From "Cheap China" to "Innovation Dawn": how global investors bet on Chinese biotech

In just one year, the attitude of global capital toward Chinese healthcare assets has undergone a complete reversal.

In September 2024, Morgan Stanley maintained a neutral-to-negative rating on Chinese medical assets, issuing "underweight" recommendations for several Chinese innovative drug stocks. However, in its latest report China Biotech: Innovation Dawn released in September 2025, the firm presented a groundbreaking conclusion:

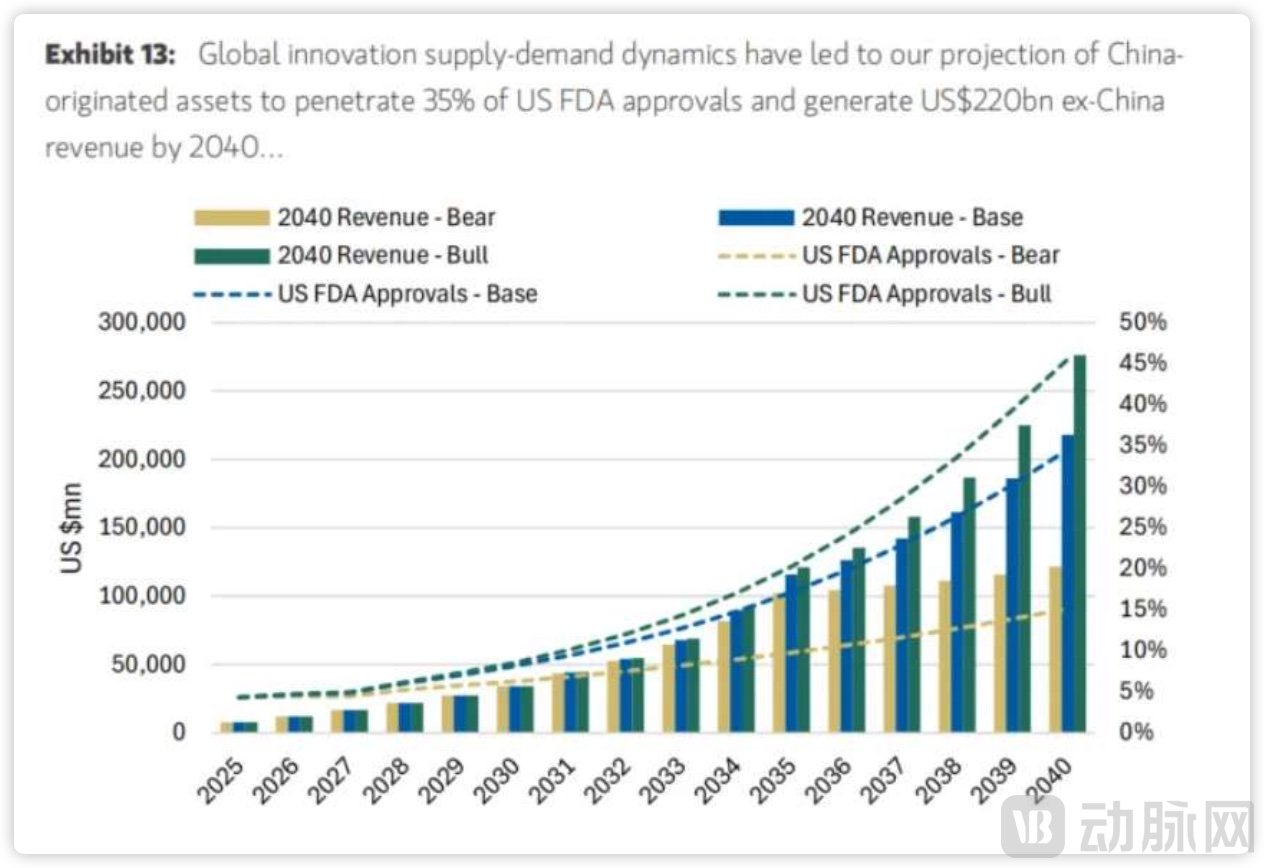

"China's biotech sector is rapidly evolving and has transitioned from merely a regional narrative to the next phase in the global drug supply chain." The report forecasts that annual revenue from drugs originating in China will reach $34 billion by 2030 and surge to $220 billion by 2040, with the share of China-developed drugs approved by the U.S. FDA projected to jump from the current 5% to 35%.

Core viewpoints of the report. Source: Morgan Stanley

Capital has been shifting its stance with striking speed. According to Choice data, since the second half of 2025, BeiGene alone has received intensive surveys from 53 global institutions, with August's roster featuring giants like State Street and BlackRock. The meeting list of Biokin Pharmaceutical included Nomura, Goldman Sachs, and Point72, while companies such as Allist and BrightGene also saw a wave of visits from global investors.

The translation of this interest into actual portfolio adjustments has been notably efficient. In late August, WuXi AppTec's H-share price surged 6.52% in a single day, driven by collective foreign buying. JPMorgan Chase increased its long position from 5.87% to 6.01%, while Citigroup raised its stake more substantially from 4.71% to 5.12%. This dual rise in both attention and holdings strikingly resonates with Morgan Stanley's shifted perspective — reflecting a broader recognition by international capital of the materializing value within China's innovative drug sector.

