Largest biotech IPO in HK 2025: Insilico Medicine debuts after record 1,427x oversubscription

On the penultimate day of 2025, the Hong Kong stock market welcomed the largest biotech IPO of the year by fundraising volume—Insilico Medicine's listing on the Main Board.

This IPO involved the issuance of 94,690,500 shares at an offer price of HK$24.05 per share, with a trading lot of 500 shares, resulting in a minimum investment amount per lot of HK$12,146.27 per lot. The stock opened at HK$35.000 per share today. As of the time of writing, Insilico Medicine's total market capitalization stands at HK$17.11 billion.

This offering set several records in scale. The Hong Kong public offering portion, accounting for 10% of the total shares, was oversubscribed by approximately 1,427.37 times, locking in subscription funds of approximately HK$328.35 billion, making it the highest public subscription amount among non-18A Hong Kong-listed healthcare IPOs on the Hong Kong exchange in 2025. Concurrently, the international offering portion, representing 90% of the shares, achieved 26.27 times oversubscription, securing the highest oversubscription multiple in the international placement among non-18A Hong Kong-listed healthcare IPOs this year.

Since the Hong Kong stock market liquidity crisis in 2021, Insilico Medicine is the first AI-driven biotech company to list under the Main Board listing criteria. This signifies the HKEX's substantive recognition of its tripartite business model integrating "software licensing, pipeline business development, and proprietary research advancement."

With revenue from drug discovery and pipeline development accounting for over 90% of its total income and its gross margins reaching 90%, how has this company—founded seven years ago and having completed eight funding rounds—convinced the secondary market to assign a premium valuation to its "AI-driven drug discovery platform and AI-empowered pipeline"?

1$115M Cornerstone Investment With 15 Top-Tier Investors

For this listing, a consortium of 15 top-tier investment institutions subscribed to a total of USD 115 million in cornerstone investments, highlighting the offering's notable characteristics of diversified industrial participation and a strong international positioning. This all-star lineup is expected to enhance secondary market attention and improve post-listing liquidity.

Structurally, the list of cornerstone investors is exceptionally diverse, encompassing multinational pharmaceutical corporations, leading internet platforms, international sovereign wealth funds, large-scale asset management firms, global thematic funds, as well as prominent Chinese public fund managers and insurance capital.

First, Eli Lilly and Company participated directly as a cornerstone investor in a biopharmaceutical IPO for the first time, subscribing to USD 5 million. For Insilico Medicine, having Lilly as a cornerstone investor represents more than just a pure financial investment from a leading strategic capital provider in biopharma. It signifies a high degree of trust and confidence from a key collaborator and suggests a "strategic lock-in" of its AI platform, with potential for deep involvement in its global expansion efforts.

Over three years, Insilico Medicine and Lilly have developed a multi-dimensional collaboration model encompassing "software + R&D strategy + equity investment." In 2023, they established a software licensing partnership based on Insilico's AI platform. In November 2025, they further solidified their ties with a collaboration agreement worth up to USD 100 million+ to generate, design, and optimize candidate compounds for a specified target.

Second, Tencent, a leader in the internet sector, also appeared on the cornerstone list with a subscription of USD 5 million. Leveraging its strengths in data storage, computing power, and platform capabilities, Tencent is positioned to act as a synergistic ecosystem partner. This collaboration could significantly broaden the application and implementation of Insilico's technologies in the life sciences field, fostering a co-creation ecosystem with wider reach, stronger innovation, and greater practical utility.

International sovereign wealth fund Temasek Holdings (Singapore), along with Schroders (UK), UBS Asset Management (Switzerland), and Oaktree Capital Management (US)—four globally top-tier asset managers—each subscribed to USD 15 million, collectively weaving a deeply internationalized capital network.

