With its HK listing, QingSong Health completes a triple IPO year for insurtech and charts a new path

In 2025, the insurance technology sector witnessed a concentrated surge of capital enthusiasm in the secondary market. On December 23, QingSong Health was listed on the Hong Kong Stock Exchange, marking the third public listing in the health insurance technology field this year (this article primarily focuses on insurtech companies in the health insurance sector).

Following the listings of Waterdrop Inc. and Sipai Health Technology Co., Ltd. ("Medbanks") in 2021 and 2022 respectively, although many insurtech companies have rushed toward IPOs, progress has been less than optimistic. Concurrently, against the backdrop of industry-wide business model bottlenecks, some companies are facing operational challenges. However, in April and May 2025, Yuanbao and Shouhui Group were listed on Nasdaq and the Hong Kong Stock Exchange respectively. Together with the recent listing of QingSong Health, these three IPOs within a single year have brought the once sluggish insurtech sector back into the spotlight.

After years of development and strategic transformation, QingSong Health has evolved from a well-known online medical crowdfunding platform into a provider of digital integrated health services and health insurance solutions.

As outlined in its prospectus, QingSong Health primarily operates two major business segments: providing individuals and corporate clients with various health-related services, including health education, digital medical research support, and comprehensive health service packages; and offering insurance-related services to support users' healthcare expenditures and meet their coverage needs.

QingSong Health's Business Model, Image Source: Prospectus

QingSong Health's Business Model, Image Source: Prospectus

Financial reports show that in 2022, 2023, and 2024, QingSong Health achieved revenues of RMB 394 million, RMB 490 million, and RMB 945 million, respectively. For the first half of 2025, the company reported revenue of RMB 656 million, an 84.8% increase compared to RMB 355 million in the first half of 2024. On an adjusted net profit basis, QingSong Health has achieved profitability.

This wave of public listings also signals that the insurance technology sector is gradually transitioning from early-stage business model exploration into a new phase of scaled development. Market focus has expanded beyond profitability models to also emphasize the industry's potential for long-term, sustainable growth.

Customizing Products to Match the Evolving Insurance Needs

For a long time, the traditional insurance industry has faced challenges such as severe product homogeneity, limited coverage scenarios, and mismatches between supply and demand.

With the growing health awareness and insurance consciousness among the general public, the demands of policyholders and insured individuals have become significantly more diverse. There is not only a higher expectation for basic coverage but also increasingly refined needs for personalized protection tailored to specific scenarios and populations—particularly the elderly, individuals with pre-existing conditions, and those managing chronic illnesses—who exhibit a more urgent need for adequate insurance coverage. A notable example in terms of insurance types is the growing limitations of traditional million-yuan medical insurance in recent years. While these products offer high coverage limits, they often fall short in covering the costs of certain high-value medications and advanced medical equipment.

Thus, innovation and transformation in insurance products are urgently needed. It is essential to move beyond traditional product mindsets, not only accurately addressing existing demands but also proactively exploring unmet coverage areas.

Insurtech companies, leveraging their insights into user needs and flexible partnership models, are breaking through industry challenges with customized and differentiated products, becoming a key driving force behind the transformation and innovation of insurance offerings.

Since selling its first policy online in December 2016, QingSong Health has continued to develop its insurance-related services, now primarily offering insurance brokerage services and insurance technology services.

In insurance brokerage, QingSong Health focuses on promoting customized product development. As of the end of June 2025, the majority of its products on sale have been developed in collaboration with insurance companies.

During the co-development process, QingSong Health utilizes data analysis to optimize the standard products of partner insurers, aiming to precisely meet user needs. For example, after in-depth analysis of claim data from its flagship insurance product, QingSong Health found that many users were unable to receive compensation due to not meeting the preset deductible thresholds. Through negotiations with insurers, it successfully reduced deductibles for dozens of specific minor illnesses. It also launched a medical insurance product with zero deductibles, benefiting a broader range of policyholders.

Additionally, QingSong Health collaborates with insurance companies to develop tailored insurance products that meet the coverage needs of specific demographic segments. For instance, in partnership with an insurance company, it launched a product designed for female users, covering medical expenses for certain female-specific conditions. For users with pre-existing medical histories, QingSong Health worked with insurers to design specific products that provide coverage for liver disease compensation and treatment costs. For the elderly, the company has prioritized the development of fracture accidental injury insurance.

As of June 30, 2025, QingSong Health collaborated with 58 insurance companies to distribute 294 insurance products, of which 284 were co-developed. Between 2022 and 2023, all insurance products sold by QingSong Health were co-developed. By June 30, 2025, its insurance-related services covered approximately 26.2 million policyholders and around 29.2 million insured individuals, generating total premium income of RMB 5.4 billion.

