Pfizer turns to Fosun’s Yao Pharma in $2B+ bet on next-gen oral GLP-1

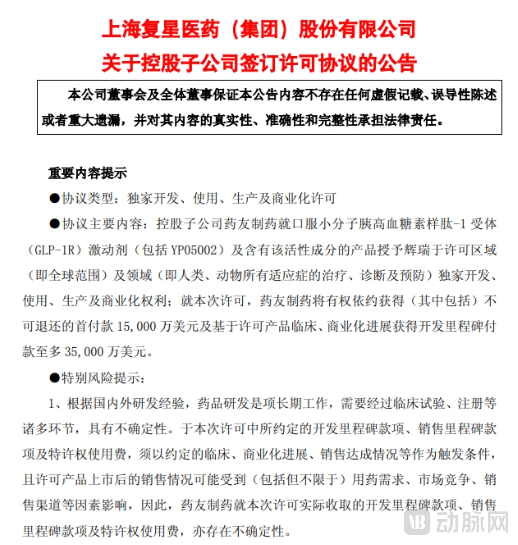

On the evening of December 9, Fosun Pharma (SSE: 600196.SH; HKEX: 02196.HK) announced that its controlling subsidiary, Chongqing Yao Pharmaceutical Company, Limited ("Yao Pharma"), has officially entered into a License Agreement with the global pharmaceutical giant Pfizer Inc. Under the agreement, Yao Pharma has granted Pfizer an exclusive worldwide license for the development, manufacturing, and commercialization of its self-developed oral small-molecule glucagon-like peptide-1 receptor (GLP-1R) agonist YP05002, along with any products containing this active ingredient. The license covers all human and veterinary indications for therapeutic, diagnostic, and prophylactic purposes.

YP05002: An Oral Small-Molecule GLP-1 Agonist with Multi-Indication Potential

YP05002 is a small-molecule agonist independently researched and developed by Yao Pharma. The molecule is currently in Phase I clinical trials in Australia. According to the announcement, Yao Pharma will receive an upfront payment of USD 150 million. If all specified milestones are met, the total potential payments, including development, regulatory, and sales-based milestone payments, could reach up to USD 1.935 billion. Additionally, Yao Pharma is eligible to receive tiered royalties on global sales.

The significant industry interest in YP05002 stems not only from its mechanism as a GLP-1 receptor (GLP-1R) agonist but also from the potential of its "small-molecule + oral" administration route to redefine accessibility and expand application scenarios for GLP-1-based therapies.

Traditional GLP-1R agonists, such as semaglutide, have demonstrated strong clinical efficacy in areas like type 2 diabetes and weight management, with both subcutaneous injection and oral (Rybelsus®) formulations available. However, their peptide-based nature presents several inherent limitations.

On one hand, the peptide chain structure translates into a complex, costly synthesis and purification process, demanding high standards throughout the supply chain for production and storage. On the other hand, peptides are highly susceptible to degradation by gastrointestinal proteases. For oral formulations, this necessitates the use of special absorption enhancers (e.g., the sodium caprate derivative SNAC) to facilitate crossing the gastrointestinal mucosa. Even with such aids, bioavailability remains relatively low, and stringent administration requirements—such as taking the drug on an empty stomach and avoiding food and water for 30 minutes afterward—are mandatory. This not only impacts long-term patient adherence but also limits the applicable patient population and reduces flexibility in market promotion strategies.

In contrast, a well-designed small-molecule compound may hold significant advantages in terms of stability, oral absorption, production processes, and scalable supply. It also aligns better with the management of chronic diseases or large-scale market adoption. The licensing of YP05002 is precisely grounded in this industrial perspective and its potential for widespread future accessibility.

Notably, the potential indications for this class of small-molecule GLP-1R agonists extend beyond chronic weight management and type 2 diabetes to include metabolic dysfunction-associated steatohepatitis (MASH, also known as non-alcoholic steatohepatitis).

Naturally, significant uncertainties remain between Phase I clinical trials and final regulatory approval leading to a commercially available drug. Key challenges include confirming safety in later-stage clinical trials, demonstrating comparable efficacy/safety profiles against existing injectable or oral peptide-based therapies, ensuring stable scale-up of manufacturing and supply chains, and navigating global regulatory pathways and market acceptance.

Particularly, given the historical safety concerns associated with GLP-1R agonists regarding hepatic and gastrointestinal effects, monitoring the long-term tolerability and potential organ toxicity of small-molecule compounds remains a core challenge.

Therefore, the significance of YP05002 lies in representing a candidate pathway characterized by "small-molecule + oral + scalable production + potential broad indications." However, whether it can become the next paradigm for the popularization and industrialization of GLP-1 drugs still requires validation through more clinical and real-world data.

Fosun's Innovation Incubation and Yao Pharma's Manufacturing Strength

The successful conclusion of this licensing deal can be largely attributed to the distinct yet complementary capabilities forged by the three parties within their respective positions in the industry chain.

As the parent company, Fosun Pharma has established a fully integrated ecosystem spanning pharmaceuticals, medical devices and diagnostics, and healthcare services since its founding in 1994. Its core businesses have achieved a significant international presence, primarily covering markets in the United States, Europe, Africa, India, and Southeast Asia. In 2024, its R&D investment reached RMB 5.554 billion. Through a diversified model encompassing in-house R&D, co-development, and in-licensing, Fosun Pharma continuously enriches its innovative pipeline.