These institutions are known for their long-term investment horizons and focus on leaders in mature sectors. Taking Oaktree Capital as an example, its previous investments in China's pharmaceutical sector were concentrated in CROs and high-end pharmaceutical packaging, with representative portfolio companies including Pharmaron and SGD Pharma (held for 6 years). This marks its first investment as a cornerstone investor in an AI-driven drug discovery company.

Leading Chinese public fund managers and insurance companies also joined the round. China Asset Management, CPIC, Fullgoal Fund, Harvest Fund, and Taikang Insurance Group each subscribed to USD 5 million, while E Fund Management subscribed to USD 4 million. Additionally, three international healthcare-focused thematic funds—Infini, RTW, and Exome—subscribed to USD 10 million, USD 4 million, and USD 2 million, respectively.

A deeper signal lies in the fact that this offering introduced multiple investors to Hong Kong's Biotech sector—and even to the Chinese and Hong Kong secondary markets—for the first time. In fact, Insilico Medicine's pre-IPO funding rounds over seven years already boasted an illustrious lineup, including renowned international venture capital firms such as Warburg Pincus, B Capital, Prosperity7 (an Aramco Ventures fund), and Lilly Asia Ventures.

Viewed from this perspective, the diverse cornerstone lineup holds benchmark significance for the entire Hong Kong Biotech market. It signals an evolution in the valuation model for AI-driven drug discovery—shifting from a "technology narrative" towards "industrialization efficiency." Furthermore, it breaks through traditional frameworks for pricing healthcare assets, focusing instead on the global allocation of AI assets and the creation of win-win ecosystems.

2Gross Margin Exceeds 80%, Pivoting from "Cash-Burning" to "Self-Sustaining"

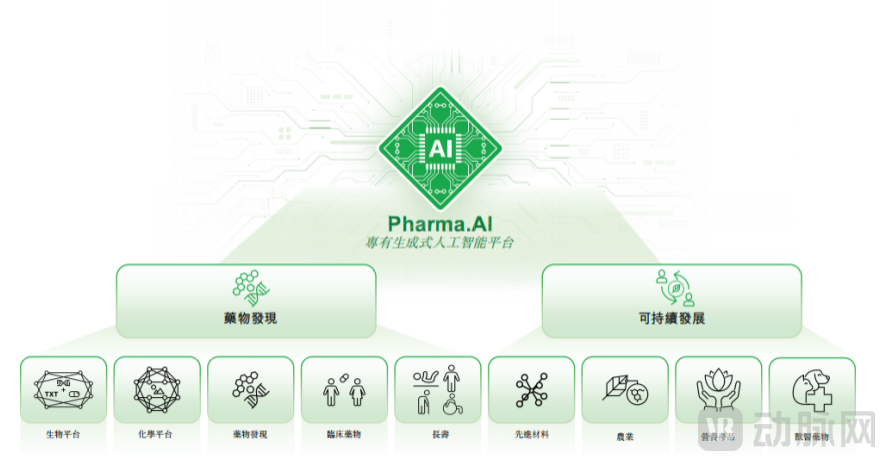

Insilico Medicine's proprietary platform, Pharma.AI, is an AI-driven drug discovery and development platform that offers end-to-end services ranging from novel target identification to small molecule generation and clinical trial outcome prediction.

Pharma.AI Overall Domain Architecture, P2

Pharma.AI Overall Domain Architecture, P2

From a business logic perspective, a "dual-engine" model has been established within the core pharmaceutical domain. The first engine comprises drug discovery, development, and partnership-based out-licensing. The second engine involves the commercialization of Pharma.AI through software licensing. Concurrently, the platform's application boundaries are continuously expanding, extending into advanced materials, agriculture, nutritional products, and veterinary medicine.

Leveraging Pharma.AI, Insilico Medicine's process from target discovery to the nomination of a preclinical candidate (PCC) averages 12 to 18 months, significantly shorter than the traditional approach (averaging 4.5 years), thereby accelerating progression to the IND (Investigational New Drug) application stage. This translates to a substantially higher R&D return on investment and significantly lower marginal time costs compared to traditional pharmaceutical companies, allowing Insilico Medicine to transcend the conventional asset valuation framework typically applied to biotechs.

