The “year of the bispecific”: how 2025’s top biopharma deals defied the downtrend, powered by Chinese innovation

Amidst a year that saw no explosive growth in overall biopharma deal volume, bispecific and multispecific antibodies emerged as undisputed "stars," particularly in oncology and beyond.

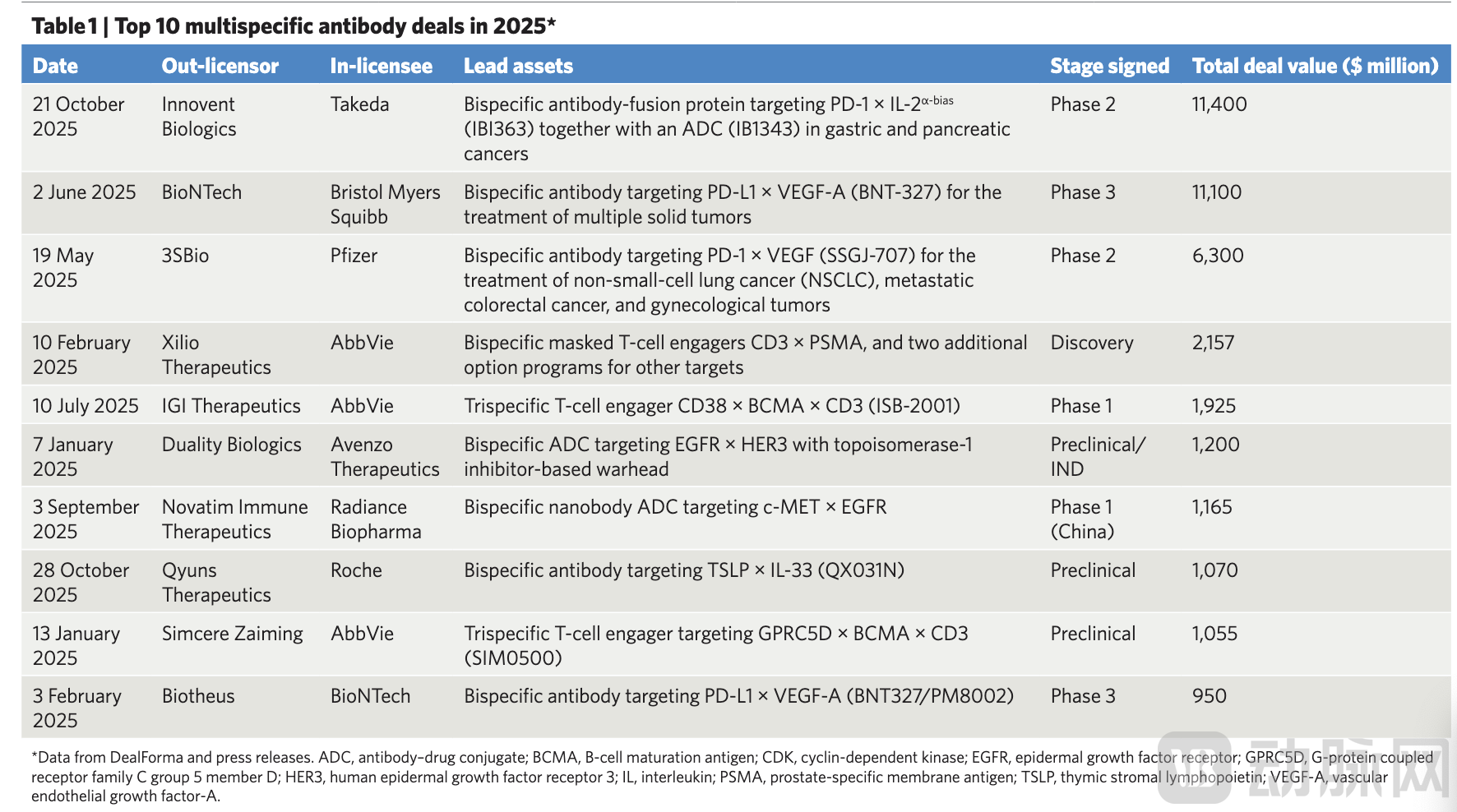

According to the report titled "The year of the bispecific in oncology and beyond," published in Nature Reviews Drug Discovery on December 1, 2025, bispecific or multispecific antibody projects accounted for one-quarter of the top 20 transactions by value recorded thus far in 2025.

