With $15M Alexza deal, Lee's Pharma aims at unmet needs in neurology and respiration

On December 8, a subsidiary of Lee's Pharmaceutical (stock code: 00950.HK) announced the acquisition of core assets from Alexza Pharmaceuticals for USD 15 million. This transaction not only secures the globally advanced respiratory drug delivery platform, the Staccato One Breath Technology (OBT), but also adds two clinical-stage drug candidates to its pipeline. It will significantly enhance Lee's Pharmaceutical's strategic positioning in addressing unmet medical needs in neurological, respiratory, and pulmonary vascular diseases.

Looking back at the collaboration between the two parties, Lee's Pharmaceutical had already licensed Staccato fentanyl inhalation products from Alexza in 2018. Through a model combining technology licensing, localized production, and clinical development, the company has actively contributed to the deployment of Staccato platform products in China, establishing itself as one of the platform's earliest partners in the region. This full acquisition marks a strategic shift from being a participant to taking on a leading role in the development and commercialization of the technology.

Alexza Focuses on Inhalation Drug Delivery Technology

To understand the potential value of this transaction, it is essential to first examine Lee's Pharmaceutical itself.

With 30 years of experience in the pharmaceutical industry, Lee's Pharmaceutical is an integrated, research-driven, and market-oriented biopharmaceutical company. It was listed on the Growth Enterprise Market (GEM) of the HKEX in 2002 and upgraded to the Main Board in 2010, marking simultaneous growth in both capital operations and business development. Initially focused on cardiovascular and infectious diseases, Lee's Pharmaceutical has since continuously expanded its therapeutic scope. Today, it has established a diversified product portfolio covering pediatrics, women's health, rare diseases, oncology, dermatology, and other therapeutic areas. Driven by a dual strategy of "in-house innovation and external introduction," the Group has established partnerships with approximately 30 companies worldwide. It currently markets over 25 pharmaceutical products in Chinese Mainland, Taiwan, Hong Kong, and Macau, with a pipeline of more than 40 products across various development stages, forming an integrated industrial chain from R&D to commercialization.

On the core business front, key products have demonstrated strong performance in recent years. The centralized procurement product, Nadroparin Calcium Injection, recorded sales of HKD 192.7 million in 2024, representing a significant year-on-year increase of 130.4%. Socazolimab Injection, approved in December 2023, further advanced its commercialization in 2024, and its new indication for small cell lung cancer was approved in July 2025, expanding its clinical application. In dermatology, the combination product Adapalene and Clindamycin Hydrochloride Gel, approved in February 2024, achieved rapid market launch by May of the same year. The successful advancement of these products fully demonstrates Lee's Pharmaceutical's mature capabilities across the entire value chain, including process development, regulatory submission, and commercial promotion, and has laid a critical foundation for the localization and transformation of inhaled drug delivery technology in China.

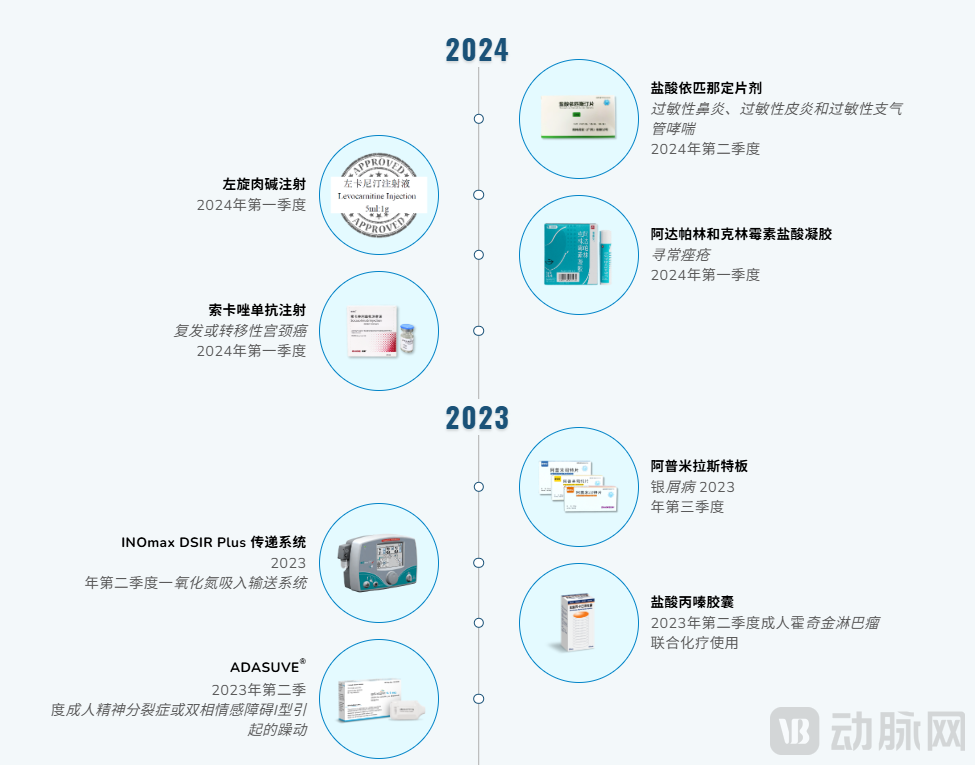

Lee's Pharmaceutical 2023-2024 Product Launch Timeline

On the production front, Lee's Pharmaceutical operates two core production bases located in Hefei, Anhui, and Nansha, Guangzhou, Guangdong, forming a diversified manufacturing system covering injectables, complex formulations, and high-end medical devices. Since its launch in 1998, the Hefei base has established a production area of 4,600 square meters and completed the construction of a liposome production line and a biological drug active pharmaceutical ingredient (API) production line. In June 2025, the base officially commissioned a new pre-filled syringe isolator production line, marking a further upgrade in its Good Manufacturing Practice (GMP) system and aseptic processing capabilities.