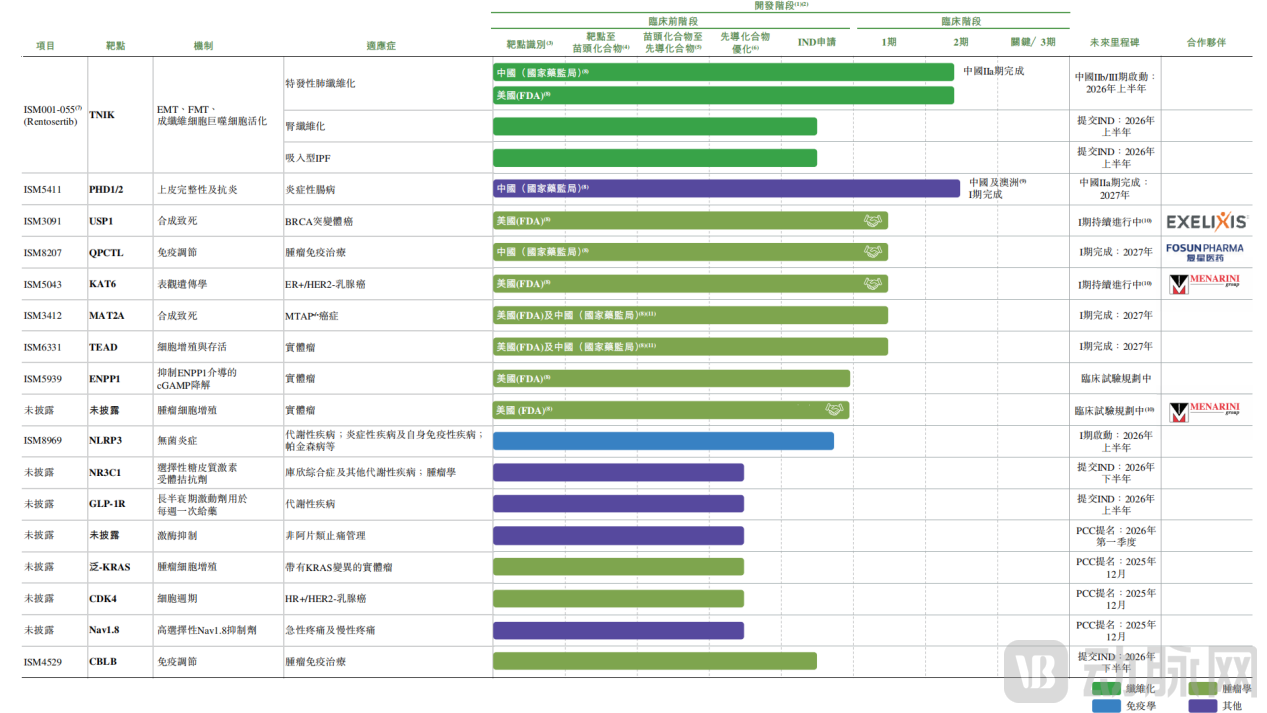

Currently, Insilico Medicine has efficiently built a pipeline portfolio encompassing more than 30 innovative programs. These programs focus on diseases with significant unmet medical needs and abundant patient multi-omics data, spanning high-value areas such as fibrosis, oncology, immunology, metabolism, and pain management. As these assets mature, value realization opportunities will be unlocked through strategic out-licensing, retaining intellectual property while generating potential milestone payments and ongoing royalty streams.

Simultaneously, the software licensing business has achieved commercialization through subscription-based access to Pharma.AI, establishing platform collaborations with 13 of the world's top 20 pharmaceutical companies by revenue. These agreements allow clients to deploy the platform for target discovery, small molecule and biologic generation, and clinical trial optimization. Furthermore, a variety of tailored software solutions are offered based on specific client needs.

