Why did Chinese BCI stocks soar? the Musk effect behind the boom

Figure 1. Increase in Chinese Brain-Computer Interface Concept Stocks

On the opening day of the A-share market in 2026 (January 5), Chinese brain-computer interface concept stocks collectively opened higher. Among them, Beoka surged over 29.98%, while SanBo, Xiangyu Medical, Mehow Medical, Apon Medical, Chieftain, and Vishee Medical all hit the 20% daily price limit (the maximum allowed gain for stocks on China's ChiNext and STAR Markets). Innovative Medical and Thalys Medical rose over 10%, with Biotest and Vishee Medical, among others, also gaining. As of the market close that day, the stock prices continued to exhibit a high-opening-and-high-trading trend, reflecting strong market expectations for the commercial prospects of brain-computer interface technology.

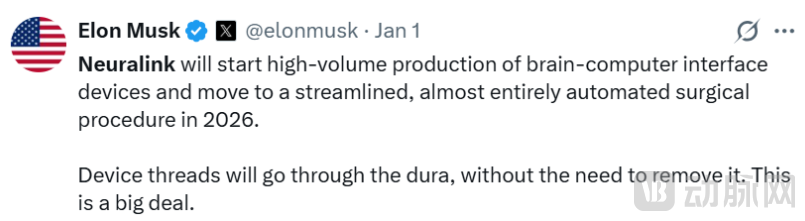

Figure 2. Musk: Neuralink to Start "High-Volume Production" in 2026

Figure 2. Musk: Neuralink to Start "High-Volume Production" in 2026

This surge is not without reason and is primarily linked to Musk's calling. On January 1, 2026 (U.S. time), Musk posted on social media, announcing that his company Neuralink would "start high-volume production of brain-computer interface devices and move to a streamlined, almost entirely automated surgical procedure in 2026."

On January 3, 2026, Musk posted again, expressing confidence that Neuralink's technology could help paralyzed individuals regain full-body functionality.

These two consecutive major announcements not only validated the feasibility of this cutting-edge brain-computer interface technology but also prompted a market-wide reassessment of its prospects across several critical application areas. As a result, brain-computer interface technology, which is transitioning from purely scientific experiments to a diversified commercial race, quickly gained widespread attention at the start of the new year. This momentum drove the related concept stocks on the A-share market to stage a "collective rally" on the first trading day of 2026.

Where Does Musk's Confidence Come From?

As a bellwether of the industry, almost every high-profile announcement or breakthrough by Musk and his company Neuralink sends significant ripples through China's brain-computer interface (BCI) market. For example, in January 2024, when Neuralink implanted a brain chip in a human patient for the first time, A-share BCI concept stocks surged accordingly. Companies such as SanBo and Innovative Medical saw weekly gains exceeding 10%, becoming rare bright spots in the healthcare sector at the time.

In fact, since its founding in 2016, Neuralink has held a "golden key" from the very beginning. To date, Neuralink has completed seven rounds of financing, raising over $1.3 billion in total. This is an astonishing figure, especially considering that the global BCI market was valued at approximately $2.9 billion in 2025—only about twice Neuralink's total funding—highlighting its exceptional ability to attract capital.

Unsurprisingly, such substantial investment has propelled Neuralink to the forefront of implantable BCI technology. In May 2023, it received U.S. FDA approval to initiate its first human clinical trial. In January 2024, it performed the world's first implantable BCI surgery on a human patient. In September 2025, its "Blindsight" visual implant was granted FDA "Breakthrough Device" designation, making it the first intracortical visual BCI worldwide to be officially included in a regulatory fast-track review process aimed at restoring vision to the blind. Most recently, Musk has publicly announced plans to commence "mass production" of BCI devices—a critical turning point that could shift the industry from "medical prototypes" to "consumer-grade products."

However, this is not the first time Musk has aimed for mass production of Neuralink devices. As early as July 2024, he revealed that Neuralink expected to serve over 1,000 patients by 2026. To prepare for this, the company significantly expanded its team, focusing on recruiting manufacturing technicians and micro-nano fabrication experts to pave the way for scaled production. Yet, as of December 2025, Neuralink had cumulatively served only 20 patients, falling far short of its target.

