The BCI survival guide: how to stay afloat before the revenue flows

In June 2025, Neuralink announced the completion of a $650 million Series E financing round, once again setting a new funding record in the brain-computer interface sector. Notably, this represents Neuralink's seventh round of financing since its founding, bringing its total cumulative funding to over $1.3 billion. This figure is particularly striking when compared to the $2.6 billion global market size for brain-computer interfaces in 2024, which is only double its total raised capital.

Figure 1. Neuralink's disclosed financing records (Data source: VCBeat, Crunchbase)

Figure 1. Neuralink's disclosed financing records (Data source: VCBeat, Crunchbase)

Nevertheless, even substantial financing falls short of covering Neuralink's expenditures. In May 2024, Musk stated during an internal meeting that Neuralink's burn rate amounts to several hundred million dollars annually. In the absence of commercial revenue at this stage, this undoubtedly represents a significant financial drain. For Neuralink, however, this is not a critical issue. On one hand, founder Elon Musk serves as a substantial financial backer, having personally invested nearly $500 million into Neuralink since its inception. On the other hand, as a super unicorn in the brain-computer interface field, Neuralink commands intense attention in capital markets, with each funding round becoming a fiercely competitive arena for global investors.

Yet there is only one Neuralink. For the vast majority of brain-computer interface companies, they lack the influential founder brand appeal or the readily accessible "funding capability." Conversely, in a market environment where stable commercialization and mature profit models are generally absent, the question of their very survival is becoming increasingly urgent. As one founder of a brain-computer interface company remarked, "I never worry about long-term commercialization. My only concern is the potential for cash flow disruption at this stage. It's like the market wants the seventh pancake, but I'm running out of flour while making the first six."

This is not an isolated case but rather a common survival dilemma faced by many brain-computer interface enterprises today. Consequently, a pressing question emerges: how can brain-computer interface companies sustain themselves before technological maturity and market acceptance are achieved?

Financing Remains the Top "Productivity"

Over the past few years, brain-computer interfaces have undoubtedly been one of the hottest investment targets in the capital markets. According to incomplete statistics from the VCBeat database, China's brain-computer interface sector has witnessed nearly a hundred financing rounds over the last five years, with total funding exceeding RMB 10 billion. Over a hundred capital firms, including Sequoia Capital, Hillhouse Investment, MPCi, Legend Capital, CDH Investments, Fortune Capital, Qiming Venture Partners, and Casstar, have successively placed their bets in this field.

The primary reason for such high pursuit lies in the immense potential of brain-computer interface technology as a cutting-edge advancement. Whether it involves restoring sight to the blind, enabling paralyzed individuals to move, or allowing the deaf to hear again, the realization of any single application scenario is estimated to unlock a market potential of at least tens of billions of US dollars. Consequently, investors have placed significant emphasis on this domain, proactively positioning themselves in advance to avoid missing out on this golden opportunity.

Figure 2. Representative financing events of Chinese brain-computer interface from January to November 2025 (Data source: VCBeat)

Figure 2. Representative financing events of Chinese brain-computer interface from January to November 2025 (Data source: VCBeat)

Entering 2025, with a significant number of clinical applications for brain-computer interfaces being implemented in China, investors have once again rushed to participate. According to incomplete statistics from the VCBeat database, between January and November 2025, a total of 24 financing rounds were completed in China's brain-computer interface sector, representing a year-on-year increase of 30%. Notably, in February, StairMed secured a RMB 350 million Series B financing round, setting a new record for the largest single financing amount in China's brain-computer interface industry.

Looking ahead, financing in the brain-computer interface field is expected to remain at a high level. However, as the industry develops rapidly, the investment logic has undergone significant changes. In this regard, Donghui Jiang, Partner at Delian Capital, noted, "In the past, investors focused more on upstream technology. However, over the past year or two, with the increasing engineering maturity of brain-computer interfaces in China and a deeper understanding of clinical needs, investors now place greater emphasis on the feasibility of the technology itself and its solutions to real clinical demands, as well as the commercialization capabilities of the team. In short, the focus has shifted from investing based on early-stage concepts and narratives to concentrating more on demonstrable market certainty." This shift has consequently imposed new requirements on brain-computer interface companies, namely the need for a clear commercialization pathway and the market capability to achieve scalable monetization.