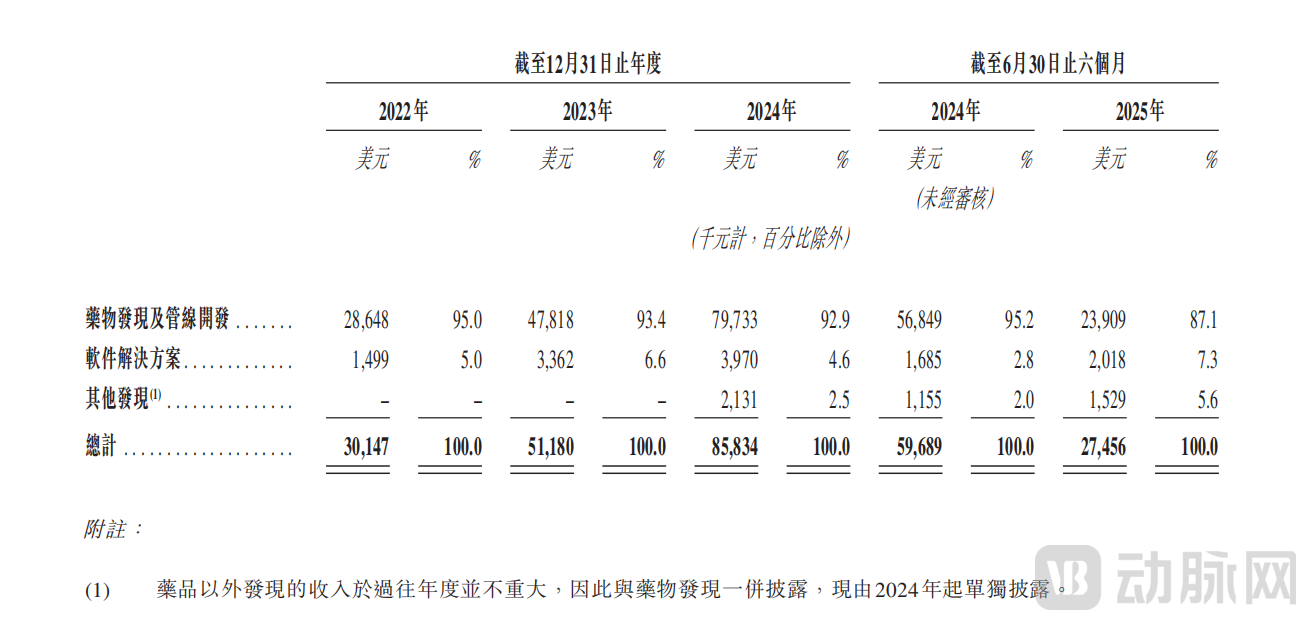

Insilico Medicine Revenue Details, P3

From a financial modeling perspective, the majority of revenue in 2022, 2023, and 2024 was derived from drug discovery and pipeline development services, accounting for 95.0%, 93.4%, and 92.9% of total revenue, respectively. This corresponded to USD 28.648 million, USD 47.818 million, and USD 79.733 million, with growth rates reaching 66.9% and 66.7%. This trend reflects a strong acceleration in the value realization of its pipeline.

On the other hand, revenue from software solutions, while constituting less than 10% of the total, also showed a year-over-year upward trend. Notably, this business line incurs zero cost of revenue, resulting in a 100% gross margin model for a low-frequency, high-value service. In terms of strategic positioning, the value of the software solutions business extends far beyond its direct financial contribution. By licensing the platform at nominal fees to multinational corporations (MNCs) and other industry players across the value chain, Insilico Medicine engages in high-touch, collaborative service models. This deep interaction with pharmaceutical R&D teams facilitates a critical trust migration—from establishing the platform's utility ("software that works") and proving the company's reliability as a partner ("a reliable collaborator") to ultimately demonstrating the inherent value of its AI-generated assets ("assets worth buying").

