Beyond the deal: AbbVie bets on Zelgen's first-in-class DLL3 trispecific antibody in the second major China deal this year

On December 30, Zelgen entered into a global development and commercialization strategic collaboration and option agreement with AbbVie. Under the terms of the agreement, AbbVie secures exclusive rights to develop and commercialize ZG006 (Alveltamig) outside Greater China (including Chinese mainland, Hong Kong SAR, and Macau SAR), while Zelgen retains exclusive rights to develop and commercialize ZG006 within Greater China.

Zelgen will receive an upfront payment of $100 million, along with near-term milestone payments tied to clinical progress and payments related to the licensing option, totaling up to $60 million. Should AbbVie exercise the licensing option, Zelgen will also be eligible for additional milestone payments of up to $1.075 billion, as well as tiered royalties ranging from high single-digit to mid-double-digit percentages on net sales of products containing ZG006 outside Greater China.

According to the Hong Kong listing application submitted on December 19, ZG006 is one of Zelgen's core assets. It is the world's first DLL3-targeting trispecific antibody with best-in-class potential.

Another noteworthy aspect is that this marks AbbVie's third acquisition of a TCE trispecific antibody asset through licensing deals in 2025.

1The World's First Tri-specific Antibody Targeting DLL3 Enters Phase III Clinical Trials

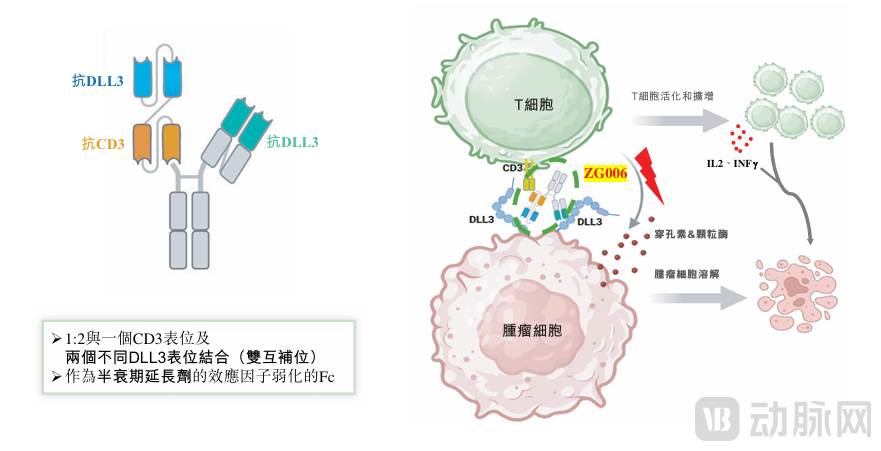

ZG006 is a novel trispecific T-cell engager targeting two distinct DLL3 epitopes and CD3. It represents the world's first DLL3-targeting trispecific antibody (CD3/DLL3/DLL3) with best-in-class potential. Currently, it is in late-stage clinical development for the treatment of small cell lung cancer (Phase III) and other DLL3-expressing malignancies.

ZG006 has received clinical trial approvals from the FDA and the NMPA. It has been designated by the NMPA's Center for Drug Evaluation as a breakthrough therapy for recurrent or progressive advanced small cell lung cancer (SCLC) and DLL3-positive neuroendocrine carcinoma (NEC), and has also been granted orphan drug designation by the FDA for the treatment of NEC.

Through its "dual DLL3 + CD3" targeting design, ZG006 represents a mechanistic breakthrough. It is equipped with two binding sites targeting different antigenic sites on DLL3, generating a synergistic effect and enhancing DLL3-binding capability. To balance efficacy and safety, ZG006 was designed with a weaker CD3 binding affinity compared to tarlatamab, aiming to reduce off-target T-cell activation while maintaining effective tumor cell killing. Its Fc region, engineered with attenuated effector functions, serves as a half-life extension element, improving systemic exposure and stability.

ZG006 binds DLL3 in two biochemically validated ways, further strengthening its binding effect. It can bind to two distinct antigenic sites on a single DLL3 molecule, achieving high-affinity binding, or simultaneously bind two DLL3 molecules on the same cancer cell, potentially creating a "cross-linking" effect that enhances tumor engagement. These two binding mechanisms may ensure robust and sustained tumor engagement even in cases of low DLL3 expression.

Upon binding, ZG006 brings T cells into proximity with cancer cells, forming an immune synapse that leads to T-cell activation. This activation triggers the release of perforin and granzymes from T cells. Perforin creates pores in cancer cells, allowing granzymes to enter and induce direct tumor cell lysis. Meanwhile, cytokines such as interferon-gamma (IFN-γ) enhance tumor killing, while interleukin-2 (IL-2) promotes T-cell proliferation, together contributing to a sustained immune response. This mechanism of action may differentiate it from several other therapeutic modalities, such as antibody-drug conjugates. Compared to tarlatamab, ZG006 has demonstrated stronger and more durable T-cell activity, reduced T-cell exhaustion, and enhanced cytokine secretion.

