Where does China stand in the global shift to organ-on-a-chip amid FDA push?

In late September 2025, the National Institutes of Health (NIH) announced a major initiative to establish the first U.S.-based Standardized Organoid Modeling (SOM) Center, with plans to invest $87 million over the next three years. This quickly sparked strong reactions across the industry, though insiders view it more as a strategic complement and reinforcement of the FDA's recent policy shifts.

Figure 1. FDA Releases Alternative Animal Testing Policies Multiple Times

Figure 1. FDA Releases Alternative Animal Testing Policies Multiple Times

In fact, since the beginning of the year, the FDA has been actively advancing a historic transition toward replacing traditional animal testing with organoids and organ-on-a-chip models. In January, the agency released a draft guidance on the use of artificial intelligence (AI) in regulatory decision-making for drugs and biological products, offering recommendations to sponsors and researchers on incorporating AI into the development process. Then, in April, the FDA issued its "Roadmap for Reducing Animal Testing in Preclinical Safety Studies," outlining a systematic strategy to replace conventional animal studies through New Approach Methodologies (NAMs).

Amid these successive major policy announcements, the industry has not only witnessed the FDA's strong determination to replace animal testing but has also seen growing enthusiasm for the promising organoid and organ-on-a-chip market. This momentum has been accompanied by a continuous stream of breakthrough achievements.

Focusing specifically on the Chinese market, according to incomplete statistics, the number of SCI publications in the field of organoids in China reached 811 in the first half of 2025, of which 592 were original research articles. These studies have been published in top-tier journals such as Cell, reflecting China's rising international influence in the field. At the research level, in July 2025, a team from Southeast University innovatively integrated human liver organoids with artificial intelligence (AI) to develop "DILITracer," the world's first AI model based on bright-field images of liver organoids. Two months later, Signet Therapeutics, in close collaboration with XtalPi Holdings, pioneered the development of SIGX1094R, the world's first targeted drug for diffuse gastric cancer. Notably, this also marks the first drug globally developed based on a combined organoid and AI technology platform.

It is evident that the global biomedical sector is embracing a technological revolution centered on organoids. At this pivotal juncture, China's organoid field—bolstered by a well-established industry chain and groundbreaking innovations—is positioned at the forefront of this transformation. With these advantages, China stands poised to lead the way in unlocking this blue-ocean market.

Why Does the FDA "Favor" Organ-on-a-Chip?

In 1938, the U.S. Congress passed the Federal Food, Drug, and Cosmetic Act (FD&C Act), mandating that drugs must undergo animal testing for safety before market approval. This is widely regarded as the beginning of the era of animal testing in the industry. Yet, from that moment on, discussions have never ceased about how to optimize, reduce, and eventually replace it.

There are clear reasons for this. From the critical perspective of success rates, data from 2021 shows that Phase I clinical trials, which aim to evaluate human safety, have a success rate of only about 50%. This means that even after passing animal testing, half of all drug candidates are still found to be unsafe in humans. Of the remaining half, over 70% fail in Phase II clinical trials, which assess efficacy. Overall, this translates to 90 out of every 100 molecules entering clinical trials failing in these first two phases. These figures highlight that animal testing performs poorly in accurately predicting drug safety and efficacy in humans.

Furthermore, cost considerations present another significant challenge. As non-human primates, monkeys are the most widely used animal models due to their physiological and genetic similarity to humans. However, their prices are heavily influenced by market supply and demand. It was reported that during 2021–2022, the cost of a single monkey surged to as high as 230,000 RMB. On average, preclinical research for a new drug requires at least 60 monkeys, implying R&D costs could exceed tens of millions of RMB. Clearly, the vast majority of pharmaceutical companies struggle to bear such high upfront investments.

Lastly, there are significant humanitarian concerns. It is estimated that approximately 100 million vertebrate animals are used in experiments worldwide each year. Although scientists have made efforts in recent years to improve animal welfare—such as administering anesthetics to reduce pain and discomfort during procedures—these measures remain insufficient. Many in the industry continue to express strong opposition. A notable example is Elon Musk's neural interface experiments, which faced substantial criticism following reports of monkey fatalities. The animal welfare concerns raised in these reports were a significant factor in the FDA's decisions, which included twice rejecting applications to proceed to human trials and leading to a temporary halt in the research.