While this may appear as a straightforward virtuous cycle, each stage of this conversion requires robust support from a skilled team, substantial software capabilities, and a mature ecosystem. Architecturally, both business modules are built upon the same foundational Pharma.AI platform, yet they offer differentiated products tailored to their distinct market positions. This design enables the two business models to operate in parallel while providing integrated support, creating an organic cycle that drives synchronized revenue growth.

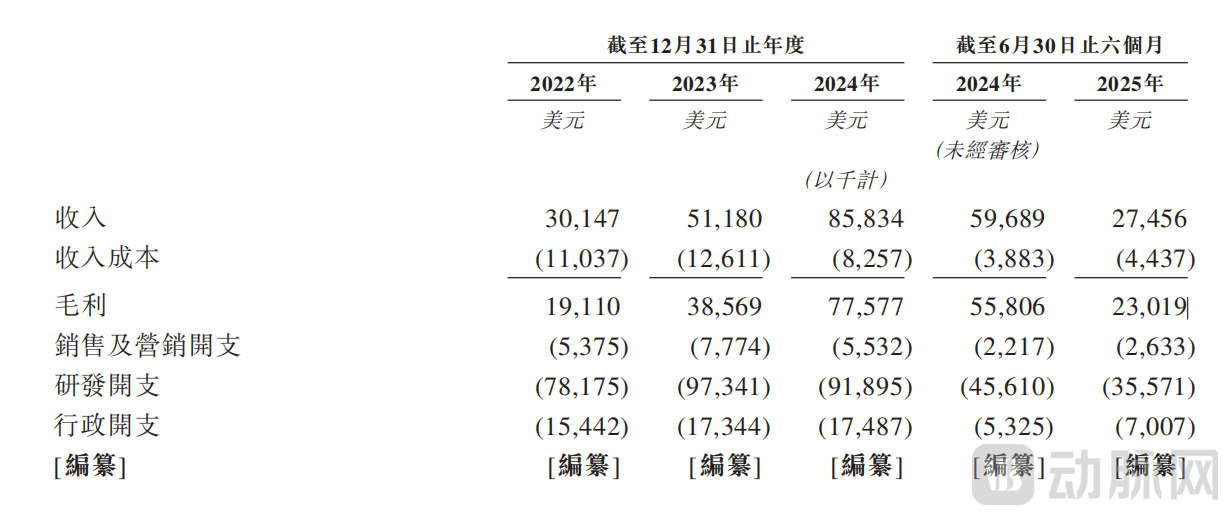

Statement of Comprehensive Income and Other Comprehensive Income, P15~16

Statement of Comprehensive Income and Other Comprehensive Income, P15~16

Driven by rapidly growing revenue, Insilico Medicine's gross margins for 2022, 2023, and 2024 were 63.4%, 75.4%, and 90.4%, respectively, demonstrating a clear and significant upward trend. In the first half of 2025, the gross margin adjusted to 83.8%. This short-term pressure on the margin is attributed to the progression of partnered projects into clinical development stages, which necessitates corresponding upfront cost investments. This shift reflects the natural transition of R&D collaborations from an initial stage characterized by upfront payments (often at or near 100% gross margin) into the practical implementation phase. As milestone criteria within these agreements are progressively met and triggered, they are expected to activate greater long-term revenue elasticity and unlock further value realization potential.

Regarding R&D expenses, they increased from USD 78.2 million in 2022 to USD 97.3 million in 2023, then saw a slight reduction to USD 91.9 million in 2024. R&D expenses for the first half of 2025 also showed a decreasing trend compared to the same period in the prior year.