From "Cheap China" to "Innovation Dawn" — the most vivid illustration of Morgan Stanley's shifted stance lies in the evolution of these two keywords within the report's title. This lexical shift reflects a fundamental redefinition of the narrative around China's innovative drug sector, acknowledging that the industry has completed a critical transition from being cost-driven to innovation-driven.

There was a time when the prevailing narrative from foreign institutions like Morgan Stanley was marked by caution. Frameworks emphasizing generic drug manufacturing, pricing pressure from volume-based procurement, and insufficient innovation capacity dominated the discourse. Underlying this was an implicit logic that tied China’s pharmaceutical sector primarily to cost advantages, with innovation rarely entering the core assessment framework of top global investment banks. During this period, Morgan Stanley maintained a largely neutral-to-negative rating stance on China’s biopharmaceutical segment.

The shift occurred between late 2024 and 2025, when Morgan Stanley significantly revised its stance on Chinese assets across multiple investment reports, abandoning its previous bearish view on Chinese equities in favor of a more optimistic outlook. The firm argued that driven by technological breakthroughs, the stock market was poised for a more sustainable rebound.

Morgan Stanley was not alone in this reassessment. Goldman Sachs also released an in-depth investment value analysis report on China's biotech sector, emphasizing that China's innovation capacity is gaining—and will continue to gain—global recognition. The firm expressed sustained confidence in the biotech segment within China's healthcare industry, noting that a cohort of leading biotech companies is expected to reach breakeven in 2025 and 2026. This turning point toward profitability marks a key milestone for China's biotech sector.

In July 2025, Morgan Stanley increased its stake in WuXi AppTec by 1.9296 million shares at approximately HK$95.86 per share, with a total transaction value of around HK$185 million. Following this purchase, its shareholding rose from 4.88% to 5.31%, totaling about 20.5881 million shares. The firm also issued "overweight" ratings for Fosun Pharma and other Chinese biopharmaceutical stocks. Subsequently, Citigroup and JPMorgan Chase also began synchronously increasing their positions in WuXi AppTec, forming a trend of concentrated accumulation by leading global institutions.

According to Hong Kong Exchange disclosures, Citigroup raised its long position in WuXi AppTec from 4.71% to 5.12% on August 20, 2025, while JPMorgan Chase increased its long position from 5.87% to 6.01% on August 21, 2025. In a related report, JPMorgan Chase expressed confidence in WuXi AppTec's business fundamentals, noting that competition in the small-molecule CRDMO segment remains relatively moderate and that the company's TIDES business continues to show strong growth momentum. The firm maintained its "overweight" rating with a target price of HK$138 per share.

In late August, BlackRock increased its stake in 3SBio by 47.60475 million shares at HK$30.1096 per share, with a total investment of approximately HK$1.433 billion. After the transaction, its total shareholding reached around 124 million shares, representing a 5.1% stake. Separately, GIC acquired an additional 40.222 million shares of Harbour BioMed at an average price of HK$12.7133 per share, involving about HK$511 million. Following this purchase, its stake rose from 1.62% to 6.37%, making it a significant strategic investor in the company.

In September, BeiGene saw The Capital Group purchase an additional 882,600 shares at an average price of HK$348.12 per share, amounting to roughly HK$307 million. After the increase, The Capital Group's shareholding rose from 4.96% to 5.02%.

During China's National Day holiday, Laura Wang, Morgan Stanley's Chief China Stock Strategist, noted in an interview that profit expectations for certain sectors, including biopharmaceuticals, are likely to be revised upward. She also observed that during September roadshows, global investors showed significantly renewed interest in Chinese equities.

In the past, global capital may have treated China primarily as an "emerging market" for diversification purposes. Now, however, they are strategically positioning specific Chinese sectors as indispensable core assets in the global technology race. Laura Wang revealed that among the U.S. investors she met in person, over 90% explicitly expressed plans to increase their exposure to Chinese equities, with biotech being one of the key sectors they highlighted.

The collective bullish stance on China's innovative drug sector is no longer merely rhetorical—it has been systematically translated into rating upgrades, target price adjustments, and concrete holdings. The logic behind this 180-degree shift deserves closer attention.

Capital markets view the patent cliff as a primary factor set to impact the future development of multinational corporations (MNCs). Morgan Stanley identifies the core driver of China's innovative drug sector as the critical role it is expected to play in mitigating the global patent cliff crisis.