However, despite these numerous drawbacks, animal testing remained the mainstream approach for a long period because the industry had not yet identified a more viable alternative—until the emergence of organoids and organ-on-a-chip technology.

In August 2022, a significant milestone was reached when the FDA approved the first investigational drug (NCT04658472) to enter clinical trials based entirely on preclinical data generated from organ-on-a-chip studies. This marked the first official recognition that organ-on-a-chip models could serve as a valid alternative to animal testing.

Following this, the FDA began actively promoting the full replacement of animal testing with these advanced models. In September 2022, just one month after the approval of that pioneering organoid-based drug, the agency passed the FDA Modernization Act 2.0, which explicitly eliminated the mandatory requirement for animal testing in drug development and permitted the use of human biology-based alternatives—such as microphysiological systems (MPS) and computer modeling—for drug evaluation. Then, in February 2024, the FDA further advanced this initiative by introducing the FDA Modernization Act 3.0, encouraging the application of New Approach Methodologies (NAMs), including organoids and organ-on-a-chip, in clinical research.

Why is the FDA so strongly advocating for organoids?

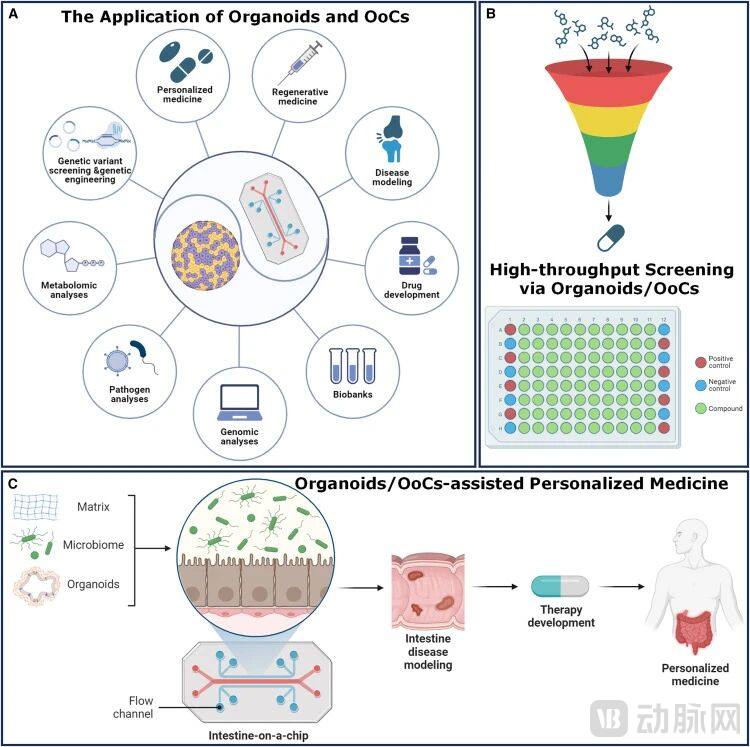

Figure 2. Applications of organoids and organ-on-a-chip models (Source: Rocky S. Tuan et al., Cell Press)

The answer lies in their fundamental structure. Organoids are three-dimensional cellular structures derived from adult stem cells, pluripotent stem cells, or tissue progenitor cells cultured in vitro. They mimic the structural and functional characteristics of real organs. A key advantage is their ability to rapidly establish highly physiologically relevant in vitro models that closely resemble human in vivo conditions. This leads to three distinct benefits in experimental applications:

High accuracy.

Short development cycles – Building specific organ-on-a-chip models typically takes only a few weeks to a month.

Significantly reduced R&D costs – The FDA has estimated that using alternatives like organoids can lower development costs for monoclonal antibody drugs by over 40%. As the technology matures, this reduction is projected to reach 60% or even higher.

