CIIE spotlights global healthcare giants with 60+ debuts deepening China presence

On November 6, at the China National Convention Center, the lunchtime queue at Starbucks stretched to a 90–120 minute wait.

The 8th CIIE set new records in both exhibition scale and participant numbers – spanning over 367,000 square meters of exhibition space and hosting more than 4,000 exhibitors, including 290 Fortune Global 500 companies and industry leaders. The event also welcomed 43 procurement delegations and over 700 sub-delegations for business negotiations, with registered professional attendees alone reaching 449,500.

As one of the most popular sections in previous CIIEs, the Medical Equipment and Healthcare Products exhibition area moved to Halls 1.1, 1.2, and 2.2 this year. The world’s top ten medical device giants and 12 Fortune Global 500 pharmaceutical companies gathered in this expansive space exceeding 70,000 square meters.

As a zone with an exceptionally high density of innovation, the area was marked by a continuous stream of "global premieres," "Asian debuts," and "China first shows." Beneath the buzz of active licensing deals, AI-integrated showcases, and the emergence of "CIIE-born" products, global multinational pharmaceutical and device giants clearly demonstrated their focus on practical applicability and real-world implementation.

1Giants Accelerate China Launch via "CIIE-born" Approach

Multinational healthcare companies are actively participating with their most cutting-edge products, aiming to leverage the CIIE's "debut" platform to gain attention from regulators, healthcare payers, and potential partners. This enables direct engagement with innovative policies such as pilot programs, where the "spillover effect" accelerates the approval, market entry, and commercialization of innovative drugs and devices at the remarkable "CIIE speed." This process transforms exhibits into mature products and treatment solutions serving Chinese patients in a significantly shorter cycle, establishing an efficient closed-loop pathway from innovation display and market access to commercial transformation.

According to incomplete statistics, this year's CIIE featured over 60 debut innovative drugs and medical devices.

Chart created by VCBeat based on publicly available data; no specific ranking is implied

At each CIIE, exhibitors take particular pride in showcasing their "CIIE-born" products—those that have successfully transitioned from "exhibition items to commercially available products" in China. This effectively demonstrates their capabilities in deepening local roots, strengthening local infrastructure, and delivering innovative drugs and devices to market. Pfizer, for instance, established its first "CIIE-born Showcase Zone" this year, featuring 17 innovative products accelerated into the Chinese market via the CIIE platform. AstraZeneca has brought a total of 18 "CIIE-born" products over the past seven years, covering respiratory, renal, digestive, rare diseases, autoimmune conditions, and multiple cancer types.

A particularly noteworthy trend is the increasing role of China-led R&D and local strategic co-development. GE Healthcare launched 18 innovative products, with nine making their global debut. Significantly, 60% of these were led by its China R&D team. A standout example is the Expert X New Quantum CT from its ultra-high-end quantum platform CT family, which had its global debut and was a major achievement driven by the China team. The Expert X integrates 4D cardiac imaging technology and a third-generation multi-core deep learning platform. Through deep hardware-algorithm synergy, it achieves an intelligent upgrade across the entire imaging chain, delivering innovative breakthroughs in optimizing complex cardiac assessments and enabling rapid, precise detection of minute lesions.

In another example, among Johnson & Johnson's two "CIIE debut" surgical products, the HARMONIC®7s Ultrasonic Scalpel is now fully manufactured locally in China. Meanwhile, the Carina™ Laparoscopic Surgery Robot represents an accelerated local collaboration, making its debut through Johnson & Johnson's partner, Ronovo Surgical.

In the field of innovative drugs, multinational pharmaceutical giants are accelerating the journey from clinical development to regulatory approval in the Chinese market. This includes driving synchronization of new drug and new indication registration applications with global timelines, while building diversified, multi-product innovative solutions across various disease areas.

Roche Pharmaceuticals presented its largest-ever lineup, comprehensively showcasing over 40 products from its full portfolio and diverse innovative solutions. A highlight was the first collective debut of more than ten soon-to-be-launched and pipeline products in China spanning the full disease spectrum. These included Gazyva® (obinutuzumab), the first anti-CD20 monoclonal antibody to show positive results in a Phase III randomized clinical trial for lupus nephritis, and the Port Delivery System (PDS), the world's first and only eye implant offering a breakthrough solution in ophthalmology.