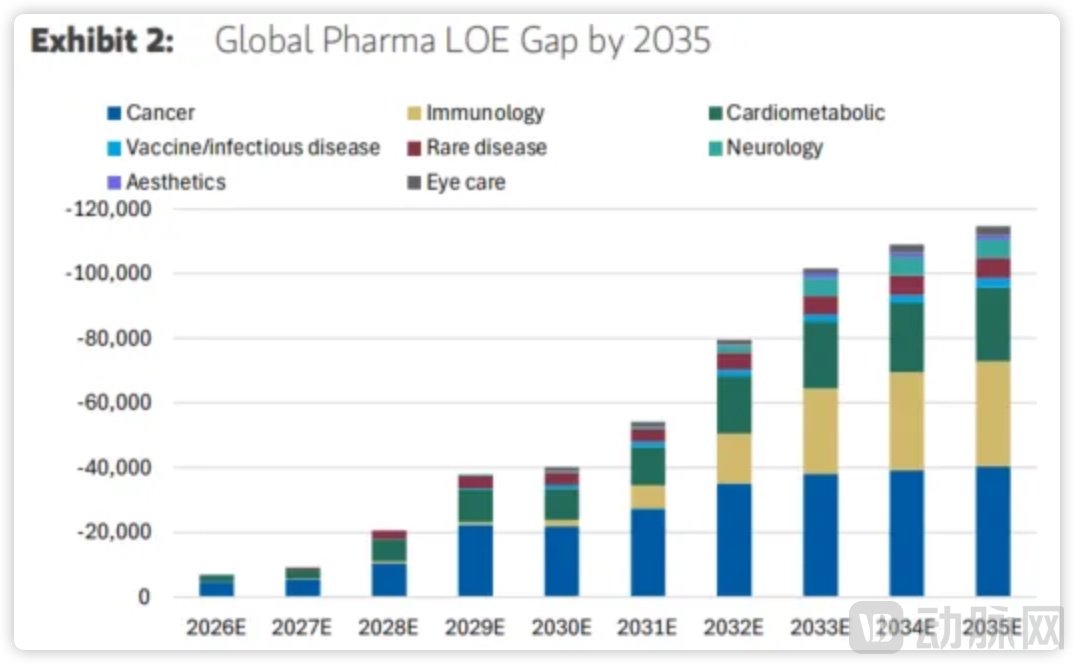

According to Morgan Stanley's estimates, MNCs—primarily pharmaceutical companies from the U.S. and Europe—are projected to lose approximately $115 billion in revenue due to patent expirations by 2035, with $40 billion of that shortfall occurring before 2030. In terms of therapeutic areas, oncology ($40 billion), immunology ($33 billion), and cardio-metabolic diseases ($23 billion) represent the largest shares, collectively accounting for over 80% of the total revenue gap. These segments are also the most urgent arenas for replacement therapies.

Impact on Global Pharma Revenue in 2035 Due to Patent Cliff. Source: Morgan Stanley

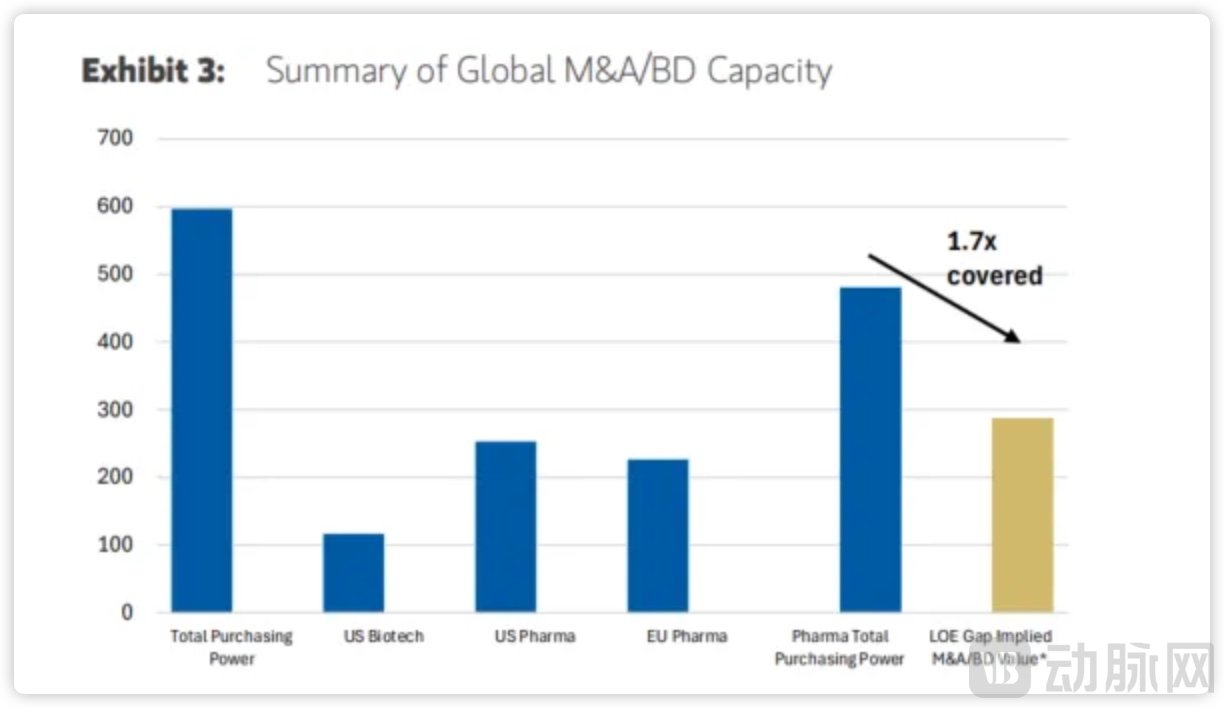

While biotech companies are expected to contribute a portion of revenue, a significant gap is projected to remain due to clinical failure rates and regulatory uncertainties. MNCs are anticipated to deploy approximately $480 billion in M&A and business development funding. Combined with an estimated $117 billion from commercial-stage innovative drug companies, this brings the total purchasing power to nearly $600 billion — about 1.7 times the projected revenue gap from the patent cliff — providing ample capital to support large-scale transactions in the coming period.