A pharmaceutical R&D director noted, "Driven by the wave of new technologies and ethical imperatives, coupled with the continuous rollout of supportive policies, animal testing is clearly no longer the only option. Organoids and organ-on-a-chip models are rapidly emerging as reliable alternatives."

From Concept to Application: Where Are Organ-on-a-Chip Technologies Now?

Despite the rapid advancement of organoids and organ-on-a-chip technologies in recent years, many industry experts believe it is still too early for them to fully replace animal testing.

This skepticism stems partly from ongoing technical limitations. For instance, organoids often exhibit heterogeneity in culture and cannot fully replicate the complexity of real human organs. These constraints affect their reliability and generalizability in areas such as disease mechanism research, drug screening, and precision medicine. As one seasoned investor commented, "An organoid is essentially a cultured cell cluster—it lacks nerves, blood vessels, and endocrine mechanisms. How can it completely replace animal testing?"

On the other hand, there remains a degree of industry skepticism toward new technologies. It is reported that many pharmaceutical companies have explicitly stated that they will not fully abandon animal testing until alternative methods are thoroughly validated. Compared to the high costs of CRO services, the price of clinical failure is far greater. Additionally, even if the FDA were to completely phase out animal testing, some companies indicated they would continue such tests to meet the requirements of other regulatory agencies worldwide.

Thus, it is clear that organoids still face multiple challenges in practical application—precisely the areas where the industry is now focusing its efforts.

Taking the construction of complex structures as an example, as mentioned earlier, current organoids often only "replicate" a limited number of cell types and simplified zonation of the target organ. They lack complete multicellular hierarchies, vascular networks, innervation, and immune microenvironments, resulting in significant disparities from real organs in terms of morphological scale, functional unit organization, and mechanical properties. Therefore, the field is now advancing from simulating single-cell-level structures toward functionally restoring multicellular and multisystem complexity.

To address this, the industry is employing strategies such as multi-lineage co-differentiation, 3D bioprinting, dynamic mechanical stimulation, and in vivo transplantation for self-assembly to systematically incorporate the missing "framework, conduits, and signaling." The goal is to create highly simulated complex structures that are perfusable, responsive, and capable of repair. For instance, in developing heart organoids, researchers are co-differentiating multiple cell lineages—including cardiomyocytes, fibroblasts, endothelial cells, and neurons—and embedding them into 3D-bioprinted collagen-fibrin scaffolds. These constructs are then subjected to rhythmic electrical and mechanical stimulation to induce the formation of functional, beating chamber-like structures.

Secondly, the field faces challenges in standardization and scalability of organoids themselves. Significant variations in cell sources, culture protocols, and matrix selection across different laboratories lead to high batch-to-batch variability and poor comparability, making it difficult to establish unified production processes and quality standards. At the same time, limitations in culture throughput, cost control, automation levels, and long-term stability prevent current organoid production systems from reaching true industrial-scale capacity, severely restricting their broad application in clinical trials.

To address these issues, the industry is actively advancing the maturation of innovative technologies such as automation and robotics, bioreactors, and closed production systems. Taking robotics as a key example, companies like D1 Medical Technology and Accurate International have already launched relevant platforms. These systems transform organoid culture into a programmable, traceable, and high-throughput industrial process by leveraging automation and robotic technologies. This not only resolves scalability challenges but also fundamentally advances the standardization of organoid production.

Lastly, progress is evident in the expansion of application areas. To date, organoids have successfully replicated the basic structures and functional units of various tissues and organs—including the heart, liver, kidney, lung, brain, stomach, and intestine. Most of these models have now achieved vascularization and immunization, and are gradually being applied in disease modeling, drug screening, and regenerative medicine research.

Looking ahead, organoid technology is set to expand into more complex, multi-organ integrated systems such as "organ-on-a-chip" and "digital twin" platforms, enabling whole-body physiological and pathological simulation. At the same time, through gene editing, microfluidics, and AI-driven design, it will be possible to construct personalized models tailored to specific tumors or rare diseases.