Novartis celebrated the arrival of its first "CIIE-born" products in renal care. These include Fabhalta® (iptacopan), the world's first oral factor B inhibitor targeting the alternative complement pathway for its renal indication, and Vanrafia® (atrasentan), the first and only highly selective endothelin-A receptor antagonist approved for IgA nephropathy in China, both of which were approved in China this year. Among them, Vanrafia® originated from a strategic collaboration between Novartis and a local biotech company, combining Novartis' drug development and commercialization expertise to accelerate the delivery of high-clinical-value medicines.

Among the two global debut products presented by Sanofi, the world's first siRNA therapeutic targeting the innovative APOC3 mRNA, Plozasiran injection, originated from a rights acquisition deal for Greater China, involving a $130 million upfront payment to Visirna Therapeutics in August this year.

Furthermore, "CIIE-born" products benefiting from pioneering policy channels are also noteworthy. Gilead presented the Asian debut of two innovative drugs: Lenacapavir, a long-acting HIV-1 capsid inhibitor, received a clinical urgent use authorization in the Boao Lecheng Pilot Zone shortly after its FDA approval in June. Meanwhile, Seladelpar, a new treatment for primary biliary cholangitis (PBC), was rapidly introduced in August via the "Temporary Import for Clinical Urgency" pathway at the Beijing Tianzhu Rare Disease Drug Security Pioneer Zone. It has become the first PBC targeted therapy that improves biochemical markers while also alleviating pruritus.

Beyond these debut innovations, the CIIE has also witnessed the growth journey of previous "CIIE-born" products as they expand their impact and benefit more patients across China. A prime example is Dupixent® (dupilumab injection), whose journey in China—from regulatory approval and market launch to inclusion in the National Reimbursement Drug List (NRDL) and subsequent expansion of indications—has unfolded across all eight editions of the CIIE. In 2025, Dupixent® returned with two new approved indications in otorhinolaryngology and dermatology, further extending its reach in immunology.

Another case is Beyfortus® (nirsevimab), the world's first long-acting monoclonal antibody for RSV prevention in all infants. It made its global debut at the 2022 CIIE, transitioning from exhibition item to commercially available product. At this year's expo, it presented its first real-world evidence from China, demonstrating 81% and 82% effectiveness in reducing RSV-associated lower respiratory tract infection medical visits and hospitalizations, respectively, among infants.

In the field of innovative medical devices, the strategic focus of major device companies on brain-computer interface (BCI) technology emerged as a key highlight.

Medtronic's strategic product—the rechargeable, perceptive closed-loop brain pacemaker Percept™ RC, which debuted last year—is poised to enter clinical application in China.

Siemens Healthineers introduced its brain-computer interface solution, accompanied by several core imaging systems integral to the approach. These include the twin-scanner ultra-high gradient MRI MAGNETOM Cima.X, the dual-source photon-counting CT NAEOTOM Alpha, and the high-speed spectral angiography system ARTIS icono ceiling Xpand. Together, these technologies advance invasive BCI surgery from "blind insertion" toward a "visible, plannable, and controllable" process, significantly enhancing the precision and safety of interventional BCI electrode implantation.

2AI Digitalization, Silver Economy: Giants Seek Practical Applications

In fact, the presentation of AI digital-intelligent solutions, the silver economy, and longevity-related scenarios shares a similar underlying logic with "CIIE-born" products—leveraging the CIIE platform to enhance visibility, using scenarios or solutions to pave the way for products, attracting attention from diverse resources, and ultimately advancing implementation and application.

The first pathway involves embedding products within practical implementation scenarios to precisely communicate their ecosystem positioning, demonstrating a trend of directly integrating consumption into contextual settings. At the 2025 CIIE, the demand for "self-health management" saw notable growth, while the silver economy and weight management scenarios remained central focus areas.