Nearly $600 billion will be allocated for pipeline replenishment in the future. Source: Morgan Stanley

With their innovation capabilities and cost-effectiveness, Chinese biotech companies are emerging as key players in filling this gap. The out-licensing model adopted by China's innovative drug sector offers global pharmaceutical companies a pathway to access novel assets that is both lower in risk and more cost-efficient than traditional M&A. For instance, in out-licensing deals from 2023 to the first half of 2025, upfront payments accounted for only 7% to 9% of the total transaction value, with the remainder structured as milestone payments.

In 2024, the total value of China's out-licensing transactions already exceeded $50 billion, and this figure is projected to surpass $100 billion in 2025. This growth underscores China's role not only as a core participant in global innovation deals but also as a firmly established niche player in this evolving ecosystem.

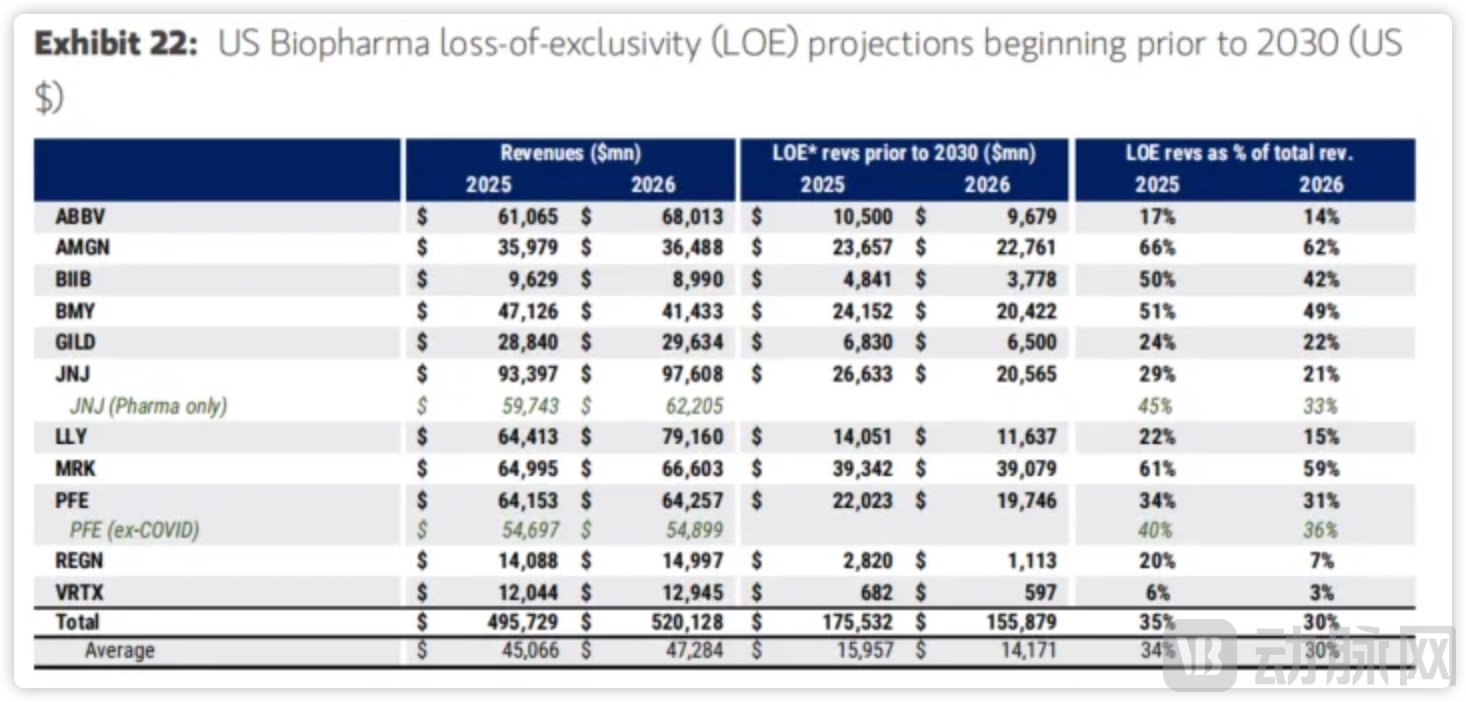

From a regional perspective, major U.S. pharmaceutical companies including Bristol Myers Squibb (BMS), Merck, and Pfizer face a significant challenge: the revenue exposed to patent expiration by 2030 accounts for 51%, 61%, and 34% of their respective 2025 revenues. Collectively, they need to fill a $36 billion revenue gap.

