Small nucleic acid therapies heat up again, driven by dual breakthroughs

Major pharmaceutical companies have recently been increasingly active in the small nucleic acid drug space.

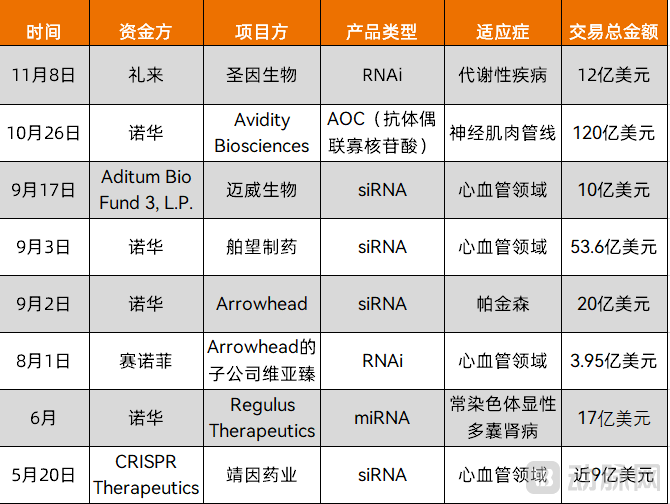

On November 8, Eli Lilly entered into a collaboration agreement with SanegeneBio, valued at up to $1.2 billion, to jointly develop and commercialize RNAi therapies for metabolic diseases.

Shortly before this, on October 30, Innovent Biologics disclosed its siRNA patent WO2025223537A1, covering progress in the development of small nucleic acid drugs targeting INHBE. INHBE, primarily expressed in the liver, has been shown to be positively correlated with insulin resistance and body mass index in humans. With this move, Innovent has also joined the ranks of companies developing in-house small nucleic acid drugs.

On October 26, Novartis entered into an acquisition agreement with Avidity Biosciences, with a total transaction value of $12 billion, marking the largest M&A deal in the small nucleic acid drug sector. Avidity is a pioneer in the field of AOC (Antibody-Oligonucleotide Conjugates), utilizing the AOC platform to deliver small nucleic acid drugs to muscles, the heart, and other tissues. Through this acquisition, Novartis will gain access to Avidity's neurology pipeline and differentiated technology platform, including three late-stage clinical candidates: Del-zota, Del-desiran, and Del-brax.

Coupled with earlier strategic moves by Sanofi and CRISPR Therapeutics in this field, it is evident that small nucleic acid drugs are regaining significant momentum. On the technological front, breakthroughs in delivery systems have expanded the application of small nucleic acid drugs beyond the liver, substantially broadening their commercial potential. On the business collaboration front, multinational pharmaceutical giants have engaged in a series of project partnerships and even major acquisitions in the small nucleic acid domain.

Figure 1. Major collaborations in the small nucleic acid drug space in the past six months (Source: VCBeat)

Notably, Novartis has been actively deploying strategies in two critical directions for small nucleic acid drug development: expanding therapeutic indications and improving delivery systems. These two aspects are also key bottlenecks restricting the advancement of small nucleic acid drugs. With breakthroughs achieved by innovative pharmaceutical companies in China and globally in these areas, the small nucleic acid field is ushering in a new wave of development opportunities. As Wang Meng, General Manager of Youjia Bio, vividly analogized to VCBeat, the current development stage of the small nucleic acid field is like "a car entering the highway on-ramp, beginning to accelerate."

Since 2016, several small nucleic acid drugs have been approved for marketing. Following the first siRNA drug approval in 2018, the therapeutic focus remained largely confined to hepatic indications. Taking siRNA as an example, among the seven globally approved siRNA drugs, six utilize GalNAc for delivery and one employs LNP delivery—all targeting the liver.

However, developing drugs solely for liver-targeted indications results in minimal differentiation in delivery efficiency and creates a highly competitive landscape. With innovative pharmaceutical companies achieving breakthroughs in major disease areas such as cardiovascular and oncology, the application scope of small nucleic acid drugs is expanding, thereby amplifying their commercial value.