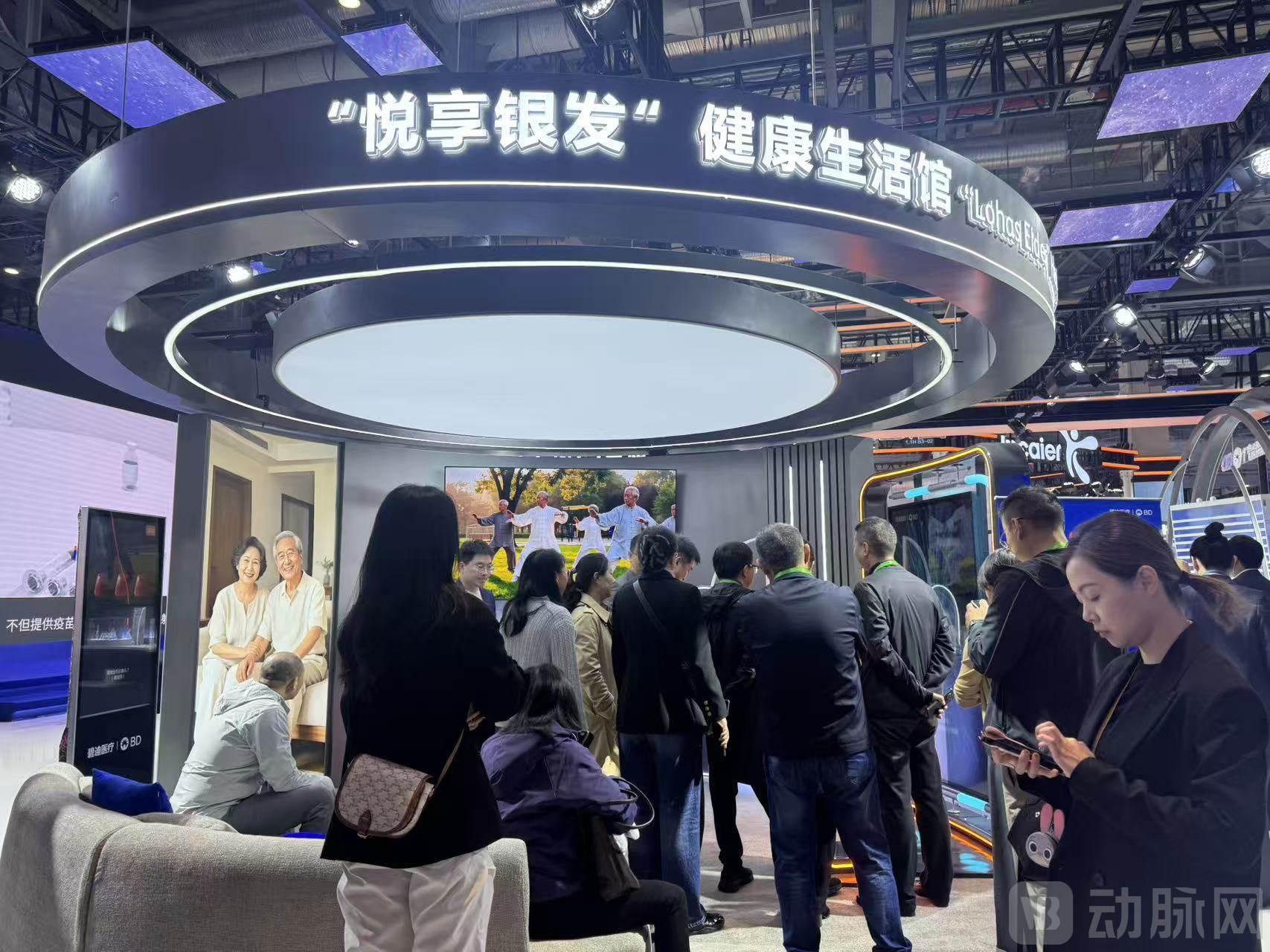

BD's "AI Palm Print Health Exploration" exhibit attracted long queues of visitors

BD's "Silver Health & Wellness Pavilion" exemplifies this scenario-based solution approach. It systematically integrates multiple chronic disease management and care solutions suitable for home and community settings. These include a digital-intelligent solution for PICC line maintenance in cancer chemotherapy, the PureWick non-invasive female external catheter (for elderly women), a hernia support garment for post-operative home care (for middle-aged and elderly men), as well as pen injectors, wearable injectors, and blood glucose lancets designed for home and community care.