To mitigate this revenue risk, these firms have been actively pursuing partnerships with Chinese biopharmaceutical companies. Notable collaborations include Merck working with Kelun Biotech on the TROP2-ADC candidate (MK-2870/SKB264), Pfizer collaborating with 3S Guojian Pharmaceutical on oncology assets, and BMS partnering with BioNTech (Biotheus) on the PD-L1×VEGF bispecific antibody (BNT327).

Impact of Patent Cliff on Major U.S. Pharmaceutical Companies.Source: Morgan Stanley

Meanwhile, U.S. biotech firms have begun focusing their pipelines on areas such as rare diseases and psychiatric disorders to avoid direct competition with Chinese biotech companies. However, these efforts remain insufficient to cover the revenue gap created by the patent cliff. As a result, these companies are also expected to increase their introduction of innovative pipelines from China in the future.

For European pharmaceutical companies, the pressure from the patent cliff is largely concentrated in the post-2030 period. Novartis and Sanofi face a projected revenue gap of $44 billion from patent expirations between 2030 and 2035, while AstraZeneca and Novo Nordisk are confronting the loss of key blockbuster products—such as Novo Nordisk's semaglutide.

In response, European pharmaceutical companies have accelerated early-stage collaborations with Chinese innovative drug firms as a strategic move. Between 2024 and 2025, over ten such partnerships were established, focusing on areas like oncology ADCs and metabolic therapeutics. Notable examples include Novo Nordisk's agreement with LianBio for the obesity triple agonist UBT251, involving a $200 million upfront payment and up to $1.8 billion in milestones, as well as AstraZeneca's preclinical collaboration with CSPC Pharmaceutical Group, which includes $110 million upfront and potential milestone payments totaling $5.2 billion.

Japanese and Korean companies maintain a relationship with Chinese firms that blends competition and collaboration. Takeda and Astellas, for instance, both regard China as a key partner for pipeline expansion. Takeda's 2023 licensing of Fruzaqla from Hutchmed has since become a significant growth driver for its oncology segment.