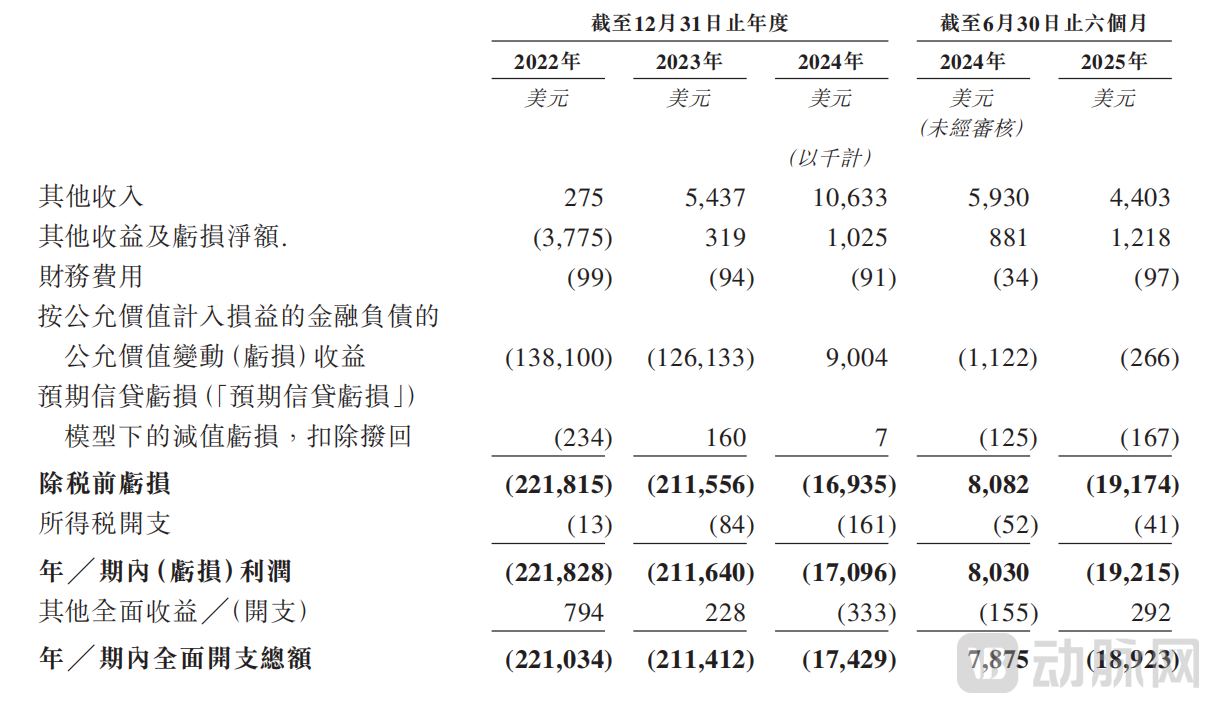

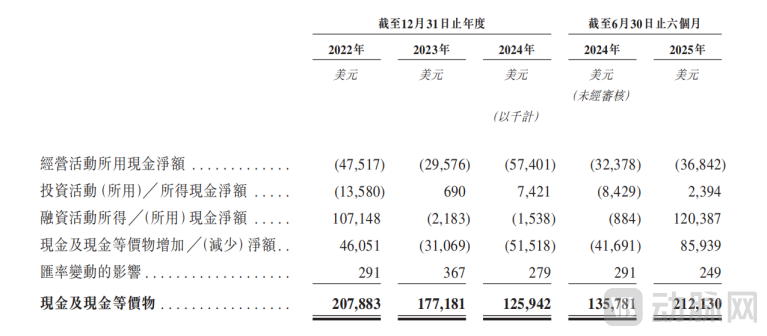

Consolidated Cash Flow Statement, P21

Consolidated Cash Flow Statement, P21

From a cash flow perspective, Insilico Medicine is not yet profitable. However, the ratio of its adjusted net loss to revenue has narrowed significantly, and loss expectations have been consistently revised downward. For the years 2022, 2023, and 2024, and the first half of 2025, the net loss figures were USD 221.8 million, USD 211.6 million, USD 17.1 million, and USD 19.2 million, respectively. Combined with its consistently high gross margin of around 90%, Insilico Medicine's cash burn rate has improved markedly, indicating that a breakeven point is imminent.