Within the GLP-1 domain, Fosun Pharma had previously established a presence for injectable formulations through strategic collaborations. For instance, in May of this year, it entered into a strategic partnership with Jiuyuan Gene. This agreement granted Fosun Pharma exclusive rights for the clinical development, registration, production, and commercialization of Jiuyuan's GLP-1 products, including a semaglutide biosimilar, across all countries in the Middle East and North Africa, Sub-Saharan Africa, and select ASEAN nations. This move strategically complemented Fosun's international portfolio in the metabolic and metabolic complication therapeutic areas.

Yao Pharma, one of the core enterprises within the Fosun Pharma system responsible for chemical drug R&D and industrialization, boasts a history of over 80 years. It holds a nationally influential position in China due to its integrated capabilities in "Active Pharmaceutical Ingredients (API) + Finished Dosage Forms." Its oral solid dosage production line has a designed annual capacity of 1 billion tablets. Having successfully passed an on-site inspection by the U.S. FDA as early as 2019, and with subsequent capacity expansions and digital upgrades in recent years, its actual supply capability continues to strengthen.

For an oral small-molecule GLP-1 drug, Yao Pharma's established manufacturing processes, quality systems, and large-scale production capacity are crucial factors for a multinational pharmaceutical company when assessing commercial feasibility. This also constitutes the core value Yao Pharma brings to this collaboration.

A New Chapter for Pfizer's GLP-1 Strategy

For Pfizer, this collaboration represents a strategic addition to its GLP-1 pipeline. As one of the multinational pharmaceutical companies with the strongest global commercial capabilities, Pfizer possesses mature global multi-center clinical networks and commercialization capabilities in key therapeutic areas such as cardiovascular/metabolism, vaccines, anti-infectives, and oncology.

However, in the highly competitive GLP-1 arena, Pfizer's internal R&D efforts have faced setbacks. In 2023, development of the small-molecule GLP-1 agonist lotiglipron was discontinued. This was followed in 2025 by the cessation of further development for its oral GLP-1 candidate danuglipron (PF-06882961) from the same series, primarily due to safety profile assessments.

Amidst the rapid market expansion led by Novo Nordisk and Eli Lilly with semaglutide and tirzepatide, Pfizer urgently needed to fill the gap in its oral GLP-1 portfolio through external partnerships. By in-licensing YP05002, Pfizer not only swiftly acquires a core oral GLP-1 asset but also, leveraging its potential for multiple indications (especially in MASH), gains an opportunity to rebuild its competitiveness within the second wave of growth in the GLP-1 market.

The GLP-1 Race Enters the Era of Segmentation

This collaboration epitomizes the global GLP-1 market's evolution from pure scale expansion into an era of segmented competition. With Novo Nordisk and Eli Lilly dominating nearly 90% of the market, latecomers must break through by "refining application scenarios, differentiating technology platforms, and extending indications". Simultaneously, industry giants actively seek external collaborations to swiftly fill gaps and reshape the competitive landscape.

The segmented competition in the GLP-1 arena is characterized by three core trends.

Firstly, emerging indications represent a new blue ocean. The World Obesity Atlas 2025 projects that by 2030, 50% of the global adult population—nearly 3 billion people—will be classified as overweight or obese, indicating explosive growth in related treatment needs. Concurrently, Frost & Sullivan forecasts that the global population affected by MASH will reach 490 million by 2030, with 56 million cases in China alone. The corresponding global drug market is expected to surge to USD 32.2 billion. The long-standing absence of effective treatments for this condition has transformed MASH into a multi-billion-dollar therapeutic area fiercely contested by pharmaceutical companies.

Currently, leading players are strategically expanding into these areas: Eli Lilly's tirzepatide has gained approval for weight loss, and Novo Nordisk's semaglutide has received FDA approval for the MASH indication. In this context, the early-stage positioning of YP05002 in the oral GLP-1 segment aligns precisely with Pfizer's need to fortify its presence in emerging metabolic indications. This strategy of targeting unmet clinical needs and substantial market potential lies at the heart of succeeding in a segmented market.

Secondly, dosage form innovation aligns with precise treatment scenarios, creating strong resonance between market demand and application suitability. Research indicates that in 2024, oral formulations constituted a dominant 42.2% share of the global pharmaceutical market, with a projected compound annual growth rate (CAGR) of 6.0% from 2024 to 2029. Favored for their high patient adherence, non-invasive nature, and ease of administration, oral drugs are the preferred dosage form for chronic disease management. This trend is particularly pronounced in the GLP-1 sector: despite a bioavailability of only 0.4%-1%, oral semaglutide (Rybelsus®) achieved sales exceeding $3 billion in 2024. This strongly validates the persistent demand for convenient treatment among patients with conditions like diabetes and obesity and underscores the irreplaceable value of oral formulations in long-term therapy.

Thirdly, integrated supply chain capabilities have become a critical, albeit less visible, competitive barrier. Yao Pharma's integrated "API + Finished Dosage Form" production capacity not only ensures supply stability but also helps reduce manufacturing costs. This capability served as a core pillar supporting the substantial licensing deal at the Phase I clinical stage, highlighting how competition has expanded beyond the molecule itself to encompass the entire industrial chain.

This transaction further reflects a broader industry realignment. Major players are actively integrating high-quality assets through mergers, acquisitions, and licensing to expedite the process of filling pipeline gaps. For the wider industry, the signal is clear: in the crowded GLP-1 space, merely following innovation offers limited opportunity for breakthrough. Projects that successfully combine precise application targeting, technological differentiation, and robust supply-chain capabilities are the ones most likely to gain a foothold.

Furthermore, it signifies a new phase for China's innovative drug sector in going global. The focus is shifting from single-molecule "point breakthroughs" toward a more systematic competitive strategy encompassing "molecular innovation + engineering and manufacturing prowess + multi-indication potential."