In terms of trends, the healthcare needs of the aging population and the corresponding silver economy are driving innovative product portfolios for home and community medical scenarios, which carry distinct characteristics of consumer healthcare. Within the "Silver Health & Wellness Pavilion," exhibitors have not only installed simulated elderly living environments but also set up display counters for health management products available on e-commerce platforms like JD.com and Tmall. Visitors can experience the products and place orders on-site by scanning QR codes with their phones.

A shift from passive response to proactive management and precise engagement is evident, with scenario-based perspectives and indication-focused strategies becoming increasingly prominent among large multinational corporations:

Eli Lilly presented its "Memory Café" for the third time, inviting elderly volunteers to serve as baristas to raise awareness for early attention and intervention in Alzheimer's disease patients. This initiative is strategically connected to donanemab injection—a breakthrough Alzheimer's therapy that debuted at the 2024 CIIE and received approval in China just one month later for treating adults with mild cognitive impairment or mild dementia due to Alzheimer's disease.

Novo Nordisk introduced its "Lightness Hut" for the first time, a scientific weight management experience space offering a full-cycle scenario of "cognitive enhancement, scientific treatment, and long-term management." This approach encourages the public to shift from passively receiving information to active learning and proactive management, thereby improving understanding of the scientific diagnosis, treatment, and long-term management of obesity. The initiative aligns with its star product, Wegovy (semaglutide injection), for long-term weight management.

Pfizer introduced Litfulo® (ritlecitinib tosylate), the world's first and only innovative treatment approved for both adolescents (≥12 years) and adults with severe alopecia areata. This product achieved synchronized global R&D and registration. During the CIIE, Pfizer entered into strategic collaborations with Shanghai Pharmaceutical Holding Co., Ltd., Yonghe Medical Group, JD Health, and MediTrust Health. These partnerships aim to build an integrated, omni-channel service system spanning online and offline, in-hospital and out-of-hospital environments, covering the entire journey "from disease education to medication services." This interconnected, innovative model is designed to comprehensively enhance the patient diagnosis and treatment experience.

Bayer China, with its Consumer Health division, adopted an even more grassroots approach by dedicating nearly one-third of its booth space to live-streaming e-commerce. Featured products included Kangwang® ketoconazole shampoo, Claritin® allergy relief OTC medication, and Elevit® multivitamin supplements. Notably, the Consumer Health division also debuted five global-first exhibition products, such as Bepanthen® B5 anti-irritation nappy rash cream, addressing public health needs across diverse scenarios.

The second implementation pathway involves AI-enabled solutions that emphasize value in solving real-world problems. Here, AI is not only integral to the product R&D framework but also drives the development of comprehensive solutions, digital-intelligent ecosystems, and supporting healthcare service systems. This marks a shift toward a more practical phase characterized by "finer granularity, more specific scenarios, and broader population reach."

Medtronic's futuristic "Envision Your 150th Birthday" showcase drew large crowds

Taking Kanghui Med (a Medtronic company) as an example, it first introduced the AiBLE™ Digital-Intelligent Ecosystem at the 2023 CIIE. This ecosystem aims to advance the orthopedics and neurosurgery fields from "point-based innovation" to "system-wide collaboration." It integrates smart equipment and implants—such as surgical robots, navigation systems, intraoperative imaging, and power instruments—and deeply incorporates artificial intelligence and data platforms to explore device interconnectivity and data interoperability.

At this year's exhibition, the AiBLE™ Digital-Intelligent Ecosystem family returned, featuring a collective reappearance of multiple star products. These included last year's debut models such as the Mazor™ XC robotic guidance system for spine surgery, the NIM-Eclipse™ intraoperative neural monitoring system, and the EngineNav™ spinal surgical navigation system—all representative of locally developed innovative capabilities. Benefiting from the strong "spillover effect" of the CIIE, these innovations have successively achieved commercialization and clinical implementation over the past year, accomplishing the leap from the "CIIE exhibition booth" to the "operating table."

Meanwhile, AI-powered digital-intelligent solutions inherently exhibit scenario-specific and progressive characteristics, enabling direct implementation within the workflows of healthcare providers, patients, and the general public. Roche Pharmaceuticals' digital innovation team, in collaboration with technology partners, launched three progressive projects. These initiatives precisely focus on three core areas: holistic patient journey management, physician-patient collaboration, and public health education. They aim to bridge the "in-hospital to out-of-hospital" digital-intelligent management pathway, delivering a comprehensive, integrated medical service matrix.