Notably, assets from Chinese biotech companies played a significant role in these high-value transactions, highlighting China's robust capabilities in antibody engineering.

This trend not only marks the transition of bispecific antibody technology from a niche field to a mainstream focus but also signals its potential to replace traditional monoclonal antibodies and antibody-drug conjugates as the cornerstone of next-generation biopharmaceutical development.

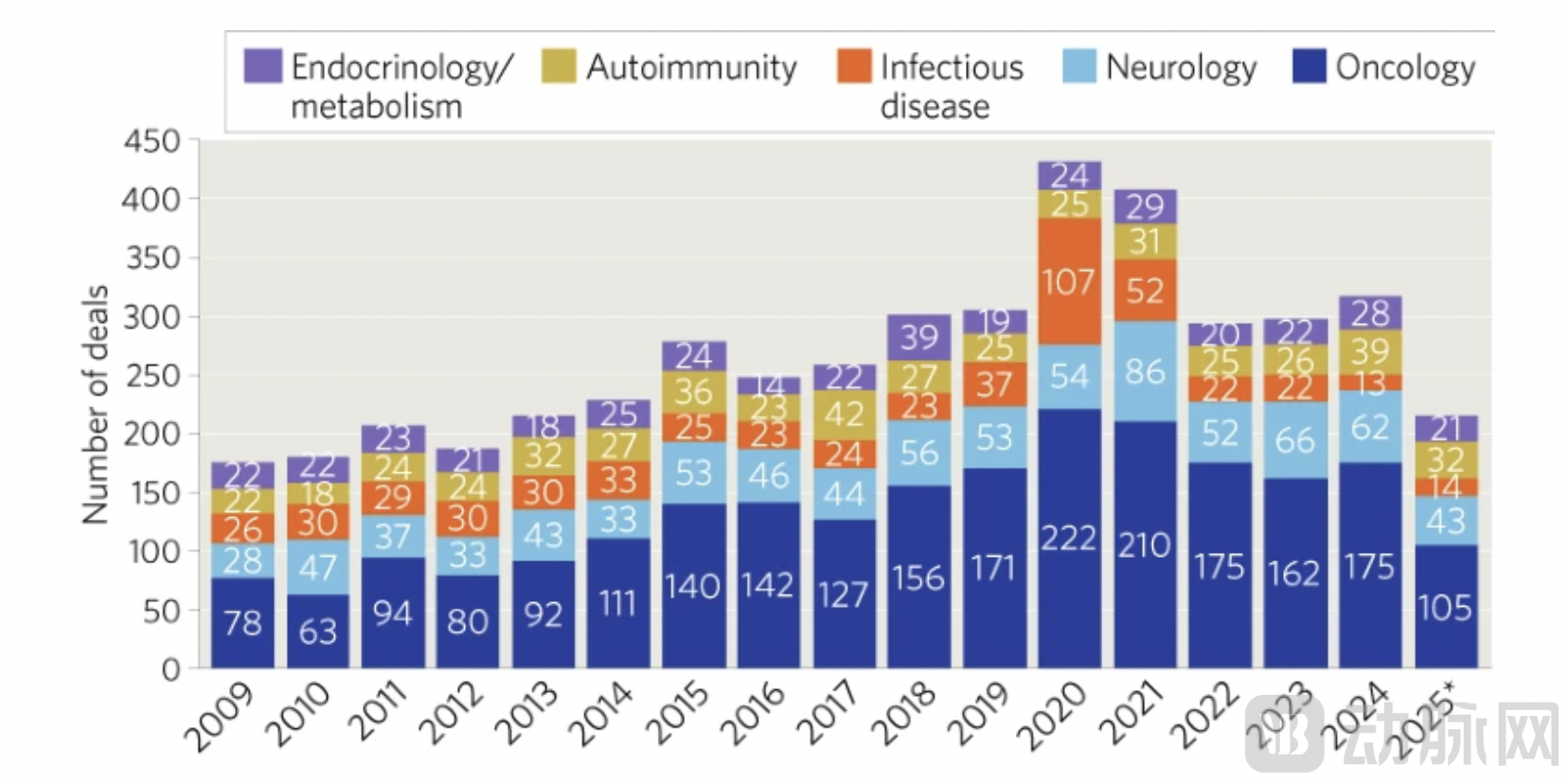

From 2024 to 2025, transaction activities in the global biopharmaceutical industry experienced a significant cooling-off period. According to data from the research firm DealForma, only 215 transactions were announced in the first ten months of 2025. This figure not only fell short of the 317 transactions recorded in 2024 and the 298 in 2023 but also marked the lowest level since 2016. This decline was particularly pronounced in oncology, traditionally a hotbed for transactions. As of October 2025, the number of transactions in the oncology