Novartis' Leqvio, an siRNA drug targeting PCSK9, is the first small nucleic acid drug approved for a chronic disease. Approved by the FDA in 2021, it is indicated for adults with atherosclerotic cardiovascular disease (ASCVD) or heterozygous familial hypercholesterolemia (HeFH) who require additional LDL-C reduction, in combination with dietary therapy and maximally tolerated statin treatment. This means Leqvio was initially approved as an adjunct to statin therapy. Administered just twice a year, Leqvio provides sustained LDL-C reduction.

On July 31, 2025, Novartis announced that the U.S. FDA had approved the expanded indication for Leqvio, authorizing its use as a monotherapy in combination with dietary control and exercise to lower LDL-C levels in adult patients with hypercholesterolemia. This approval establishes Leqvio as a first-line treatment for hypercholesterolemia, significantly expanding its commercial potential.

From 2021 to 2024, Leqvio's annual sales grew from $12 million to $754 million. In the first half of 2025, sales surged 66% year-over-year to $555 million, positioning the drug to potentially become a blockbuster with future sales exceeding $3 billion. The successful commercialization of Leqvio has paved the way for siRNA therapeutics to enter the realm of common chronic diseases.

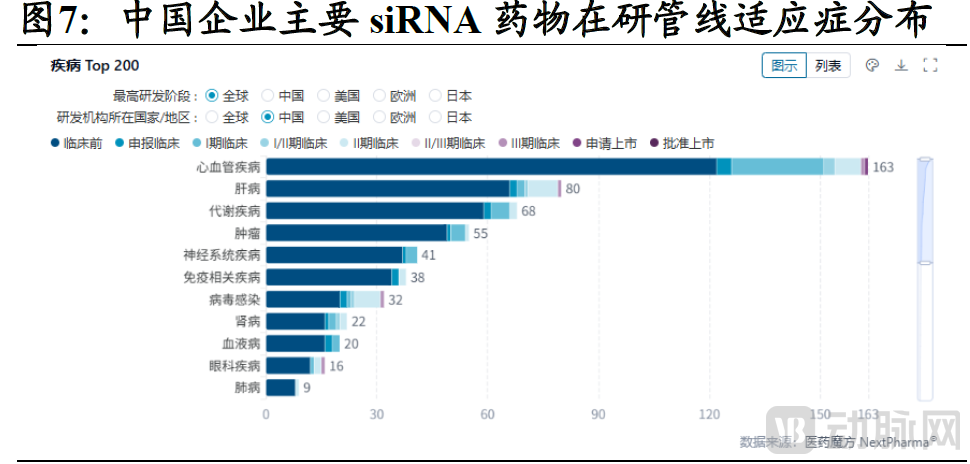

Currently, innovative pharmaceutical companies worldwide are steadily increasing their R&D pipelines in the small nucleic acid domain, with oncology and cardiovascular diseases representing the two leading therapeutic areas by pipeline volume. Taking China's siRNA drug landscape as an example, cardiovascular disease is a predominant focus in terms of pipeline quantity. Most candidates are in early-stage clinical development, indicating that Chinese innovator companies are rapidly entering this field.

Figure 2. Indications of siRNA drugs in the R&D pipeline in China (Source: Guotai Haitong Securities)

Currently, the most advanced small nucleic acid drugs in clinical development in China all follow the siRNA approach. Among them, Visirna Therapeutics' VSA003 has progressed to Phase III clinical trials.

Figure 3. Small nucleic acid drugs with leading clinical progress in China (Data Source: PharmaCube)

On December 18, 2024, the first patient in the Phase III clinical trial of VSA003 was successfully dosed at Peking Union Medical College Hospital, Chinese Academy of Medical Sciences. VSA003 is an innovative siRNA drug targeting ANGPTL3. It effectively reduces LDL-C levels in patients with homozygous familial hypercholesterolemia (HoFH) through dual lipid-lowering mechanisms that are both LDLR-independent and LDLR-dependent. The drug's target, ANGPTL3, is distinct from those of clinically recommended medications such as statins, PCSK9 inhibitors, cholesterol absorption inhibitors, antioxidant drugs, bile acid sequestrants, niacin, and fibrates.

