient compliance. The development of new GLP-1 drugs in China is mainly focused on these two aspects.

1) Better weight loss effect

The main reason Eli Lilly's tirzepatide can shine and achieve a leapfrog advancement is that dual-target agonists offer better weight-loss effects than single-target ones. Based on this concept, domestic companies have developed a series of products.

In addition to the already marketed I-Mab's Masudodipetide, pharmaceutical companies such as Hengrui and Sciwind Biosciences are also actively developing dual-target drugs. Currently, in the domestic market, Hengrui's HRS9531-301 is leading in clinical progress. Phase III clinical trial results of HRS9531 showed that after 48 weeks of treatment, the average weight reduction reached up to 17.7% (16.3% after placebo adjustment). In terms of safety, HRS9531 demonstrated favorable safety and tolerability, with most treatment-emergent adverse events being mild to moderate, primarily gastrointestinal-related events.HRS9531 is expected to become the second GLP-1/GIP dual receptor agonist in the Chinese market.

Figure 4. Major dual-target weight-loss drugs under development in the current domestic market (Diagram by Arterial Network)

Dual-target drugs have better weight-loss effects than single-target drugs. Domestic companies are actively developing triple-target drugs. According to our incomplete statistics, at least 12 products are currently advancing in clinical trials in China.

Figure 5. Triple-target anti-obesity drugs under development in the current domestic market (Arterial Network diagram)

2) Better patient compliance

Another approach in developing GLP-1 weight-loss drugs is to improve patient adherence, primarily through two research strategies: one is reducing the frequency of injections, and the other is developing oral small-molecule formulations.

Semaglutide is a once-weekly formulation, and currently domestic companies are actively developing formulations with dosing frequencies of once every two weeks or even once a month. For example, RAY1225 injection, an ultra-long-acting GLP-1/GIP agonist independently developed by Zhongsheng Ruichuang, a subsidiary of Zhongsheng Pharmaceutical, achieves a dosing frequency of once every two weeks.

Shijiu is also developing SYH9017, a once-monthly semaglutide product. Meanwhile, Hanyu Pharmaceutical's HY3003, a GLP-1/GIP/GCG triple agonist, is concurrently advancing the development of weekly, monthly, and oral formulations.

ButAs an injectable product, a once-weekly administration regimen is already relatively acceptable to patients, and developing longer-acting injectable formulations does not significantly improve the patient experience.。

What the market truly expects is the small-molecule oral formulation. In clinical use, oral formulations have always been more readily accepted by patients compared to injectables, thus enabling expansion of the patient population and capturing a larger market share. Major multinational pharmaceutical companies have previously been actively investing in oral small-molecule GLP-1 drugs, hoping to develop the next generation of weight-loss medications.

Domestic companies have also made moves in this field, such as Hengrui's HRS-7535, Huadong Medicine's HDM1002, Innovent's IBI3032, and Gilead's ASC30.

However, the recent consecutive setbacks of Pfizer, Eli Lilly, and Novo Nordisk have made us more clearly aware that,In the field of GLP-1 weight loss, small-molecule drugs are unlikely to achieve a balance between efficacy and safety.。

5The domestic weight-loss drug market is in a calm before the storm.

Given the challenges facing the development of next-generation oral small-molecule GLP-1 drugs, we believe market attention will shift back to peptide-based therapies. In overseas markets, the key focus ahead will remain the intense competition between Novo Nordisk's semaglutide and Eli Lilly's tirzepatide.

andThe domestic market is in a calm before the storm, a brief time window left for already-launched products.Semaglutide's original patent will expire in March 2026, and currently, more than 15 manufacturers in China have submitted applications for semaglutide generics. It is foreseeable that half a year later, as domestically produced semaglutide generics are gradually approved and launched, semaglutide products in the domestic market will enter a price-competitive situation.

Figure 6. Domestic market companies applying for clinical trials of semaglutide generics (Diagram by Arterial Network)

In addition, other domestic GLP-1 weight-loss drugs competing with semaglutide are also expected to be launched陆续 in 2026, with Hengrui's HRS9531 likely to be approved soonest. Hengrui will then gain a stronger advantage in the domestic market leveraging its commercialization capabilities. Competition in China's GLP-1 weight-loss drug market will become increasingly intense.

At that time, the competition in the GLP-1 weight-loss drug field will enter the second half.

If the competition in the first half tests a company's technological strength, then the leaders in the second half will need stronger market operation capabilities.

First, peptide drugs differ from small molecules and have more complex manufacturing processes. Overseas pharmaceutical companies have previously encountered difficulties due to production capacity constraints. Therefore, domestic companies with production capacity advantages will undoubtedly gain greater initiative in competition. Second, as generic versions of semaglutide陆续 enter the Chinese market, price competition is inevitable, and companies with lower production costs will clearly have an edge. Finally, stronger sales channels and products more readily accepted by patients can help companies secure greater commercial opportunities.

As the competition in GLP-1 weight-loss drugs enters the second half, products will transition from luxury items to mass-market consumer goods. The winner in this second phase will not be the one with the strongest technology, but the ecosystem builder best able to balance scientific value, patient accessibility, and commercial sustainability.