The U.S. medicare negotiation storm: how an 85% cut is cracking the foundation of global drug pricing

By the end of 2025, the second round of Medicare price negotiation results released by the U.S. Centers for Medicare & Medicaid Services (CMS) rattled the market with a maximum price cut of 85%. Fifteen blockbuster drugs, covering a broad spectrum from diabetes and cancer to rare diseases, are expected to save the Medicare program up to $12 billion after the negotiated prices take effect in 2027. This negotiation goes far beyond mere "price reduction"; it constitutes a comprehensive stress test for national health expenditures, pharmaceutical innovation incentives, patient drug accessibility, and the global drug pricing system.

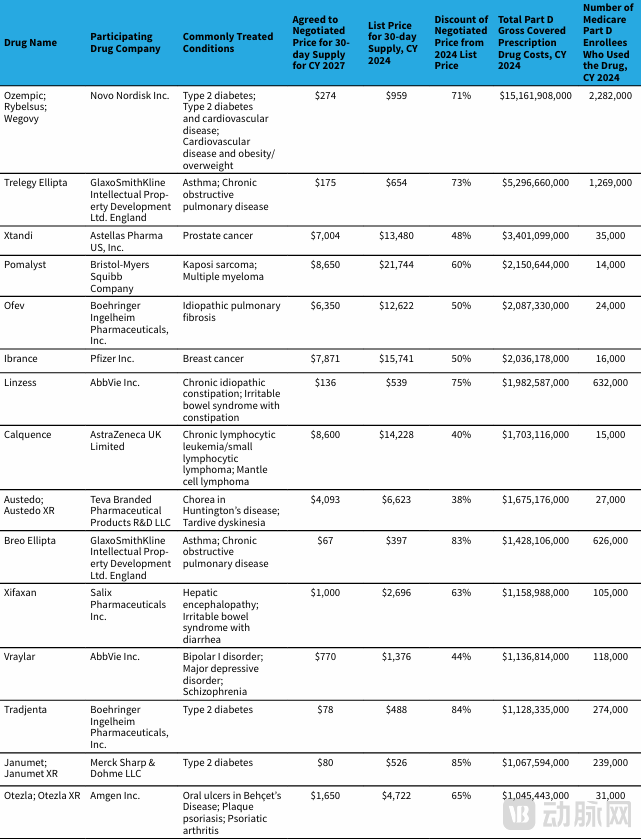

The Second Round of Medicare Negotiation Price Reduction List in the United States

01

Patients: The Hidden Concerns Behind the Good News

The announcement of the results of the second round of U.S. Medicare price negotiations has undoubtedly dropped a bombshell in the healthcare sector. This round added 15 drugs to the negotiations, with the prices of 11 drugs being cut by at least half, and the highest reduction reaching 85%. This move directly benefits approximately 5.3 million Medicare enrollees, bringing tangible relief to numerous patients.

For blockbuster drugs like Novo Nordisk's semaglutide (Ozempic/Wegovy), which treats obesity and diabetes and has the largest number of patients and highest expenditure under Medicare Part D, the price was slashed following the negotiations. The prices for Ozempic and Rybelsus were reduced to $274, and the price for Wegovy was lowered to $385. This represents a significant reduction in financial burden for patients who rely long-term on these medications. Furthermore, the prices of drugs widely used in cancer treatment, such as Astellas' prostate cancer drug enzalutamide (Xtandi) and Pfizer's breast cancer drug palbociclib (Ibrance), were halved. This enables more cancer patients to access effective treatments, substantially alleviating their economic pressure.

However, beneath this wave of positive news, some non-negligible concerns lie hidden. A "ceiling" effect is beginning to emerge. The negotiations set a price ceiling, which, while helping to control healthcare costs to a certain extent and allowing more mainstream drugs to enter the Medicare system—thereby improving medication accessibility for the general public—may also inadvertently restrict the entry of more effective but costlier "breakthrough therapies" into the Medicare system.

Taking rare disease drugs as an example, although the rare disease drug Austedo (deutetrabenazine) was included in this round of negotiations and its price was reduced from $6,623 per month to $4,039 per month, a monthly cost of over $4,000 remains an astronomical figure for ordinary families. Patients with rare diseases already face numerous challenges, including small patient populations, difficult diagnoses, and limited treatment options. Exorbitant drug prices exacerbate their plight. While the price negotiations enhance the accessibility of mainstream drugs, this limitation on access to "niche" and "ultra-high-cost" innovative drugs raises a critical question worthy of in-depth consideration and ongoing monitoring: Will it exacerbate inequity in the allocation of healthcare resources?

02

Pharmaceutical Companies: Choices at the Crossroads

For pharmaceutical companies, the second round of U.S. Medicare price negotiations presents an unprecedented challenge, dealing a significant blow to their traditional business models. For a long time, the industry has adhered to a "high-price, high-return" strategy, relying on a few blockbuster drugs to generate substantial profits that support extensive R&D pipelines. However, the substantial price cuts of up to 85% in this round of negotiations have drastically compressed the profit margins for these star products.