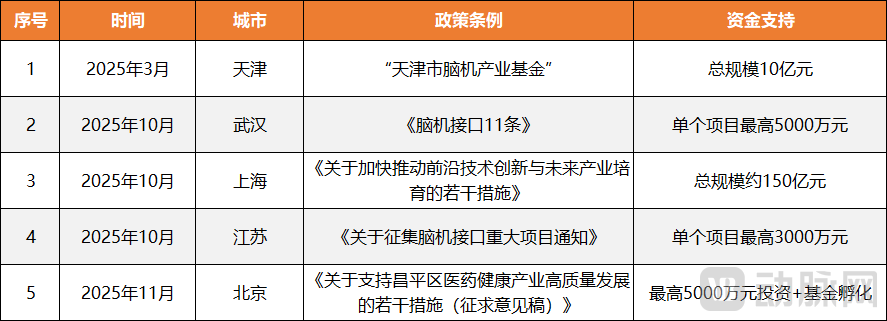

In addition to market capital, government funding remains one of the critical financing channels for brain-computer interface companies. Since the beginning of this year, several significant national policies related to brain-computer interfaces have been introduced in China. In July, seven departments, including the Ministry of Industry and Information Technology of the People's Republic of China and the National Development and Reform Commission, jointly issued the Implementation Opinions on Promoting the Innovative Development of the Brain-Computer Interface Industry, formally elevating the brain-computer interface industry to a national strategic level. Subsequently, in October, the China's "15th Five-Year Plan" further designated brain-computer interfaces as one of the "Six Major Future Industries," reinforcing its strategic importance. Driven by these policies, an increasing amount of dedicated government funding is rapidly flowing into the brain-computer interface sector.

Figure 3. Special funds for brain-computer interface established by local governments in 2025

Figure 3. Special funds for brain-computer interface established by local governments in 2025

In November 2025, the Beijing Municipal Science & Technology Commission, Administrative Commission of Zhongguancun Science Park, and Changping District Government jointly announced the establishment of the "Brain-Computer Interface Special Incubation Fund," with a maximum single funding amount exceeding RMB 50 million. This marks another city joining the track of dedicated financial support for brain-computer interfaces, following Wuhan, Shanghai, Jiangsu, Tianjin, Shenzhen, and Hangzhou. It can be foreseen that the gradually expanding government funding will become a crucial pillar for many brain-computer interface enterprises to address their survival challenges.

In fact, over the past few years, Chinese government funds have already increased their investment in multiple brain-computer interface companies. For example, Neuracle Technology has received over RMB 30 million in government funding through undertaking specialized projects, participating in national research and development programs, and being recognized as an innovative enterprise. In addition, leading companies such as NeuroXess, BrainCo, We-Linking, and StairMed have also received various forms of government financial support.

Regarding this, a venture capitalist commented, "Before brain-computer interfaces achieve large-scale commercial monetization, financing remains the primary or even the only 'lifeline' for many brain-computer interface enterprises. Therefore, for companies seeking to survive, securing financing quickly and continuously is crucial. Currently, the key factors for obtaining financing are twofold: possessing mature technology and having a clear commercialization pathway."

Targeting Two Major Scenarios of Scientific Research and Consumption

A founder of a Chinese brain-computer interface company stated that to maintain stable cash flow for the company, they must, on one hand, continuously persuade investors and advance the next round of financing. On the other hand, they need to actively develop revenue-generating business lines for the company, an approach often referred to as "on-the-go monetization."

So, how is this specifically implemented?

As is widely known, brain-computer interfaces are primarily categorized into two types based on the implantation location and method of electrodes relative to the cerebral cortex: invasive and non-invasive. Due to the distinct differences in their technological pathways, their approaches to "on-the-go monetization" also vary significantly.

Starting with non-invasive interfaces, which only require electrodes to be attached to the scalp, they offer high safety, low cost, and ease of operation. Consequently, their rapid monetization strategies primarily target consumer healthcare scenarios. These include training for attention and cognitive abilities, closed-loop regulation of sleep and emotions, as well as closed-loop neurorehabilitation utilizing eye tracking, electroencephalography (EEG), electromyography (EMG), and rehabilitative assistive devices. Other applications encompass movement assistance or speech output. From a current perspective, many of these products have already achieved successful commercialization.