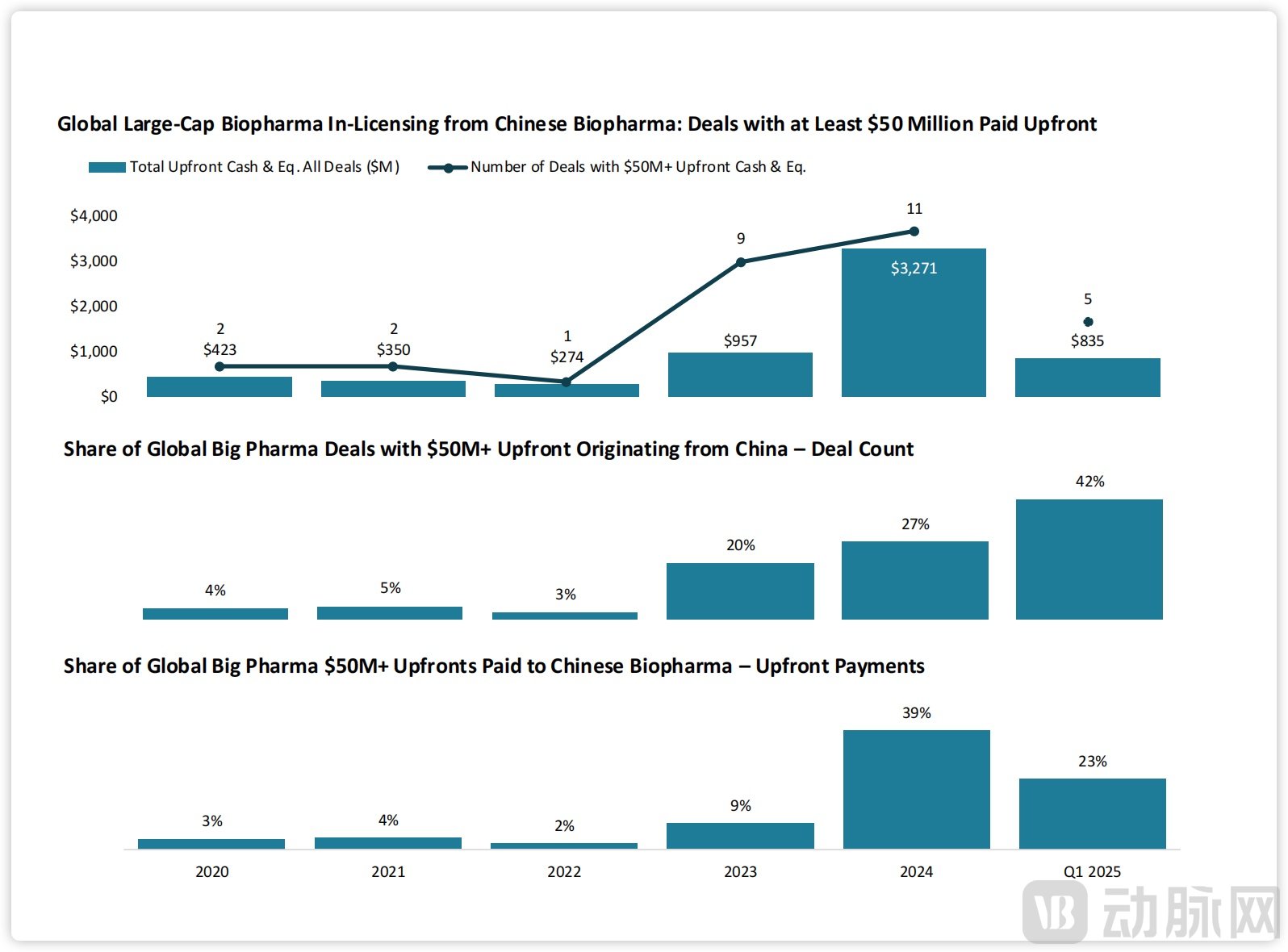

J.P. Morgan also emphasized in a recent report that MNCs are deepening their ties with China's innovative drug industry. The report notes a marked increase in both the share of deals and the size of upfront payments made by global large-cap biopharma companies (those with a market capitalization of $50 billion or more) to local Chinese biopharmaceutical firms.

Deals of China's Innovative Drugs. Source: J.P.Morgan

In 2024, global pharmaceutical companies entered into 11 licensing-in agreements with Chinese biopharmaceutical firms, with total upfront payments reaching $3.3 billion. Deals with individual upfront payments exceeding $50 million accounted for 27% of the total number and 39% of the total upfront value. In the first quarter of 2025, the Chinese market recorded five major biopharmaceutical licensing-in deals, representing 42% of all such transactions globally and 23% of the total upfront payments in large deals. Prior to 2023, China's share in major licensing-in transactions by pharmaceutical companies was less than 5% of the global total.

This trend underscores a growing consensus among international investors: faced with mounting revenue pressure, global drugmakers increasingly see Chinese innovative biopharma companies as critical future players in the worldwide innovation ecosystem.

The reversal in capital sentiment stems from tangible breakthroughs in industry data. China is no longer merely a manufacturing base but has established an end-to-end innovation ecosystem. Chinese biopharmaceutical companies have not only mastered "1-to-N" iterative innovation—developing improved and best-in-class drugs—but are also achieving a growing number of breakthroughs in "0-to-1" pioneering innovation, resulting in first-in-class therapies.