Due to its novel mechanism and therapeutic potential, VSA003 was granted Breakthrough Therapy Designation by the Center for Drug Evaluation (CDE) in January this year for the treatment of HoFH. It is expected to potentially become the world's first approved small nucleic acid drug targeting ANGPTL3.

From a pipeline perspective, the "dark horse" in the small nucleic acid field, Argo Biopharma, has one of the most substantial pipelines, with four candidates currently advancing to Phase I/II or Phase II clinical stages. Leading Chinese innovator companies such as CSPC Pharmaceutical Group, Hengrui Pharmaceuticals, and Chia Tai Tianqing Pharmaceutical (CTTQ) also have active pipelines, with their therapeutic indications expanding beyond liver diseases to major conditions like cardiovascular diseases and oncology.

Particularly noteworthy is the growing interest from innovator companies in candidates targeting major disease areas. A prime example is the small nucleic acid drug targeting INHBE mentioned at the beginning of the article. INHBE encodes the Activin E protein and is closely associated with lipid metabolism. Small nucleic acid drugs targeting INHBE are now attracting significant attention from biotech companies.

Figure 4. INHBE small nucleic acids from various companies in China are beginning to emerge (Data Source: PharmaCube)

Beyond expanding therapeutic indications, breakthroughs in delivery technology represent another critical direction for the advancement of small nucleic acid drugs.

The delivery method and efficiency are pivotal to whether small nucleic acid drugs can enter cells and exert their therapeutic effects. These drugs face two major challenges when entering cells: first, RNA exposed to the bloodstream is susceptible to degradation by RNases in plasma and tissues; second, the negatively charged RNA struggles to cross the cell membrane. Chemical modifications of nucleotides can enhance substrate specificity and increase resistance to nucleases, while the discovery of GalNAc technology has addressed the critical delivery challenge for small nucleic acid drugs.

GalNAc specifically recognizes the asialoglycoprotein receptor (ASGPR), which is highly expressed on the surface of hepatocytes, enabling efficient liver targeting and facilitating the intracellular delivery of sufficient nucleic acid quantities. The delivery system constitutes a core barrier to the industrialization of small nucleic acid drugs, and GalNAc has become the mainstream strategy for intrahepatic delivery. Consequently, the central challenge for extrahepatic delivery lies in identifying receptors that are specifically and highly expressed in other tissues—similar to how GalNAc targets the liver—and developing delivery tools capable of overcoming complex biological barriers like the blood-brain barrier. This would enable targeted delivery to tissues such as the kidneys, central nervous system, muscles, and adipose tissue.

Breakthroughs in extrahepatic delivery are gradually being achieved, with approaches such as AOC, TRiM, and C16 beginning to demonstrate promise.

An AOC (Antibody-Oligonucleotide Conjugate) consists of an oligonucleotide (such as siRNA or ASO) site-specifically or non-specifically conjugated to a target-specific antibody. AOCs leverage the high affinity of antibodies for precise recognition and binding to specific cell surface antigens, followed by internalization into cells via endocytosis. Once inside the cell, the linker is cleaved under specific intracellular conditions, enabling efficient release of the oligonucleotide payload. This approach effectively combines the high precision selectivity of nucleic acid drugs with the targeted delivery capability of antibodies.