Lee's Pharmaceutical's financial performance also supports its pursuit of external innovation through acquisitions. In 2024, Lee's Pharmaceutical reported revenue of approximately HKD 1.4 billion and net profit attributable to shareholders of HKD 93.099 million, a year-on-year increase of 457.5%. For a mid-sized pharmaceutical group, the USD 15 million investment remains within a manageable range.

In contrast to Lee's Pharmaceutical's integrated value chain, Alexza's core competency lies in the field of respiratory drug delivery technology. As a wholly-owned subsidiary of the Ferrer Group, Alexza's Staccato One Breath Technology (OBT) handheld inhaler represents a breakthrough in drug administration. Traditional injection methods face limitations such as slow onset and invasiveness, while conventional inhalation formulations often struggle with low drug deposition efficiency and inconsistent dosing. The Staccato system employs rapid heating technology within 100 milliseconds to convert unformulated active pharmaceutical ingredients into pure drug aerosols. With a single inhalation, patients achieve precise drug deposition in the lungs, ensuring rapid and complete absorption into the bloodstream without invasive procedures.

Currently, Adasuve (loxapine inhalation powder), developed based on this platform, has been approved by the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) for the acute treatment of agitation associated with schizophrenia or bipolar disorder, providing an important option for neurological emergencies.

The core assets of this transaction also include two key pipeline candidates under development by Alexza: FNP 010 (a Staccato-based therapeutic for cyclic vomiting syndrome) and FNP 150 (a candidate for managing "off" episodes in Parkinson's disease). Both candidates are in critical stages of clinical development and demonstrate high complementarity with Lee's Pharmaceutical's existing pipelines in neurology and respiratory diseases.

Global Giants Have Formed a Long-Term Layout in Inhalation Drug Delivery Technology

From a broader industry perspective, this acquisition by Lee's Pharmaceutical is not an isolated event but rather aligns with a rapidly expanding window of opportunity in respiratory drug delivery technology. According to the QYResearch report 2025–2031 Global and China Inhalation Preparations Market Status and Forecast, the global inhalation preparations market reached sales of USD 44.45 billion in 2024 and is projected to grow to USD 63.9 billion by 2031, with a compound annual growth rate (CAGR) of 5.4% during the forecast period from 2025 to 2031. In the Chinese market, driven by an accelerating aging population and rising demand for chronic disease management, the inhalation preparations market is steadily expanding, becoming a key driver of global market growth.

In this promising field, international pharmaceutical giants have already established long-term strategic positions. Novartis has built its dry powder inhaler (DPI) system around Ultibro Breezhaler, steadily covering patients with chronic obstructive pulmonary disease (COPD). AstraZeneca has reinforced its long-standing dominance in global respiratory business with Symbicort Turbuhaler, while GSK promotes the clinical and commercial application of inhaled drugs through devices such as its Ellipta series. Different approaches coexist, but all point to the same trend—inhalation is no longer limited to specialized departments for asthma or COPD but is emerging as a potential gateway for systemic drug delivery.

Compared to the typical investment of over USD 100 million required for an innovative drug delivery technology, Lee's Pharmaceutical's acquisition of the Staccato® OBT platform and its production system for USD 15 million represents significant advantages in cost and timeline. More importantly, this technology possesses clear transferability: beyond neurological emergencies, it can be extended to areas such as acute pain, migraines, and epileptic seizures.

For Lee's Pharmaceutical, the value of this acquisition extends beyond acquiring a technology—it opens a differentiated competitive pathway previously underexplored by the company. China's inhalation preparations industry possesses mature production capacity and engineering foundations but remains in the early stages of exploration regarding systemic inhalation as a route for drug delivery. The integration of Staccato positions Lee's Pharmaceutical as one of the companies poised to achieve early platform-level localization in China.

Nevertheless, the path to technology translation is not without challenges. Post-migration re-registration, lung safety evaluations, indication selection, the pace of device localization in China, and the regulatory stance toward systemic inhalation delivery could all influence the translation timeline. The commercialization journey for an inhalation platform is typically lengthy, often starting with a clinically impactful, well-defined indication before expanding to broader applications. However, this aligns with the strategic rhythm management expertise of established pharmaceutical companies—stable technology, clear pathways, and precise market entry points. Lee's Pharmaceutical's accumulated experience across the full value chain will provide strong support in addressing these challenges.

From a higher-level industry viewpoint, this transaction also reflects an emerging trend: Chinese pharmaceutical companies are expanding their innovation boundaries from "drug targets" to "drug delivery methods." Over the past decade, domestic innovation in China has primarily focused on antibodies, novel pathways, and small nucleic acids. Entering the next cycle, "drug delivery system innovation"—represented by inhalation, transdermal, nasal spray, and implantable devices—is gaining attention from both the market and capital, and may well become a key differentiator in the next wave of competition.