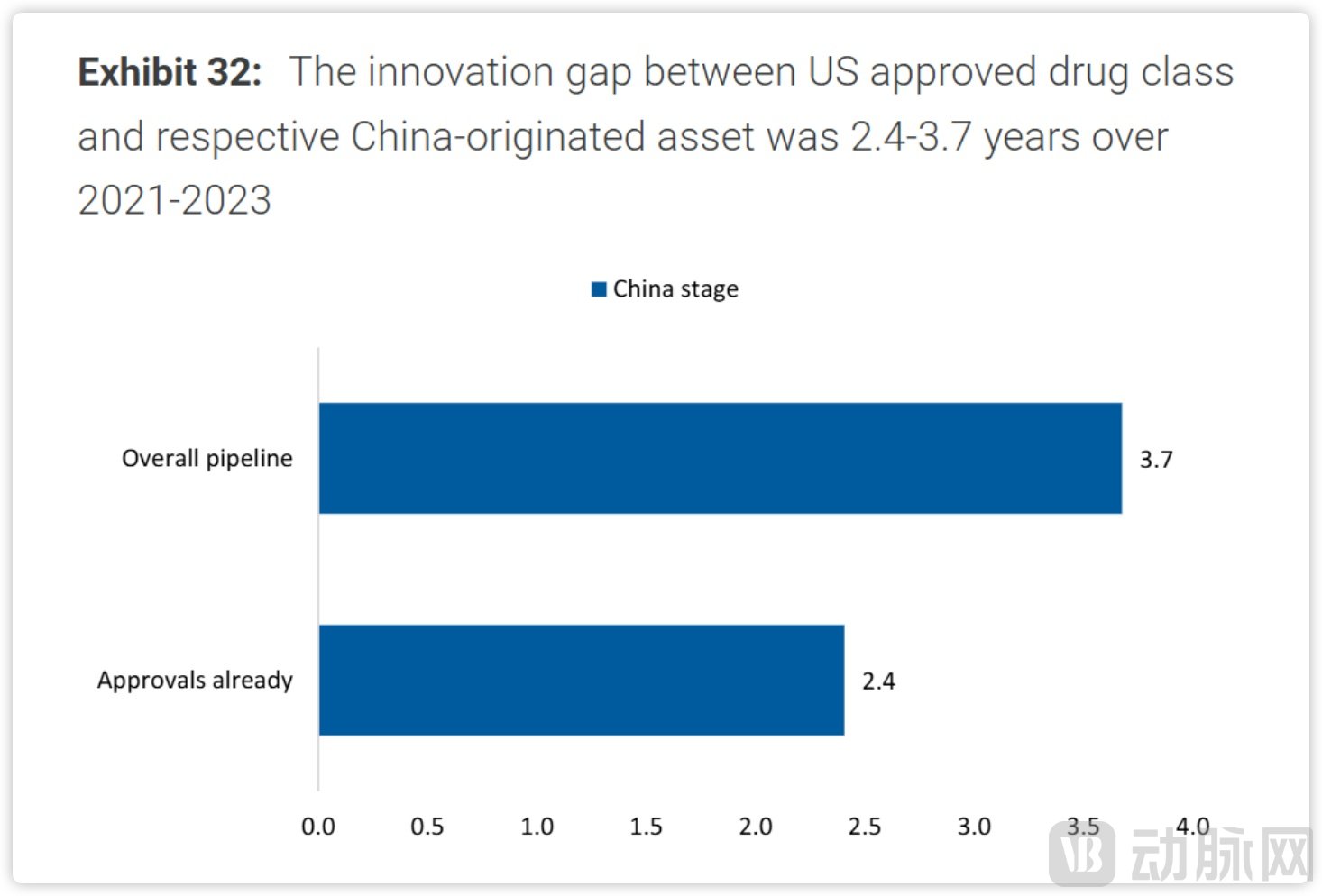

According to Morgan Stanley analysis based on the GBI pipeline database, the gap in development stages between China-originated novel assets and corresponding approved drug categories in the U.S. narrowed to just 3.7 years during 2021–2023. This represents a significant acceleration from a 10-year gap in 2005–2009 and a still substantial lag in 2010–2014. Notably, IQVIA research has reached a similar conclusion.

A Leap Forward From 10 Years to 3.7 Years. Source: Morgan Stanley

The report attributes this narrowing gap to a systemic enhancement of the innovative drug industry's capabilities.