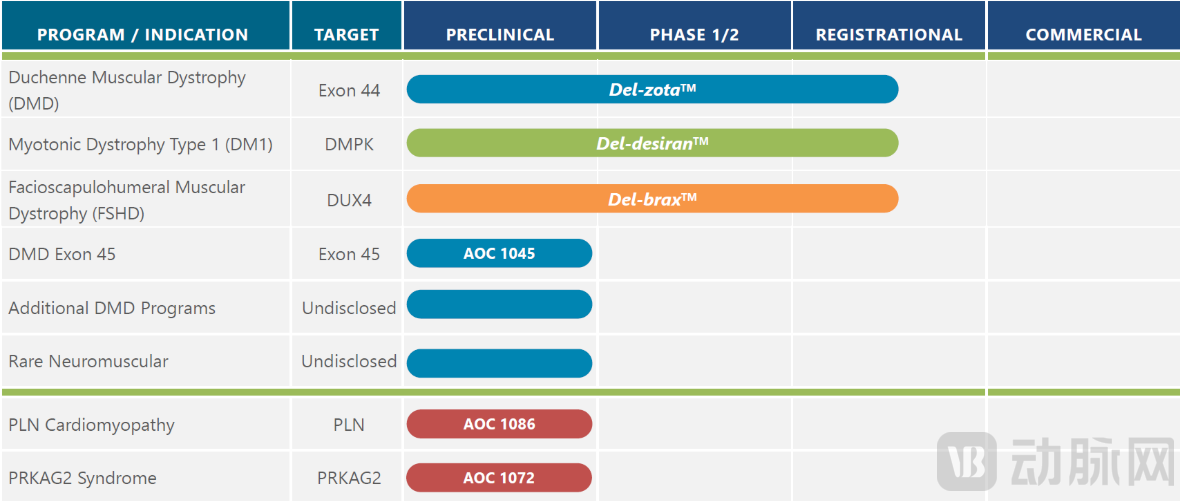

Avidity Biosciences is a leading company in the AOC field. Its proprietary AOC platform enables targeting of previously inaccessible cell types while reducing off-target effects. Currently, three of Avidity's AOC programs for different rare diseases—myotonic dystrophy type 1 (DM1), facioscapulohumeral muscular dystrophy (FSHD), and Duchenne muscular dystrophy (DMD)—are in clinical development. Additionally, AOC candidates for other indications, including DMD, rare neuromuscular diseases, and rare precision cardiology, are also advancing.

Figure 5. Avidity Biosciences Pipeline (Source: Company Website)

Del-zota, a notable candidate in Avidity's pipeline, is composed of a monoclonal antibody targeting Transferrin Receptor 1 (TfR1) conjugated to an oligonucleotide. TfR1 is highly expressed in muscle tissue. The TfR1-targeting monoclonal antibody enhances muscle-specific delivery of the oligonucleotide by binding to receptors on the surface of muscle cells.

In September this year, Avidity Biosciences announced positive new data from the EXPLORE44 and EXPLORE44-OLE trials for Del-zota. Analysis showed that Duchenne muscular dystrophy (DMD) patients who received continuous Del-zota treatment for one year experienced a reversal of disease progression across multiple functional endpoints, demonstrating "unprecedented" improvements compared to both baseline and the natural history of the disease. Del-zota has received Breakthrough Therapy Designation for the treatment of DMD patients amenable to exon 44 skipping.

Shortly thereafter, Novartis acquired Avidity Biosciences for $12 billion, marking the largest M&A deal in the small nucleic acid field this year—a clear indication of Novartis' strong confidence in the potential of the AOC technology platform.

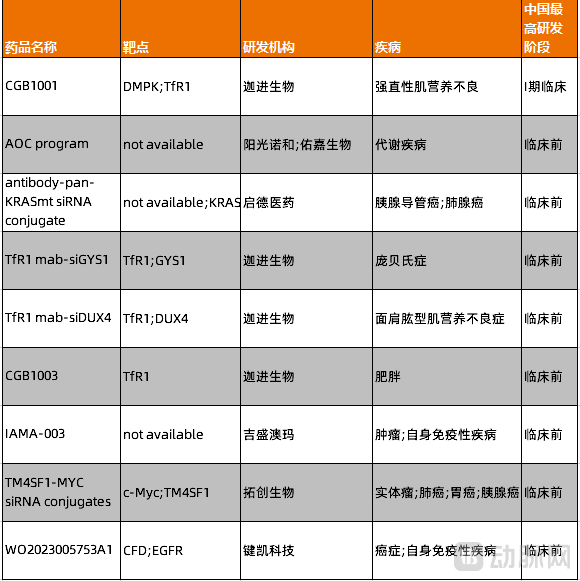

Currently, Chinese innovator companies are also beginning to establish their presence in the AOC field, with several players such as ChainGen Bio and Youjia Bio actively entering the space.