field stood at just 105, a substantial drop from the 175 recorded in the same period of 2024. However, alongside the decline in transaction volume, the quality and average value per deal saw a notable increase. The average value of each licensing transaction reached $47.6 million, up 30% from the prior year.

Figure 1. Trends in Biopharmaceutical Industry Deals. Number of biopharmaceutical R&D deals by therapeutic area. Data source: DealForma database. YTD: Year to date.

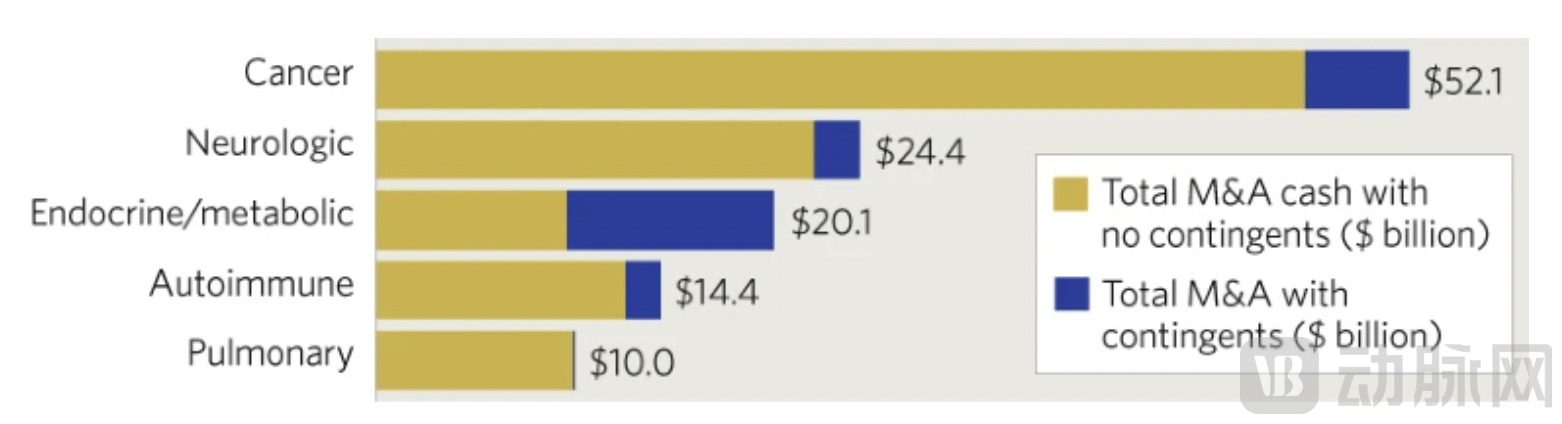

This trend of "fewer but higher-quality" deals was even more pronounced in mergers and acquisitions (M&A) activity. Despite strong acquisition interest from multinational pharmaceutical companies under pressure from the patent cliff, only 26 M&A transactions related to cancer therapies were announced in the first ten months of 2025, down from 36 in the previous year. However, buyers were considerably more generous in their spending, with the average value per M&A deal soaring to $1.1 billion, far exceeding last year's $475 million.