In June 2025, a team led by Professor Joseph C. Wu at Stanford Medicine published a study in Science demonstrating the use of embryoid body technology to successfully simulate the early vascularization processes of the human heart and liver. This breakthrough addresses a key bottleneck in organoid research and provides a powerful new tool for studying human organ development and advancing drug screening.

A pharmaceutical R&D director commented, "The transition of organoids from experimental research to clinical application will be an incremental revolution. It requires overcoming challenges such as increasing model complexity, achieving technological industrialization, and enabling clinical adoption — all of which demand continuous technological iteration, interdisciplinary collaboration, and policy support."

Who is Leading in the Potential Market?

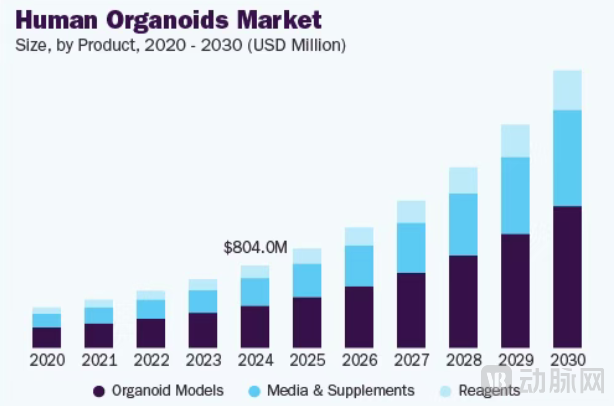

Figure 3. Trend of the Global Organoid Market Size (Source: Research and Markets)

According to an April 2025 market report by Research and Markets, the global organoid market is projected to grow from $1.11 billion in 2024 to $1.26 billion in 2025, with an estimated value of $2.58 billion by 2030, representing a compound annual growth rate (CAGR) of approximately 15%. As the pharmaceutical industry actively seeks new growth opportunities, this undoubtedly represents a significant potential market.

However, as is the case in most innovative drug sectors, the organoid market remains dominated by international giants. Companies such as Thermo Fisher Scientific, Emulate, MIMETAS, and Organovo have already achieved successful commercialization. Among them, Thermo Fisher Scientific, which offers a complete closed-loop ecosystem spanning culture media, matrix gels, and high-content imaging, generated over $600 million in organoid-related revenue in 2025, ranking first globally in market share.

Focusing on the Chinese market, a cohort of emerging players is rapidly gaining prominence. Reports indicate that China now boasts over ten representative companies in the organoid field, including Accurate International, Daxiang Biotech, D1 Medical Technology, Avatarget, K2 Oncology, and bioGenous BIOTECH. Most of these companies were founded around 2018 and are still in their early developmental stages.

Nevertheless, their potential should not be underestimated. Taking Accurate International as an example, the company successfully closed a nearly 100 million yuan Series B financing round in May 2025. This achievement is largely attributed to its leading organoid technology and industrial platform, which has established a comprehensive technological ecosystem covering the entire lifecycle of organoids. Its technological outcomes have already demonstrated significant application value in cutting-edge fields such as precision medicine and drug discovery.

Additionally, D1 Medical Technology achieved a significant milestone in August 2025. A "Composite Organoid System" project, led by the Institute of Zoology, Chinese Academy of Sciences with D1 Medical Technology as a key contributor, was approved under the National Key R&D Program. It is reported that this project pioneered the development of a cross-germ-layer composite organoid system, effectively filling a gap in international technology and providing a novel research platform for metabolic syndrome (MetS) treatment. This accomplishment undoubtedly validates D1 Medical Technology's leading position in organoid research and its capability in industrial translation.

Looking ahead, with further implementation of supportive policies, coupled with robust innovative research and strong industrial capabilities, the Chinese organoid market is poised for explosive growth, unlocking substantial economic value. Success in this competitive landscape will be determined by which players can first establish a "closed-loop advantage" — integrating technological barriers, clinical translation speed, industrial chain coordination, and regulatory compliance.

Much like the journey toward fully replacing animal testing with organoids, achieving this will require continued refinement and validation over time.