Insilico Medicine's cash position has stabilized and remains near its highest level in the past three years. As of June 30, 2025, cash and cash equivalents stood at USD 212.13 million.

3The World's First FIC Drug Discovered and Designed by Generative AI, Catalyzing $2B+ Licensing Deal

Insilico Medicine's most advanced pipeline asset, ISM001-055 (Rentosertib), is a potential global first-in-class (FIC) small molecule drug with broad therapeutic potential across multiple fibrotic indications. It successfully completed a Phase IIa clinical trial in August 2024 and is planned to initiate a Phase IIb/III study for Idiopathic Pulmonary Fibrosis (IPF) in China in the first half of 2026.

Notably, Rentosertib is recognized as the world's first first-in-class (FIC) drug discovered and designed using generative AI. The entire process, from the identification of the novel target TNIK to compound design, was executed by the Pharma.AI platform. This achievement validates the feasibility of using generative AI to create new drugs from the ground up.

Concurrently, the rapid advancement of Rentosertib serves as strong validation of the Pharma.AI platform's high efficiency. The journey from initial research to the Preclinical Candidate (PCC) stage took less than 18 months, and progression into Phase I clinical trials required only an additional 9 months. Rentosertib is now poised to potentially become the world's first AI-discovered FIC candidate drug to enter Phase III clinical trials.

The Phase IIa clinical trial data demonstrated clear clinical value. Patients receiving a once-daily 60mg dose showed a mean improvement in Forced Vital Capacity (FVC) of 98.4 mL, whereas the placebo group experienced a mean decline of 20.3 mL. Currently, Rentosertib has received Breakthrough Therapy Designation from China's Center for Drug Evaluation (CDE) for the treatment of IPF, as well as Orphan Drug Designation from the U.S. Food and Drug Administration (FDA).

Development Progress of Several Candidate Drugs as of the Latest Practicable Date, P14

Development Progress of Several Candidate Drugs as of the Latest Practicable Date, P14

According to the prospectus, Insilico Medicine has entered into three out-licensing agreements for its assets, including ISM3091, ISM5043, and one undisclosed candidate drug. The total potential value of these agreements exceeds USD 2 billion, with counterparties including Exelixis and Stemline Therapeutics (an affiliate of the Menarini Group), with the latter involving two separate collaborations. In December, Insilico Medicine also concluded a transaction for a PHD inhibitor with TaiGen Biotechnology, with a total potential value in the tens of millions of US dollars.

Concurrently, Insilico Medicine has secured multiple collaborative R&D partnerships with companies such as Eli Lilly, Fosun Pharma, and Harbour BioMed, conducting strategic drug discovery collaborations that extend into fields including immunology, oncology, and neuroscience, as well as AI-powered large molecule drug discovery.

Examining the value chain, Insilico Medicine exhibits an exceptionally high client repeat collaboration rate among biotechs, as evidenced by multiple deals with partners like Lilly and Menarini—a rarity in the innovative drug sector. The underlying commercial rationale is that Pharma.AI delivers quantifiable efficiency gains. An initial collaboration, perhaps a pilot project worth a few million dollars, allows for the accumulation of usage data. This data, in turn, drives the platform's evolution through a positive feedback loop, creating a path dependency where the tool becomes "increasingly fit for purpose" the more it is used.

For the capital markets, this high repeat collaboration rate serves not only as a gold standard for ecosystem vitality but also as a crucial indicator of sustainable revenue. It represents a shift from a one-time platform subscription model towards a client model characterized by strong network effects and lock-in. This ecosystem network underpins Insilico's core narrative: building an innovation factory with an industrial-grade trust moat, capable of sustainably generating pharmaceutical assets.

Within this three-dimensional framework of software value, pipeline value, and ecosystem network value, AI-driven drug discovery is evolving from an "efficiency tool" into an "asset creation system."