Figure 1. ZG006 Drug Design and Mechanism of Action

In a Phase II dose optimization clinical trial for advanced SCLC in the third-line setting and beyond, ZG006 demonstrated outstanding efficacy across both dosing regimens of 10mg biweekly (Q2W) and 30mg biweekly (Q2W), as measured by objective response rate (ORR), median progression-free survival (mPFS), duration of response (DoR), as well as a favorable overall survival (OS) trend. In the recommended dosage group of 10mg Q2W, the best ORR was 60.0%, with a confirmed ORR of 53.3%. The mPFS reached 7.03 months, and the 6-month/12-month OS rates were 83.2% and 69.1%, respectively.

Furthermore, ZG006 also exhibited remarkable efficacy in patients with advanced NEC who had received second-line or later therapy, particularly among DLL3-positive NEC patients. In the recommended dosage group of 30mg Q2W, the confirmed ORR for the overall population was 38.5%, while in DLL3-positive patients (defined as ≥50% of tumor cells showing staining of any intensity), the confirmed ORR reached 66.7%.

2Zelgen: Commercialization of 3 New Drugs, Catching the "A+H" Listing Trend

Zelgen stated that this collaboration is expected to support the global expansion of ZG006 across multiple indications and provide more treatment options for patients worldwide, further elevating Zelgen's profile as an innovative company and enhancing its international influence.

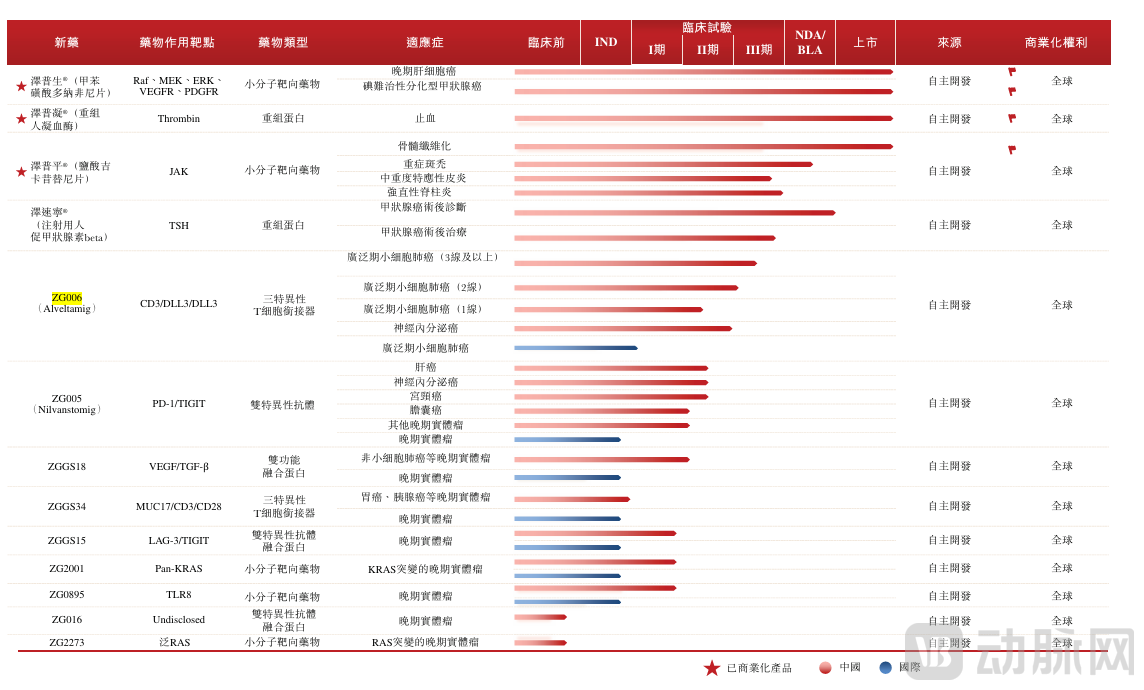

Importantly, this collaboration validates Zelgen's proprietary bispecific/trispecific antibody and complex recombinant protein R&D platform, which comprises three in-house developed bispecific/trispecific antibody platforms: TriGen, CheckGen, and TGen. Based on this platform, Zelgen currently has six projects: ZG006 and ZG005 are undergoing international collaborative development, both having demonstrated promising efficacy and safety in Phase I/II clinical studies for oncology indications; ZGGS34 has received clinical trial approvals in both China and the United States; and ZGGS34 has also entered Phase I clinical trials in China and obtained IND clearance in the U.S.

Meanwhile, this collaboration is expected to significantly improve Zelgen's financial position. In the first three quarters of 2025, Zelgen achieved operating revenue of 593 million RMB, a year-on-year increase of 54.49%, with net profit attributable to shareholders at -93.42 million RMB. R&D expenditure accounted for 48.80% of operating revenue. The $100 million upfront payment from this transaction will directly strengthen its cash flow, representing an amount 1.8 times greater than its full-year 2024 R&D expenditure (388 million RMB), and is expected to accelerate the clinical development and commercialization readiness of ZG006.