Against this backdrop, bispecific and multispecific antibodies successfully seized the spotlight, displacing the once highly sought-after antibody-drug conjugates (ADCs) as the leading protagonists in transaction activities. The three largest licensing deals to date this year, along with the second-largest M&A transaction, all centered on bispecific antibodies as their core assets. Notably, Genmab's $8 billion acquisition of Merus in September emerged as the year's second-largest M&A deal. This transaction not only included the FDA-approved Bizengri (zenocutuzumab-zbco, targeting HER2 and HER3) but also encompassed multiple bispecific assets in clinical stages, such as petosemtamab (targeting EGFR and LGR5) and the PD-1 × CD3 T-cell engager ONO-4685, underscoring a comprehensive strategic bet on a bispecific antibody platform.

Figure 2. Top Five M&A Deal Values by Therapeutic Area. Data shown in billions of dollars, covering the period from 2024 to early 2025. Data source: DealForma.

Bispecific antibodies refer to antibody molecules capable of simultaneously binding to two different antigens or two distinct epitopes on the same antigen. This unique mechanism enables them to achieve synergistic effects unattainable with monoclonal antibodies, such as concurrently blocking two signaling pathways or "redirecting" immune cells (e.g., T cells) toward tumor cells for precise elimination. Although pharmaceutical giants like Roche, AstraZeneca, and AbbVie have also made substantial investments in areas such as CAR-T cell therapies, 2025 has unequivocally been the year of bispecific antibodies, both in terms of transaction volume and overall attention.

The remarkable surge of bispecific antibodies in 2025 can be attributed primarily to commercial strategy, validation through clinical data, and regulatory breakthroughs—these are the three key drivers summarized by Matt Phipps, a partner at investment bank William Blair.

First, from a commercial perspective, as patent protection for many blockbuster monoclonal antibodies approaches expiration, developing bispecific antibodies targeting two known antigens has become an efficient strategy for pharmaceutical companies to extend product lifecycles and build patent barriers.

Second, accumulating clinical data has confirmed the synergistic advantages of bispecific antibodies in disease mechanisms. For example, The Phase II VEGA trial data (Johnson & Johnson, 2022) successfully validated the efficacy of simultaneously inhibiting interleukin-23 (IL-23) and tumor necrosis factor-alpha (TNFα) in ulcerative colitis. This milestone event significantly boosted industry enthusiasm for bispecific antibody development, with their combinatorial potential widely recognized, whether targeting cytokines, receptors, or T-cell engagers.

The third critical driver stems from regulatory breakthroughs. Amgen's T-cell engager Imdelltra (tarlatamab, targeting CD3 and DLL3) received approval for treating small cell lung cancer, marking a groundbreaking achievement as the first T-cell engager approved for a solid tumor. Its success shattered the long-standing challenge of T-cell engagers in effectively targeting solid tumors and subsequently sparked a series of high-value transactions centered on T-cell engagers. In 2025, AbbVie was particularly active, securing partnerships with Simcere Zaiming, Xilio Therapeutics, and IGI Therapeutics, with potential deal values for T-cell engager assets totaling up to $5.1 billion.

Chinese biotech companies have stood out prominently in this wave of bispecific antibody enthusiasm. In 2025, the demand from multinational pharmaceutical firms for Chinese assets remained strong. Within the field of bispecific and multispecific antibodies alone, there were 10 transactions involving Chinese companies, with upfront payments exceeding $2.6 billion. Leon Tang, founder of InScienceWeTrust BioAdvisory, highlighted that the core advantages of Chinese companies lie in their robust antibody engineering capabilities and their ability to rapidly and cost-effectively achieve "proof of signal" validation in early-stage human trials. Examples of this trend include Takeda's $11.4 billion licensing deal for Innovent Biologics' PD-1 × IL-2 bispecific antibody (IBI363), as well as BioNTech's collaboration with Bristol Myers Squibb (BMS), valued at up to $11.1 billion and centered on a bispecific asset licensed from Biotheus.