With the release of the updated National Reimbursement Drug List, the inaugural Commercial Health Insurance Drug List has been officially introduced, presenting a significant policy opportunity for the transformation of commercial insurance products.

This long-awaited list provides a unified and authoritative reference for the scope of drug coverage in commercial health insurance, offering the potential to steer the industry away from homogeneous price competition toward differentiated value-based rivalry. In this shift, precise coverage for innovative drugs is particularly critical, especially specialized protection targeting specific diseases and populations—areas where insurtech companies are expected to concentrate their efforts.

In response, QingSong Health has outlined in its development strategy that it will continue to diversify its services and product offerings. It plans to collaborate with insurance partners and health service providers to develop customized services and products that address users' personalized health-related needs. Examples include further expanding the coverage scope of million-yuan medical insurance products to incorporate more advanced medical solutions, as well as partnering with insurers, pharmaceutical companies, and hospitals to offer more tailored solutions such as medical surgery insurance products.

How Technology Drives the Restructuring of the Insurance Value Chain

The rapid development of internet-based insurance has not only driven the overall expansion and structural optimization of the insurance industry but also provided fertile ground for the fast growth of insurtech companies. However, insurtech is not merely about "internet + insurance"; the penetration of "technology +" within the sector is deepening steadily.

QingSong Health's technology services for insurance companies have already generated meaningful revenue. For instance, leveraging its "Phoenix" enterprise service platform, QingSong Health provides insurers with a suite of technological solutions, including intelligent operations, smart risk control, and automated monitoring. From 2022 to 2024, its insurance technology services contributed over RMB 180 million in annual revenue, with customer retention rates consistently rising, reaching 70.0% in 2024.

Notably, QingSong Health has integrated its technological capabilities throughout the entire business workflow.

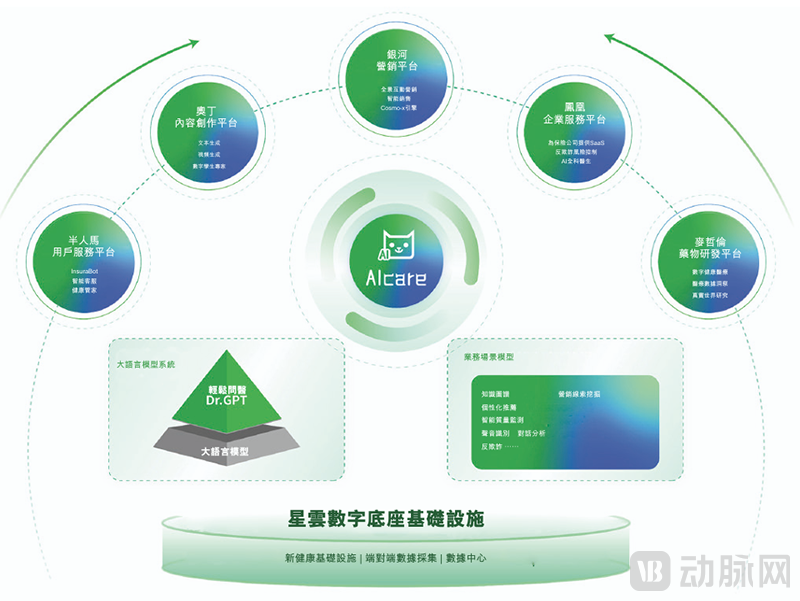

Specifically, QingSong Health has established a core technological architecture comprising the Xingyun digital foundation and the AIcare technology stack, which provides underlying technical support for business development. The Xingyun digital foundation serves as the digital infrastructure, integrating cloud-based AI collaboration and identity verification functions. It employs a comprehensive data collection approach combining real-time data streams and batch processing, legally and securely gathering users' social information, health data, and operational data while strictly adhering to compliance requirements. Through real-time analytics and in-depth mining, it enables the accumulation of data assets, serving as a core driver for business digital transformation. AIcare, as a proprietary AI technology stack, supports end-to-end business scenarios—including daily operations, product development, and service delivery—through multiple functional modules, delivering intelligent assistance across the board.

QingSong Health's technical platform, source: prospectus

Based on its core technology architecture, QingSong Health has built an application matrix designed for multiple stakeholders, achieving deep integration between technology and business operations. In addition to the previously mentioned "Phoenix" enterprise service platform, this matrix includes the "Galaxy" marketing platform, the "Centaurus" user service platform, the "Magellan" drug R&D platform, and the "Odin" content creation platform. These platforms apply AI technology to scenarios such as hyper-personalized marketing, in-depth analysis of health data, drug development efficiency enhancement, and precise dissemination of health knowledge.