Taking Johnson & Johnson's Otezla (apremilast) as an example, this drug used for treating psoriasis and psoriatic arthritis saw its price slashed post-negotiation. For Johnson & Johnson, Otezla was originally a crucial driver of profit growth; it now faces declining sales and profits. Similarly, drugs like Eli Lilly's Tradjenta (linagliptin) were not spared. The price reductions for these drugs have imposed unprecedented pressure on the companies that depend on them.

Confronted with this severe situation, pharmaceutical companies have universally realized that strategic transformation is essential for survival and development in the new market environment.

First, companies are shifting from "marketing-driven" to "value-driven" approaches. In the past, heavy marketing campaigns were often used to promote products and boost sales. However, in the context of Medicare negotiations, this model is becoming less effective. Now, pharmaceutical companies need robust clinical data to demonstrate the cost-effectiveness of their drugs. For instance, they are increasing investment in clinical research, conducting more clinical trials, and collecting more comprehensive efficacy and safety data. This enables them to fully showcase the value of their drugs during negotiations with Medicare, striving for more favorable pricing and reimbursement terms. Simultaneously, there is a greater emphasis on real-world evidence studies. By collecting and analyzing data from patients in actual treatment settings, companies further validate the effectiveness and safety of their drugs, providing stronger support for negotiation positions.

Second, accelerating diversified portfolios has become a key strategic choice. To reduce reliance on single star products, companies are expanding their pipelines into multiple therapeutic areas. Some are increasing R&D investment in emerging fields like gene therapy and cell therapy. These areas hold significant potential; although R&D is difficult and high-risk, success can open up new profit streams. For example, Novartis has invested heavily in gene therapy, and its developed Zolgensma for spinal muscular atrophy, while high-priced, offers new hope for patients and has established Novartis's leading position in this field. Furthermore, companies are actively using mergers, acquisitions, and collaborations to rapidly acquire new technologies and products, thereby enriching their pipelines. For instance, Hengrui Pharma has expanded its pipeline scale and enhanced its competitiveness through a series of acquisitions and partnerships.

Moreover, re-evaluating R&D direction is also crucial for corporate transformation. Companies may now prefer developing truly breakthrough therapies with stronger negotiation leverage, rather than "me-too" drugs. While "me-too" products carry relatively lower R&D risks, they often lack competitive advantage in price negotiations and face intense price competition. In contrast, breakthrough drugs that address unmet medical needs and offer superior clinical outcomes hold greater sway in negotiations. For example, BeOne Medicine (formerly BeiGene)'s zanubrutinib (Brukinsa), as an innovative BTK inhibitor for lymphomas, has achieved remarkable global success based on its unique efficacy and advantages, generating substantial revenue for BeOne Medicine. During R&D, companies will place greater emphasis on target selection and drug innovation, strengthening collaborations with research institutions to explore new therapeutic targets and drug mechanisms of action, thereby increasing the success rate and efficiency of their R&D efforts.

03

Global: The Upheaval of Pricing Systems

The United States has long held a unique position as the "price peak" in the global pharmaceutical market. Its distinct market environment and pricing mechanisms have resulted in the prices of numerous drugs being significantly higher there than in other countries. Historically, the U.S. drug pricing system was primarily market-driven, with minimal direct government intervention, granting pharmaceutical companies considerable autonomy in setting prices. They determined drug prices based on factors such as production costs, R&D investment, market demand, and the demonstrated "value" of their products, which led to the high prices of many innovative and branded drugs in the U.S. market. For instance, some drugs with relatively moderate prices in Europe and China could be priced 3-4 times higher in the U.S., sometimes even over 10 times the price in China. This price differential established the U.S. as a critical profit source for global pharmaceutical companies and made the U.S. market a key reference point for global drug pricing.

However, the outcome of the second round of U.S. Medicare price negotiations has undoubtedly delivered a massive shock to this long-standing pricing structure. When global drugs like Xtandi and Ibrance experienced substantial price cuts in the U.S., the news quickly triggered a chain reaction across global pharmaceutical markets. Payers in other countries promptly used the U.S. negotiated prices as a key benchmark to pressure companies for corresponding price reductions in their own markets. This is because, within the global pharmaceutical market, companies typically aim to maintain relative price consistency for their products to preserve brand image and market share. Once prices fall in the largest market, the U.S., payers in other countries gain stronger justification to demand lower prices domestically.

This chain reaction will initiate a "downward transmission" across the global drug pricing system. For countries and regions already expressing dissatisfaction with high drug prices, the U.S. Medicare price negotiation results provide powerful leverage in their own negotiations with pharmaceutical companies. In Europe, for example, some countries have begun re-examining their agreements with companies, demanding price reductions in European markets aligned with the magnitude of cuts seen in the U.S. In Asia, countries like Japan and South Korea are also closely monitoring the developments of the U.S. Medicare price negotiations, preparing to leverage the U.S. price reductions to secure more favorable terms in their future drug procurement. This worldwide price linkage will subject pharmaceutical companies to unprecedented pricing pressure, forcing them to fundamentally reassess their global pricing strategies.