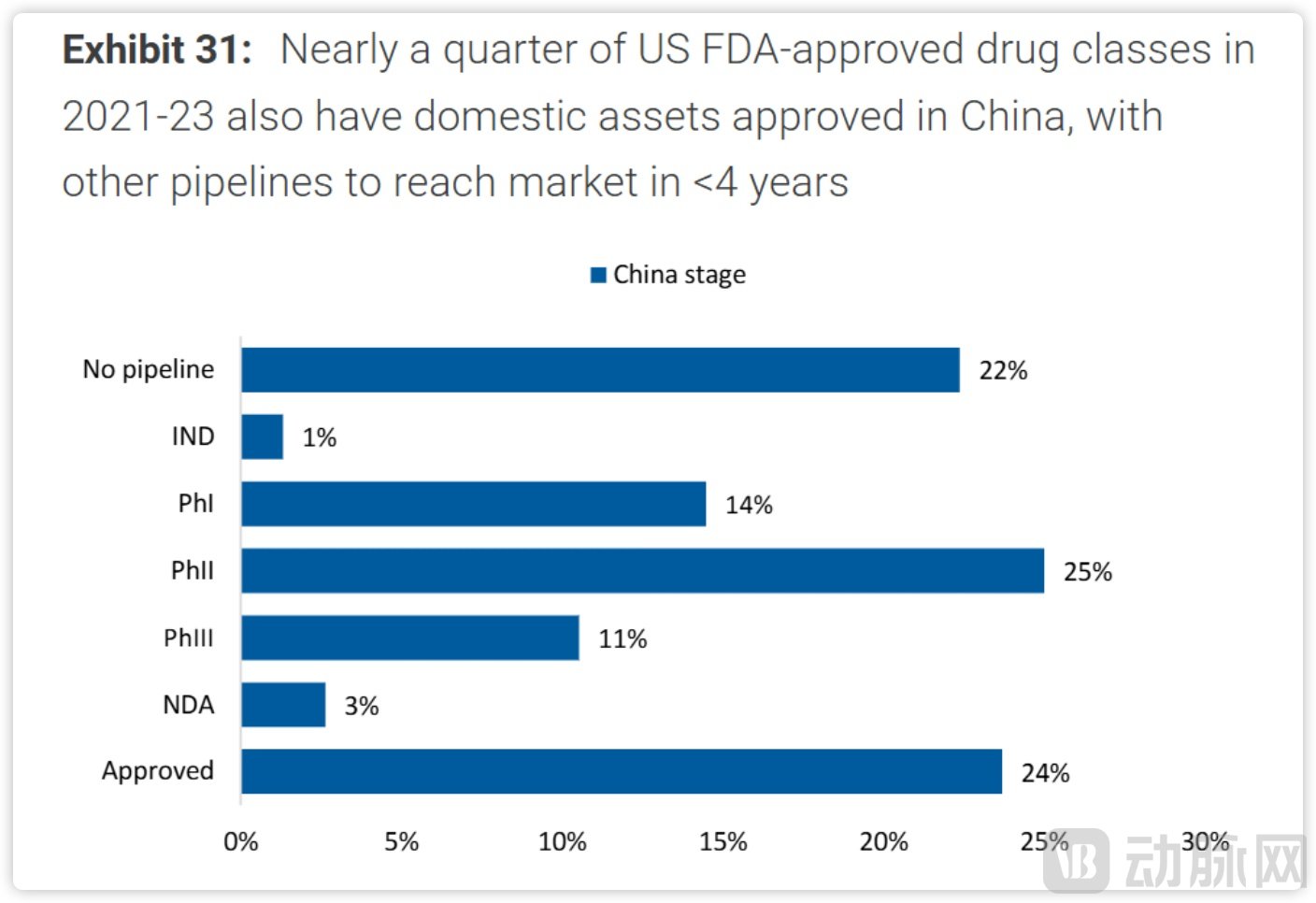

Between 2020 and 2024, a total of 112 new molecular entities were launched in China, accounting for approximately one-quarter of the global total (394 NMEs) during the same period. Notably, among drugs approved by the U.S. FDA from 2021 to 2023, 24% of pipelines with Chinese origins have already gained approval within China, with the remainder expected to be launched domestically within four years. It is projected that by 2040, the global conversion rate of China's Phase III clinical assets will reach 32%, contributing to an increase in the share of FDA-approved drugs originating from China to 35%.

The number and quality of pipelines are rapidly improving. Source: Morgan Stanley

Quantity alone only tells part of the story; the core of the transformation lies in the marked improvement in quality.

Since China joined the International Council for Harmonisation (ICH) in 2017, the integrity of its clinical data has significantly improved—rising from an 80% data reliability concern rate in 2016 to an industry acceptance rate exceeding 80% by 2025. At the same time, the proportion of global clinical trials sponsored by Chinese entities has continued to grow.

In 2024, China sponsored 30% of global clinical trials, with oncology representing the largest therapeutic area at 39%, followed by infectious diseases at 33%, and immunology at 29%. Moreover, 17% of trials initiated by China included overseas study sites, further enhancing the global applicability of the clinical data.

Financial considerations also represent a key factor for global investors.

The high efficiency of clinical development is closely linked to cost advantages. According to Morgan Stanley estimates, the direct cost per patient in a Phase III clinical trial in China is approximately $25,000, compared to $69,000 in the United States. By conducting Phase I/II trials in China and half of Phase III trials globally, the average internal rate of return (IRR) for drug development reaches 8.5%—2.4 times higher than the 3.6% IRR for purely domestic U.S. development. Additionally, the development cost for follow-on projects by Chinese biopharma firms is 43% lower than in the U.S.

From a financing perspective, biotech funding in China peaked at around $45 billion in 2021. Although it moderated to an annual average of approximately $5 billion from 2022 to 2024, the first seven months of 2025 have already seen a recovery to $6 billion, indicating a return to year-on-year growth. Meanwhile, channels such as the Hong Kong Listing Rule 18A and the STAR Market in mainland China provide vital funding avenues for pre-profit companies. In 2024 alone, biotech firms listing under Rule 18A raised a total of $1.5 billion, a figure expected to be surpassed in 2025.

It is the combined advantages in policy, cost efficiency, and R&D execution that form the core drivers behind the rise of China's innovative drug sector.

Geopolitical uncertainties have not led global investors to adopt a pessimistic outlook.

In its report, Morgan Stanley acknowledged that China has, over the past decade, established an innovation policy framework comparable to the U.S. FDA. Moreover, recent policy releases have evolved from general quality control to a sharper focus on specific therapeutic areas. Over the last five years, more than 60% of China's issued guidance documents have centered on oncology, infectious diseases, and cardio-metabolic diseases, effectively steering the direction of innovation.

Furthermore, Morgan Stanley has outlined three potential development scenarios based on capital flows and policy directions:

Base Case (50% probability): Maintains competitive yet cooperative relations with the U.S., with China-originated pipelines achieving a 35% FDA approval rate, generating $220 billion in overseas revenue by 2040, and financing CAGR of 14%.

Bull Case (30% probability): Recognizes China's R&D efficiency and eases regulatory constraints, leading to a 46% FDA approval rate, $276 billion in revenue, and financing CAGR of 20%.

Bear Case (20% probability): Faces restricted cross-border collaboration and constrained investment flows, resulting in only a 15% FDA approval rate, approximately $122 billion in revenue, and financing CAGR of 7%.

Revenue Forecast in Different Cases. Source: Morgan Stanley

Even under the most severe Bear Case, the report still projects global sales exceeding $122 billion by 2040. This figure not only far exceeds current levels but also underscores firm confidence in the core competitiveness of China's innovative drug sector. Morgan Stanley further suggests that given the pressing need to fill the patent cliff gap and China's R&D advantages, the competitive cooperation pathway remains the most probable outcome. Notably, many global pharmaceutical companies have already established R&D and production centers within China to mitigate potential risks.

The shift in global capital—from skepticism to "all-in"—transcends short-term trading fluctuations. It marks a historic moment where China's innovative drugs are being integrated into the core asset allocation of global portfolios. The willingness of international investors to pay a premium stems fundamentally from an emerging "cash flow inflection point," driven by synchronous improvements in both the quality of Chinese biotech pipelines and their profitability. As top-tier institutions underwrite China's innovation capacity with their capital positions, the future appears decidedly promising.

References:

Morgan Stanley China Biotech: Innovation Dawn

JPMorgan Strategic shifts and market dynamics

McKinsey How China could impact the global biopharma industry