In December, Zelgen's new antibody drug manufacturing facility officially commenced operations, providing future commercial-scale production capacity for innovative antibody drugs, including ZG006, ZGGS18, and other antibody candidates under development.

Figure 2. Zelgen's R&D Pipeline Assets

In 2020, Zelgen was listed on the Shanghai Stock Exchange's STAR Market as the first unprofitable company to be listed on the A-share market. Although the company has not yet achieved profitability since its listing, its net loss has been narrowing year by year. From 2022 to 2024, Zelgen's operating revenue was RMB 302 million, RMB 386 million, and RMB 533 million, respectively, while net losses for the corresponding periods were RMB 457 million, RMB 279 million, and RMB 138 million.

The improvement in revenue was primarily driven by the approval and commercialization of three core products. As stated by Zelgen's management in prior institutional analyst meetings: "Zepsun® (Donafenib Tablets) is steadily increasing its market share; Zepuning® (Recombinant Human Thrombin) is currently in the market-entry phase following its inclusion in the National Reimbursement Drug List (NRDL), with sales gradually ramping up; Zepuping® (Jacktinib Tablet), as China's first domestically developed Class 1 innovative drug for the treatment of myelofibrosis, is in the stage of medical education and promotion post-approval."

On December 19, Zelgen submitted an application to the Hong Kong Stock Exchange for the issuance of H shares and listing on the Main Board. In the same month, Zepuping® (Jacktinib Tablet) was included in the National Reimbursement Drug List, with the inclusion taking effect on January 1, 2026.

3AbbVie's Second Major China Deal This Year

In January 2025, Simcere Zaiming entered into a collaboration with AbbVie for the development of SIM0500, a trispecific antibody candidate for multiple myeloma. SIM0500 is a humanized GPRC5D/BCMA/CD3 trispecific antibody developed based on a proprietary T-cell engager multispecific antibody technology platform.

The transaction structure follows a similar pattern. Simcere Zaiming will receive an upfront payment from AbbVie, along with potential option exercise fees and milestone payments totaling up to $1.055 billion. Additionally, Simcere Zaiming will receive tiered royalties based on the product's net sales outside Greater China. AbbVie, in turn, is entitled to receive tiered royalties based on net sales within Greater China.

In July 2025, AbbVie entered into a licensing agreement with IGI for ISB 2001, a lead asset CD3/CD38/BCMA trispecific T-cell engager (TCE), granting AbbVie exclusive rights for development, manufacturing, and commercialization in North America, Europe, Japan, and Greater China for oncology and autoimmune diseases (with the first indication being multiple myeloma). IGI received a $700 million upfront payment and is eligible for up to $1.225 billion in development, regulatory, and commercial milestone payments, as well as tiered double-digit royalties on net sales.

These three TCE trispecific antibody deals demonstrate AbbVie's clear and systematic strategic intent: to comprehensively cover oncology indications (hematologic malignancies and solid tumors) through differentiated target combinations (DLL3, GPRC5D, BCMA/CD38), thereby building a next-generation portfolio of T-cell engagers. This strategy aims to strengthen its oncology franchise and address upcoming patent cliffs.

Taking ZG006 from this latest deal as an example, as of now, there is only one approved CD3/DLL3 bispecific drug, tarlatamab (Imdelltra) from Amgen, which received approval in 2024 for the treatment of small cell lung cancer. Benefiting from an impressive overall survival of 13.6 months in the second-line setting, Imdelltra has shown strong and growing market uptake in SCLC. Its sales reached approximately $115 million in 2024, achieved $178 million in Q3 2025 alone, and cumulative sales have reached $393 million to date.

Figure 3. Competitive Landscape of CD3/DLL3 Antibody Drugs in Global Clinical Development

On one hand, the small cell lung cancer (SCLC) market has historically been underdeveloped due to a relatively small patient pool and short survival duration, yet significant unmet clinical needs remain. In 2024, the global number of new SCLC cases rose to 391,200, with a compound annual growth rate (CAGR) of 2.7% from 2020 to 2024. It is projected to reach 453,400 cases by 2030 and 510,100 cases by 2035, with a CAGR of 2.5% from 2024 to 2030 and 2.4% from 2030 to 2035.

On the other hand, the therapeutic and commercial value of the DLL3 target continues to rise, driving several major out-licensing deals. Hengrui licensed the global exclusive development, production, and commercialization rights for SHR-4849 (a DLL3-targeting antibody-drug conjugate, ADC) to IDEAYA Biosciences, in a deal with a potential total value of up to $1.045 billion. Similarly, Innovent licensed the global exclusive rights for IBI3009 (a DLL3-targeting ADC) to Roche, securing an $80 million upfront payment and potential milestone payments of up to $1 billion.