The primary practical challenge lies in the surgical procedure itself. Under the current protocol, Neuralink implantation requires a neurosurgeon to first remove a section of the skull, then part of the dura, before a robotic arm inserts ultra-fine electrode threads into the brain. This process is highly complex, varies significantly among patients, and heavily relies on the surgeon's expertise, making it difficult to standardize and scale.

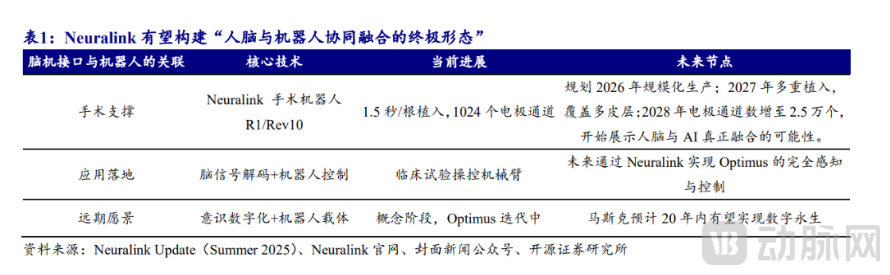

Figure 3. Neuralink Future Plans and Ultimate Vision

Figure 3. Neuralink Future Plans and Ultimate Vision

Therefore, with this renewed announcement of "mass production," Musk has also introduced improvements to the accompanying surgical protocol. The procedure is now highly streamlined and almost fully automated. This not only addresses the issue of invasiveness associated with implantable brain-computer interfaces but also achieves a dual optimization of efficiency and cost, clearing a critical obstacle for BCIs to transition from "laboratory tools" to "accessible products."

Regarding this development, a senior investor commented, "If Neuralink can truly lower the threshold and cost of this surgery through scaled production, it would undoubtedly be a transformative event for tens of thousands of brain-computer interface products. The widespread adoption of Neuralink's technology has the potential to spark a new medical revolution in 2026."

Why Did China's Brain-Computer Interface Sector Surge in Response?

Reportedly, on the very day Musk announced mass production, Gestala—China's first innovative company dedicated to ultrasound-based brain-computer interface technology—was officially established. The company was co-founded by Peng Lei, former co-founder and CEO of NeuroXess, alongside Chen Tianqiao, founder of Shanda Group and the Tianqiao and Chrissy Chen Institute. It aims to achieve whole-brain signal reading, writing, and modulation through ultrasonic technology, marking the launch of a new technological pathway in China's BCI field centered on ultrasound.

In fact, the year 2025 has been hailed as the "Year One of Brain-Computer Interfaces in China." This is largely due to the release of numerous clinical results, which have propelled China's BCI sector to a critical turning point—transitioning from early-stage exploration of cutting-edge technologies to a new phase focused on clinical value validation.

Specifically, these clinical breakthroughs have primarily concentrated on restoring motor and language abilities in patients with high-level paralysis, visual reconstruction, as well as the alleviation and treatment of mental disorders.

Figure 4. Breakthrough Clinical Research in China's Brain-Computer Interface Field by 2025

Figure 4. Breakthrough Clinical Research in China's Brain-Computer Interface Field by 2025

In June 2025, a team led by Professor Duan Feng of Nankai University completed the world's first trial of interventional brain-computer interface-assisted motor function restoration in a paralyzed limb. By integrating interventional BCI technology with functional electrical stimulation, the team successfully helped a hemiplegic patient restore motor function in the affected limb. In September 2025, Mindtrix completed the world's first Investigator-Initiated Trial (IIT) for visual reconstruction, marking a leap in visual reconstruction from simple light perception to complex shapes and even color awareness. In November 2025, a team led by Sun Bomin from Ruijin Hospital published data from China's first prospective clinical trial on invasive brain-computer interface treatment for treatment-resistant depression in a Nature sub-journal. During the open-label phase, half of the patients (13 out of 26) showed significant improvement in depressive and anxiety symptoms, with nine even reaching a state of near-complete remission.

Beyond the clinical breakthroughs, supportive policies are paving the way for BCI products to rapidly enter the market. In March 2025, China's National Healthcare Security Administration issued the Guidelines for Establishing Medical Service Price Items in Neurology (Trial), marking the first inclusion of BCI in national medical insurance and signaling the preliminary formation of a commercial closed loop.