Figure 3. Top Ten Bispecific/Multispecific Antibody Deals in 2025 YTD. Data Source: DealForma Database and Corporate Press Releases.

It is worth noting that China's position in the global new drug R&D landscape is undergoing a historic transformation. According to statistics from the pharmaceutical R&D database Pharmaprojects, China has surpassed Europe as the source of new drugs entering clinical pipelines, with South Korea also moving ahead of the United Kingdom and Switzerland. Behind this shift, bispecific antibodies have played a pivotal role. The target landscape of Chinese assets also shows a clear trend toward diversification. Beyond traditional oncology targets such as PD-1, VEGF, and EGFR, bispecific antibodies targeting TSLP, IL-33, KLK2, and other autoimmune and inflammatory targets are beginning to emerge.

In fact, data from the period spanning July 2024 to June 2025 reveals that over 40% (7 out of 16) of multispecific antibody transactions were concentrated in the field of autoimmune or inflammatory diseases. These bispecific or trispecific antibodies primarily target CD19, CD20, or BCMA on pathological B cells or plasma cells, highlighting how Chinese R&D is shifting from merely following oncology trends to pursuing more diversified innovative exploration.

With the comprehensive surge of bispecific antibodies in 2025, this technological approach is gradually shedding its labels as a "niche" or "complementary therapy" and is instead becoming a cornerstone of future biopharmaceutical research and development. Over the past year, several bispecific drugs, including Imdelltra, Ziihera (zanidatamab), Bizengri (zenocutuzumab), and Ordspono (odronextamab), have been approved for marketing in the United States or Europe. These regulatory milestones, coupled with the continuous emergence of positive clinical data, have unprecedentedly solidified the validation of bispecific antibodies as a therapeutic modality. For buyers, bispecific antibodies are no longer merely supplementary enhancements to existing pipelines but are increasingly regarded as potential core therapies capable of addressing a wide range of solid tumors and even extending into autoimmune diseases.

Looking ahead, innovation in bispecific antibodies is far from over. Bispecific antibody-drug conjugates (bispecific ADCs) are emerging as a new focal point of attention. Leon Tang particularly emphasized, "Bispecific ADCs are an area worth close monitoring." This new type of drug, which combines the precise targeting capability of bispecific antibodies with the potent cytotoxic effect of ADCs, holds the potential to further widen the therapeutic window. Concurrently, Matt Phipps highlighted the high anticipation for clinical data on T-cell engagers targeting novel antigens such as CLDN6 and ENPP3: "Clinical data in ovarian cancer suggest that claudin 6 (CLDN6) will be highly significant; in the field of renal cell carcinoma, the industry eagerly awaits data on T-cell engagers targeting ENPP3."

It is noteworthy that while bispecific antibodies dominate the landscape, other innovative therapies are also vying for market share. Molecular glues accounted for four of the Top 20 transactions in 2025, and in vivo CAR-T therapies have attracted over $4.8 billion in investments (with AstraZeneca, AbbVie, Gilead, and Bristol Myers Squibb acquiring EsoBiotec, Capstan Therapeutics, Interius Therapeutics, and Orbital Therapeutics, respectively, since December 2024). Although the overall volume of biopharmaceutical transactions declined in 2025, bispecific antibodies single-handedly sustained momentum, demonstrating their strategic value through "fewer deals, larger sums."

Having crowned 2025 as the "Year of Bispecific Antibodies," the focus now shifts to whether 2026 and beyond can deliver clinical proof that next-generation bispecific antibodies can comprehensively surpass existing single-target monoclonal antibody therapies. As multinational pharmaceutical companies continue to rely on licensing deals to navigate patent cliffs, and Chinese biotech companies leverage their engineering strengths to accelerate asset monetization, cross-border collaborations in the bispecific antibody space are expected to remain active. Once early "proof of signal" translates into definitive survival benefits in larger-scale clinical trials, bispecific antibodies will truly cement their historical status as the "default modality" in new drug development.