Simultaneously, this move by the U.S. in its Medicare price negotiations provides a significant observation window and negotiating tool for countries like China, which are continuously refining their own health insurance negotiation mechanisms. In its own negotiation process, China has consistently worked towards reducing patients' medication burden and improving the efficiency of its healthcare fund utilization through reasonable price negotiations. The experiences and lessons from the U.S. Medicare price negotiations can offer valuable insights for China. For instance, China can draw lessons from the U.S. regarding negotiation tactics, the scope of drugs included in negotiations, and communication strategies with pharmaceutical companies to further optimize its own system. Furthermore, the post-negotiation price drops in the U.S. furnish China with additional reference points in its dealings with drugmakers, strengthening its position to more confidently demand lower drug prices and secure greater benefits for Chinese patients.

04

Negotiation: The Elevation from "Price" to "Value"

Reviewing the two rounds of U.S. Medicare price negotiations, we can clearly observe the gradual deepening of strategy by the Centers for Medicare & Medicaid Services (CMS). During the first round, the targets were relatively focused, primarily negotiating prices for some high-expenditure drugs under Medicare Part D. This achieved certain price reduction outcomes and accumulated valuable experience for subsequent negotiations. This second round, however, has not only expanded in scope by adding 15 drugs covering more therapeutic areas—including cancer, diabetes, asthma, and other chronic diseases—but has also demonstrated greater strategic precision.

CMS precisely targeted core products within Part D that collectively accounted for annual expenditures as high as $42.5 billion. Negotiating price reductions for these drugs, which represent the highest-spending portions of Medicare Part D, allows for maximum savings in healthcare expenditures, demonstrating CMS's determination and precision in cost control. For example, in this round, CMS successfully secured a 71% price reduction for Novo Nordisk's GLP-1 drug semaglutide, used for obesity and diabetes, which has the largest patient population and highest expenditure in Medicare Part D. This outcome is highly significant for controlling Medicare spending and alleviating the financial burden on patients.

Looking ahead, Medicare price negotiations are likely to exhibit several notable trends.

Moving the target earlier in the development process will become an important direction. Drugs like semaglutide, which show great potential and broad indications early in clinical development, will enter the negotiation radar sooner. As medical research advances, an increasing number of innovative drugs demonstrate unique efficacy and market potential during their R&D phases. To reasonably control drug prices early on while ensuring timely patient access to these innovations, payers will focus more on drugs in early clinical stages, intervening proactively in negotiations to discuss reasonable pricing and payment methods with companies. For pharmaceutical companies, this necessitates factoring in the potential for future price negotiations during the R&D process itself, strengthening communication and collaboration with payers, and enhancing the focus and efficiency of R&D.

Expansion into new disease areas is another key future trend for negotiations. The inclusion of mental health drugs (e.g., Vraylar) and digestive system drugs (e.g., Xifaxan) in this round indicates that Medicare negotiations will cover a broader range of disease areas. With societal development and evolving health awareness, conditions like mental health issues and digestive diseases are receiving increased attention, driving growing demand for treatments in these areas. Including these drugs in negotiations helps improve patient access to treatment, promoting effective disease control and management. In the future, negotiations may further expand into areas such as rare diseases, neurological disorders, and cardiovascular diseases, bringing benefits to more patients.

Increasing complexity of negotiation terms will be another characteristic of future Medicare negotiations. We may see the emergence of "risk-sharing" pricing agreements tied to efficacy and real-world outcomes, shifting the focus of negotiations from solely disputing "price" to deeply assessing "value." These agreements would place greater emphasis on a drug's actual therapeutic effect and its improvement on patient health. For instance, pharmaceutical companies might need to base the drug's price and payment terms on real-world performance data, such as patient cure rates, survival rates, or quality of life improvements. If the drug meets predefined efficacy benchmarks, the payer would pay the agreed price; if not, the company might need to lower the price or provide other compensation. Such "risk-sharing" agreements can incentivize companies to enhance drug quality and efficacy, while also better safeguarding the appropriate use of healthcare funds and protecting patient interests.

The changes triggered by the second round of U.S. Medicare price negotiations span multiple levels: patients, pharmaceutical companies, the global pricing system, and negotiation strategies themselves. This series of transformations not only profoundly impacts the U.S. domestic healthcare ecosystem but also provides valuable experience and insights for the development of the global pharmaceutical industry. Moving forward, with the continuous advancement and refinement of price negotiations, we anticipate the emergence of a fairer, more efficient, and sustainable global healthcare ecosystem, enabling more patients to benefit from high-quality and affordable medical services.

05

Conclusion

The conclusion of the second round of U.S. Medicare price negotiations represents not merely a reshuffling of drug prices, but a profound transformation in the value orientation of the healthcare system. From the patient's perspective, lower drug prices are a tangible benefit; from the industry's perspective, it is a severe test concerning innovation and sustainability.

Looking ahead, finding the equilibrium between ensuring patient access and incentivizing continued pharmaceutical innovation will be a core challenge for global health policy. This round of negotiations may be just the beginning—an era of more transparent, equitable, and rational medicine is quietly dawning.

Reference: Centers for Medicare & Medicaid Services (CMS); collation of public information