From a development trend perspective, digital technologies such as AI and big data have become core infrastructure within the insurance industry. They enable deeper analysis of the risk profiles of policyholders and insured individuals, accurately capturing user characteristics and behavioral patterns, while also supporting the automation and optimization of critical processes such as policy management, underwriting, and claims handling.

Therefore, the rapid growth of internet-based insurance is not merely a channel shift but a comprehensive digital transformation of the insurance value chain. Throughout the entire process—from product design, user engagement, underwriting and claims, to service enhancement—technology continuously optimizes each key stage, ultimately improving both user experience and industry operational efficiency.

As "AI+" initiatives penetrate various industries, the wave of technological innovation in the insurance sector is set to deepen further. According to its prospectus, QingSong Health will significantly increase investment in technology R&D, allocating up to 20% of its IPO proceeds to enhance capabilities in AI and big data, thereby continuously strengthening its core competitive advantages.

While the internet-based insurance industry has maintained overall growth, its development has shown noticeable volatility, which is directly linked to ongoing adjustments in regulatory policies and continuously evolving compliance requirements for business operations. At the same time, "big tech" companies have accelerated their expansion into the insurance sector by leveraging their traffic advantages, while traditional insurers are actively advancing digital transformation, expanding their internet-based businesses through self-operated platforms or third-party channels. These leading players each possess distinct core strengths, intensifying competition within the industry.

Currently, insurtech companies primarily generate revenue from transaction-based businesses—mainly insurance brokerage—and technology services centered on technical solutions. Faced with increasingly fierce market competition and regulatory volatility, diversifying revenue streams has become a crucial strategic choice for companies seeking stable growth.

It is reported that after launching its insurance-related services, QingSong Health has built a highly engaged, health-conscious user base. These users not only show strong acceptance of insurance products but also exhibit significant interest in non-insurance health solutions. Demographically, QingSong Health's insurance product users are predominantly young, accustomed to obtaining insurance and other health information through online channels. As these users age and experience life events such as marriage and parenthood, their accumulated assets and growing family responsibilities are expected to naturally translate into higher spending on non-insurance health solutions, including health management and disease prevention.

Against this backdrop, QingSong Health has expanded its business scope into health-related services, gradually introducing offerings such as comprehensive health service packages, early disease screening promotion and consultation services, digital marketing (health education), and digital medical research support. Its clients now extend beyond insurance companies to include pharmaceutical firms, non-insurance corporate clients, charitable foundations, and other industry participants.

Specifically, QingSong Health collaborates with residential communities through free screening-related promotions and consultation services, focusing on preventive care initiatives such as cancer risk screening, bone density testing, and traditional Chinese medicine consultations. Building on these preventive health services, it provides solutions through comprehensive health service packages, which include personalized health management programs, access to medical resources, and membership benefits. As a key component of its service offerings, QingSong Health also designs health-related educational content in the form of digital marketing campaigns primarily for pharmaceutical companies, while raising public awareness of specific health issues.

Overview of QingSong Health's "Health-related Services" Business Segment, Source: Prospectus, VCBeat Analysis

Overview of QingSong Health's "Health-related Services" Business Segment, Source: Prospectus, VCBeat Analysis

Through these initiatives, revenue from non-insurance businesses has continued to grow. In 2022, QingSong Health's non-insurance-related revenue accounted for only 15.2% of its total revenue. Following the expansion of non-insurance operations, this proportion increased rapidly to 31.7% in 2023, making a significant contribution to the company's overall performance growth. In terms of revenue from health-related services, it reached RMB 503 million in 2025, representing 76.7% of total revenue.

More importantly, health-related services can also create synergies with insurance-related services and even enhance cross-selling opportunities. For instance, early disease screening promotions, consultation services, and health awareness campaigns serve as important user acquisition channels for QingSong Health. As of 2025, approximately 29.5% of its policyholders had already been clients of its health-related services prior to purchasing insurance.

From an industry development perspective, QingSong Health's business expansion aligns precisely with the high-growth opportunities in the digital health sector. In an increasingly competitive insurtech environment, this diversified yet synergistic business model is becoming a key pillar for companies to mitigate risks and build long-term growth advantages.

Overall, the concentration of IPOs among insurtech companies in 2025 is the inevitable result of rising demand, supportive policies, and continuous product and technological advancements. It also marks a significant milestone for the industry.

As market transformation deepens and digital technologies evolve, insurtech companies will play an increasingly critical role in improving the multi-tiered medical security system, enhancing overall industry operational efficiency, and meeting users' diversified health protection needs.

In the face of intensifying competition, only those companies that adhere to regulatory compliance, consistently create user value, and respond sensitively to industry shifts will secure long-term growth opportunities.