The innovative patient management service network within this framework has successfully expanded to cover over 200 medical institutions by 2025, serving tens of thousands of patients. Furthermore, Roche has partnered with 41 medical institutions to jointly establish industry standards for digital-intelligent healthcare. Its AI-driven health education initiatives have been deployed across five major platforms, in collaboration with 133 hospitals and 260 leading medical experts, delivering extensive public health and disease education content.

The third pathway involves comprehensive collaboration across the industry chain to jointly accelerate multi-stakeholder implementation within specific therapeutic frameworks, as exemplified by the recent partnership between Novartis and Siemens.

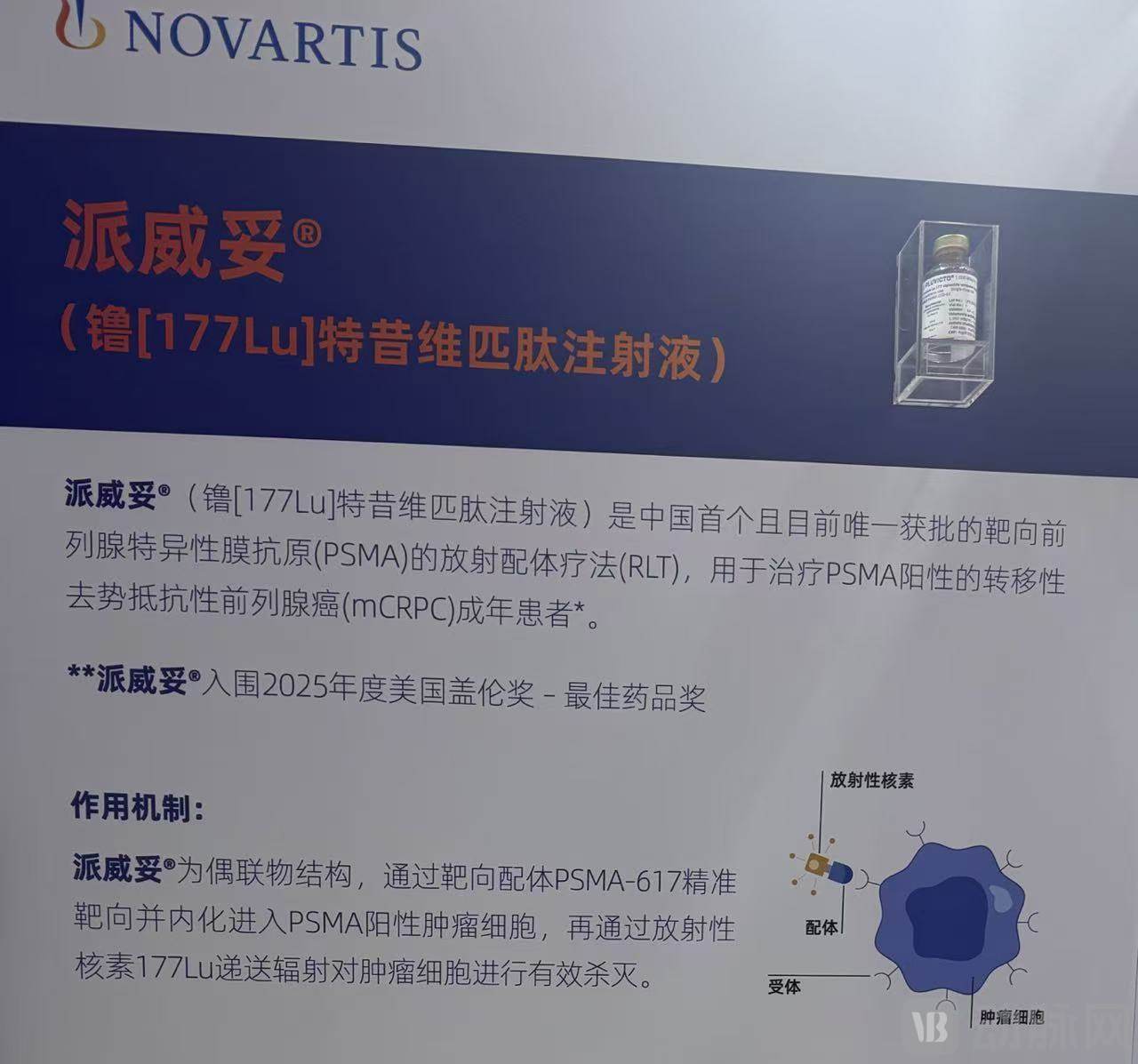

Just before the CIIE, on November 6, Novartis announced the simultaneous approval of its first radioligand therapy (RLT) drug, Pluvicto® (lutetium Lu 177 vipivotide tetraxetan), for two indications. It is approved for treating two types of metastatic castration-resistant prostate cancer (mCRPC) in adults. This also makes Pluvicto® the first and currently only approved RLT drug in China. As a "CIIE-born" product, Pluvicto® made its debut at the CIIE in 2021.

Nuclear medicine carries relatively high costs in oncology treatment. Globally, Novartis' two nuclear drugs surpassed a combined revenue of $2 billion in 2024, though their pricing in China remains undisclosed. Furthermore, radioligand therapy (RLT) presents challenges related to production timelines and complex logistics, necessitating the establishment of a robust supply chain and a network of specialized treatment centers, such as nuclear pharmacies and nuclear medicine departments.

As a typical theranostic product, RLT utilizes the same targeting ligand linked to different radionuclides—a diagnostic one (e.g., ⁶⁸Ga for PET imaging) and a therapeutic one (e.g., ¹⁷⁷Lu for RLT treatment). In practice, RLT relies on molecular imaging to confirm the expression level of specific tumor targets, guiding the treatment process. This includes precisely screening suitable patients, verifying target expression, calculating radiation dosage, and monitoring tumor response in real-time.

At this CIIE, Novartis and Siemens signed a memorandum of understanding to explore multi-faceted collaboration. This includes fostering multidisciplinary cooperation, analyzing and optimizing payment pathways for theranostic solutions, assisting in enhancing the diagnostic and treatment capabilities of healthcare systems, and optimizing clinical pathways to improve the entire patient journey—from patient identification and diagnosis to treatment justification, therapy monitoring, and centralized surgical management. Concurrently, the two companies will drive the implementation of pilot projects for integrated theranostic centers.