On the market access front, in September 2025, China's National Medical Products Administration released the official terminology standard Brain Computer Interface Medical Equipment (BCI-ME)—Terminology, which took effect on January 1, 2026. This signifies that BCI medical devices have entered a new phase of "standards to follow and regulations to abide by." In November 2025, the "Implantable Wireless Brain-Computer Interface System" independently developed by StairMed officially entered the special review process for innovative medical devices under the Center for Medical Device Evaluation of the NMPA. This is China's first invasive BCI product to enter this "green channel," marking a critical step in the industrialization of Chinese BCI technology—from clinical validation to market access.

Finally, in the capital market, according to incomplete statistics from the VCBeat database, the Chinese BCI sector completed 24 financing rounds in 2025, a year-on-year increase of 30%. Among these, a RMB 350 million Series B funding round secured by StairMed in February set a new record for the largest single financing round in China's BCI industry.

All these developments indicate that China's BCI field is gradually entering the commercialization stage, and Musk's announcement of "mass production" by Neuralink has undoubtedly injected significant confidence into the industry.

How Much Longer Until China's First Brain-Computer Interface Stock Lists?

Although as many as 20 concept stocks surged in this rally, none of them are pure brain-computer interface companies. For instance, Beoka, which surged nearly 30%, primarily focuses on rehabilitation medical devices, with BCI serving only as a technological means for signal acquisition. Similarly, SanBo and Innovative Medical are specialized healthcare service groups without independent commercialized product systems in the BCI field. SanBo is primarily engaged in BCI clinical trials, while Innovative Medical participates by funding the establishment of Cereblink.

Thus, to date, there is no publicly listed company in China that is purely dedicated to brain-computer interface technology, despite the presence of numerous competitors in the space. According to observations by VCBeat, companies such as Brainco, Neuracle, GenLight MedTech, NeuroXess, and Cereblink are all actively advancing their IPO preparations, competing fiercely to become "China's first BCI stock."

For example, in August 2025, Brainco was in talks for a pre-IPO funding round of approximately $100 million at a valuation exceeding $1.3 billion, potentially paving the way for a subsequent IPO in Hong Kong or mainland China. Another notable example is Neuracle, which is currently undergoing its final pre-IPO funding round and plans to list on the STAR Market. Regarding this trend, a senior investor noted that against the backdrop of supportive policies, the approval of major products, and the reopening of the IPO market, an increasing number of BCI companies are likely to pursue public listings.

So, who will emerge as the frontrunner?

Previously, VCBeat interviewed several industry experts, who unanimously agreed that companies poised to succeed in the BCI field share two key characteristics: first, possessing mature technology; and second, having a clear commercialization pathway. In short, they must excel in core product development while accelerating market penetration simultaneously.

Taking product progress as an example, as a representative player in the non-invasive segment, Brainco has successfully commercialized multiple products, including its intelligent bionic hand, which has received FDA certification in the U.S. and entered mass production. In the semi-invasive segment, Neuracle's "NEO" system has completed multi-center clinical trials and plans to submit an application for Class III medical device registration in the near future, positioning it to potentially become China's first commercially available implantable BCI product. In the invasive segment, GenLight MedTech has already secured market approval for three products, including LaserRO, while its Epilcure device has completed clinical trials and is expected to obtain registration certification in 2026. Meanwhile, NeuroXess has completed 53 short-term clinical trials and is planning to initiate long-term clinical studies.

Regarding commercialization progress, Brainco has established a sales network spanning over 30 countries globally, with annual shipments exceeding 10,000 units. Neuracle has collaborated with multiple top-tier hospitals in China to establish clinical cooperation centers, with commercialization imminent. GenLight MedTech's products have been adopted by more than 200 hospitals across China, with over 100 clinical implant procedures completed. NeuroXess has pioneered the release of a high-throughput BCI system for research and commercial use, initially building a commercialization pathway driven by both "research and clinical" applications.

It is foreseeable that as China's BCI field officially enters its first year of commercialization in 2026, an industrial race will also begin to unfold.