Figure 4. Representative commercialized brain-computer interface products in China

Figure 4. Representative commercialized brain-computer interface products in China

Take the intelligent bionic hand launched by BrainCo as an example. This is one of the earliest non-invasive brain-computer interface products to enter the market in China, officially introduced and mass-produced in 2020. According to the latest data, the quarterly sales of the intelligent bionic hand in 2024 have exceeded four to five times the total sales for the entire year of 2023, indicating it is in a phase of rapid market expansion. With a market price ranging from RMB 30,000 to 50,000, this has generated at least tens of millions of RMB in revenue for BrainCo. In addition to the intelligent bionic hand, BrainCo also offers several other products, including the Easleep brain-intelligent sleep aid device and the FocusZen brain ring for stress relief and concentration enhancement, all of which have achieved substantial market revenue.

Shifting the focus to invasive interfaces, since electrodes are fully implanted into the cerebral cortex, the signal quality is exceptionally high. As a result, these systems target more advanced clinical applications, such as restoring motor function in paralyzed patients, enabling the blind to regain vision, or restoring hearing in the deaf. However, due to technological and market constraints, these clinical applications cannot be realized in the short term. Consequently, invasive brain-computer interface companies have pivoted their approach toward research scenarios with clear demand.

A representative example is NeuroXess. As early as 2022, the company began selling its wireless, fully implantable flexible brain-computer interface systems to the research market to support projects like the "China Brain Project." According to a November 2025 report, orders in the research sector for the first three quarters of this year increased by 75% year-on-year, with research market revenue now exceeding 100 million of RMB. Regarding this, Tao Hu, founder of NeuroXess, stated, "Many research teams are not directly developing brain-computer interfaces but require them for their studies. This is a market that cannot be overlooked. Moreover, technologies validated in research settings can gradually transition to medical devices."

Beyond NeuroXess, other invasive or semi-invasive brain-computer interface companies, such as Sanbo Brain, Neuracom Technology, StairMed, We-Linking, and Link-X Technology, have also secured orders in the research market. As research progresses, the funding obtained will increase, providing critical support for the survival of many invasive brain-computer interface companies.

In fact, this phenomenon is not unique to China; brain-computer interface companies in other countries are also engaging in "on-the-go monetization" through similar approaches. In the non-invasive sector, the focus remains on consumer healthcare. For instance, the Muse headband developed by InterAxon, one of the earliest commercialized brain-computer interface products globally, has sold over 500,000 units cumulatively in North America, making it one of the highest-selling non-invasive brain-computer interface products based on publicly available data, with total market revenue approaching 100 million of RMB.

Similarly, in the invasive sector, overseas companies are also concentrating on research services. For example, Blackrock Neurotech's electrode arrays and neural signal acquisition systems, such as NeuroPort and NeuroPixels, have become standard tools in thousands of neuroscience laboratories worldwide, generating revenue on the scale of tens of millions of dollars. Founded in 2021, Paradromics has received over $18 million in funding from the NIH and DARPA, primarily for developing the "Neural Input-Output Bus" device—a typical research service contract.

Regarding this, a senior investor commented, "Although the revenue generated from 'on-the-go monetization' by most brain-computer interface companies may not be substantial at present, it is a necessary market strategy. First, these funds can help address operational challenges for some companies. Second, they demonstrate profitability to the capital markets, adding leverage for future financing. Finally, from a long-term perspective, engaging in market activities now lays the groundwork for the future commercialization of core products."

The Future Is Bright, but the Road Ahead Is Still Winding

Many industry insiders consider 2025 the "inaugural year for brain-computer interfaces in China." This designation primarily stems from the concentrated emergence of numerous cutting-edge achievements in clinical applications during this year. For instance, in March, StairMed successfully completed China's first long-term implantation feasibility (FIM) clinical trial of an invasive brain-computer interface system at Huashan Hospital, Fudan University. This milestone signifies China's entry into the clinical trial phase for invasive brain-computer interfaces, making it the second country to do so after the United States. Additionally, dozens of other pioneering advancements have achieved breakthroughs in clinical translation this year.

This undoubtedly represents a historic milestone. However, it is also essential to recognize that entering clinical trials does not equate to success. Even if successful, achieving large-scale commercialization will likely require at least 5 to 10 years, or even longer. Tom Oxley, founder of Synchron—Neuralink's primary competitor—remarked during the Annual Meeting of the New Champions in June, "Approval for medical applications of brain-computer interfaces is expected to take another 3 to 5 years, while consumer-grade implantable devices will likely require at least 15 to 20 years."