Figure 6. Pipeline of Chinese innovative pharmaceutical companies in the AOC field (Source: PharmaCube)

ChainGen Bio's CGB-1001 is currently in Phase I clinical trials in China for the treatment of patients with myotonic dystrophy type 1 (DM1). Recently, CGB-1001 received Orphan Drug Designation from the FDA and is expected to address an unmet medical need in this field in China.

Building upon its validated GalNAc liver-targeting platform, Youjia Bio is making significant investments in its AOC technology platform. Within this technological framework, the antibody is responsible for "precision targeting," while the oligonucleotide carries out "targeted intervention"—both of these independent technologies are relatively mature. The critical factor determining whether a product can be successfully developed, along with its safety profile and cost control, lies in the "linkage." Specifically, the level of conjugation technology directly impacts the success of drug development and its clinical application value. Leveraging its proprietary site-specific conjugation platform and collaborating with listed pharmaceutical companies, Youjia Bio has advanced multiple pipeline candidates into the preclinical stage, achieving a closed-loop process from design to validation ahead of many peers.

In addition to AOC technology, Youjia Bio is also strategically focusing on the development of "dual-target and triple-target" therapeutics. Founder and General Manager Wang Meng told VCBeat that multi-target drugs require the simultaneous delivery of longer oligonucleotide fragments, placing extremely high demands on the drug-loading capacity, tissue selectivity, and metabolic stability of the delivery system. To address the technical challenges associated with multi-target combination therapies, Youjia's R&D team is continuously refining its dynamic conjugation and tissue-specific release technologies.

The small nucleic acid drug field is now entering a "golden age of development." Leveraging its platform technology advantages, Youjia Bio has successively established collaborations with multiple listed pharmaceutical companies and biotech firms to jointly advance the industrialization of pipelines targeting metabolic, cardiovascular, and autoimmune diseases. The commercialization process for small nucleic acid drugs has entered a phase of comprehensive acceleration.

Beyond AOC technology, other delivery platforms are also under development. To address the challenge of CNS delivery, Alnylam has developed the C16-conjugate delivery platform. The core of this platform, C16 delivery, is a drug delivery system that leverages lipid chain-cell membrane interactions. C16 (cetyl), a short lipid chain attached to siRNA, utilizes its lipophilic properties to interact with cell membranes, facilitating drug penetration across the blood-brain barrier or pulmonary vasculature for targeted delivery. C16 enables uptake by various cell types, including those in the central nervous system and lungs.

ALN-APP, an RNAi therapeutic targeting the amyloid precursor protein (APP) developed based on the C16 platform, is currently being investigated for the treatment of Alzheimer's disease and cerebral amyloid angiopathy. This candidate is co-developed by Alnylam in collaboration with Regeneron.

Meanwhile, Arrowhead has successfully developed RNAi therapies for various diseases using its TRiM™ platform, with indications spanning muscle, metabolic, and pulmonary disorders. These investigational candidates have been subject to licensing agreements with several multinational pharmaceutical giants.

On September 2, 2025, Novartis entered into a collaboration agreement with Arrowhead Pharmaceuticals with a potential total value of $2 billion to jointly develop ARO-SNCA for the treatment of Parkinson's disease. Shortly before this, Visirna Therapeutics, a subsidiary of Arrowhead, partnered with Sanofi to develop and commercialize cardiometabolic drug candidates. Additionally, Arrowhead has established a series of collaborations with companies including Amgen, GSK, and Takeda. The application scope of small nucleic acid drugs continues to expand.

Over the past year, both specialized small nucleic acid R&D companies and multinational pharmaceutical giants, as well as traditional Chinese pharmaceutical firms, have been increasing their investments in the small nucleic acid field. China's small nucleic acid R&D has now advanced to the forefront globally. In terms of the number of projects, published literature, and patents, China's output is nearly on par with that of other countries. Moreover, Chinese companies demonstrate advantages in product quality, faster data validation, and more efficient patient enrollment compared to international counterparts, giving them a competitive edge in the global small nucleic acid landscape.

As more drugs for new indications advance to critical clinical milestones or even gain market approval, the prospects of small nucleic acid drugs will gain broader recognition. Wang Meng believes the industry is poised to enter a phase of rapid growth, potentially within the next two to three years.