3Giants Grab Market Share, Scene Application Becomes Key

For the industry, the operation of blockbuster products by pharmaceutical and medtech giants reveals three core trends:

First, the traditional blockbuster product model is becoming unsustainable. Building scenario-based chains and application ecosystems around products will create market premium and expand market space.

Second, the depth of local data and channel integration determines the speed of implementation. The strength of alignment with China's innovation ecosystem has become a critical variable for success.

Third, the expansion from in-hospital diagnosis and treatment to whole-process management and self-care – adopting strategies from consumer healthcare and online channels – is opening new opportunities at the intersection of health consumption and serious medicine.

The successful piloting, regulatory approval, and market collaboration of "CIIE-born" products across eight CIIE editions demonstrate that speed is a core competitive factor in capturing opportunities in China's healthcare market. Approaches such as scenario embedding, AI-enabled digitalization, and cross-sector integration are driving a coupled model of "drugs-devices-digital solutions-services," spanning R&D, clinical practice, and commercial payment to build increasingly diversified value pathways.

In a convergent move, policymakers have recognized this two-way, mutually reinforcing dynamic between scenarios and market development. On November 2, the General Office of the State Council issued the "Implementation Opinions on Accelerating Scenario Cultivation and Opening to Promote Large-Scale Application of New Scenarios." The document emphasizes "enriching application scenarios in areas related to people's livelihoods," including:

Healthcare Sector

Promote the integrated application of new-generation information technologies such as big data, the Internet of Things, and brain-computer interfaces, together with intelligent equipment like medical robots. Innovate medical application scenarios including health consultation, triage guidance, assisted diagnosis, telemedicine, and medication review.

Elderly Care, Disability Support, and Childcare Sectors

Innovate application scenarios involving service robots, smart wearable devices, remote terminal service systems, and online family doctors and pharmacists. Develop integrated life service scenarios that combine technology-assisted disability support, home services, childcare, rehabilitation medicine, and health services.

The vitality of the Chinese market is now providing a platform for Chinese innovation to compete on the global stage.