This is not an exaggeration. Even for a formidable player like Neuralink, founder Elon Musk has indicated that commercialization efforts will not begin until 2030, with plans to generate over $500 million in revenue that year.

The primary reasons for such an extended timeline lie in several unresolved industry challenges. Foremost among these is the difficulty in signal reception and processing. As is widely known, the human brain contains at least 86 billion neurons, each with thousands of connections, forming an immense network. Currently, the most advanced implantable device globally—Neuralink's N1 implant—features only 1,024 electrodes, a mere fraction of the total number of neurons in the human brain.

Secondly, implanted materials may trigger allergic or rejection responses in the brain. The human brain is exceptionally complex and fragile, and any foreign substance can activate the immune system's "full-scale alarm," leading to adverse reactions such as cerebral edema, inflammatory responses, neuronal damage, and even seizures or cognitive dysfunction. In severe cases, these reactions may pose life-threatening risks.

Finally, there is the challenge of market education, which can be divided into two aspects. One is patient distrust, driven by significant concerns regarding safety. The other involves ethical questions, such as whether accessing patients' neural activity information or subconscious content constitutes an infringement of personal privacy, and whether brain-computer interface enhancements for a minority could impact social equity. These issues will require extensive clinical research and real-world cases to address progressively.

Therefore, the commercialization of brain-computer interfaces still has a long journey ahead. Nevertheless, a quiet "survival" elimination contest has already begun. To stand out, brain-computer interface companies must seize greater market certainty in the present.

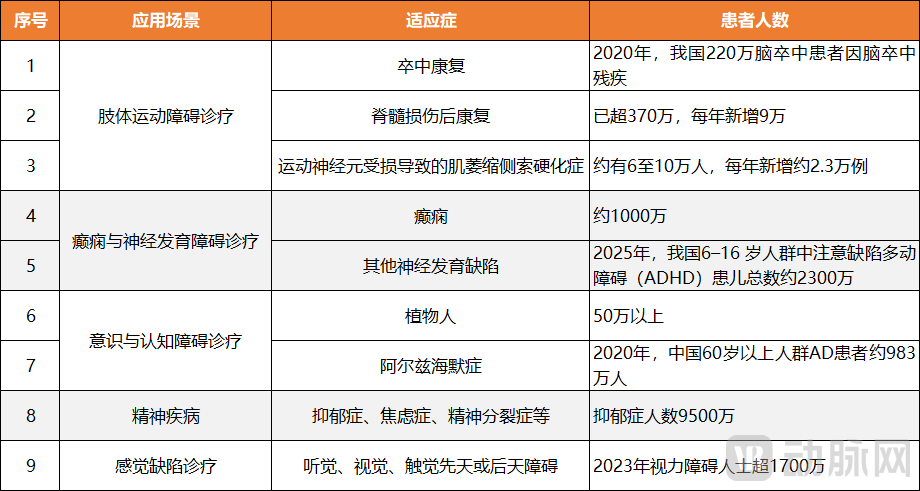

Figure 5. Main indications and patient numbers for brain-computer interfaces in the medical field

Figure 5. Main indications and patient numbers for brain-computer interfaces in the medical field

For instance, in selecting a market segment, companies should avoid spreading efforts too thinly and instead anchor themselves in a niche field with both rigid demand and technically feasible solutions. Liu Bing, founder of Mindtrix Technology, commented on this approach: "We should not always aim for grand, all-encompassing projects. What's more important is to identify a definitive market segment. First, this segment must address a rigid clinical need. Second, its payment logic must be very clear. Finally, it should be relatively easy to develop—a niche direction that current technology can already cover and achieve."

Secondly, a clear commercialization pathway is essential. Companies should not become overly fixated on obtaining the first regulatory approval in a particular domain. Instead, they should focus on whether the product is genuinely effective and provides tangible benefits to patients. Additionally, the market accessibility of the product is crucial, which involves key issues such as pricing and sales strategies.

Finally, it is important to understand the principle of sustained, steady progress. The brain-computer interface industry combines technological depth with a long development cycle. Therefore, for companies, balancing short-term survival with long-term development remains a core challenge. To establish a foothold, a company must be capable of generating revenue to survive in the present while also possessing the capability and patience to tackle more complex problems in the future.

Thus, as brain-computer interfaces gradually transition from science fiction scenarios to reality, an industrial transformation and reshuffling are simultaneously underway.