From spinoff to listing: how a HKD 4.9B pharma incubated a HKD 6B biotech

On October 15, 2025, Xuanzhu Biopharmaceutical Co., Ltd. was officially listed on the Hong Kong Stock Exchange, with a market capitalization of approximately HKD 6 billion, becoming the 17th Chinese Biotech company to go public in Hong Kong this year.

The controlling shareholder of Xuanzhu Biopharm is Sihuan Pharmaceutical, a listed company on the Hong Kong Stock Exchange. Since 2018, Sihuan has spun off Xuanzhu Biopharm, allowing it to operate independently. Xuanzhu Biopharm had submitted an application for an IPO on the STAR Market in September 2022 but later voluntarily withdrew the application and shifted its focus to listing in Hong Kong.

Over the past seven years, Xuanzhu Biopharm has completed several rounds of financing and capability building. In 2020, it secured a Series A investment of RMB 963 million from institutions including Future Industry Investment Fund. In 2021, after acquiring Beijing Combio, it completed a Series B financing of over RMB 600 million. This acquisition enabled the company to establish comprehensive R&D capabilities spanning from small molecules to large molecules. According to the prospectus, state-owned funds represented by Future Industry Investment Fund are currently the most significant external shareholders of XZenith, holding approximately 20.72% of the total issued share capital as of the last practicable date.

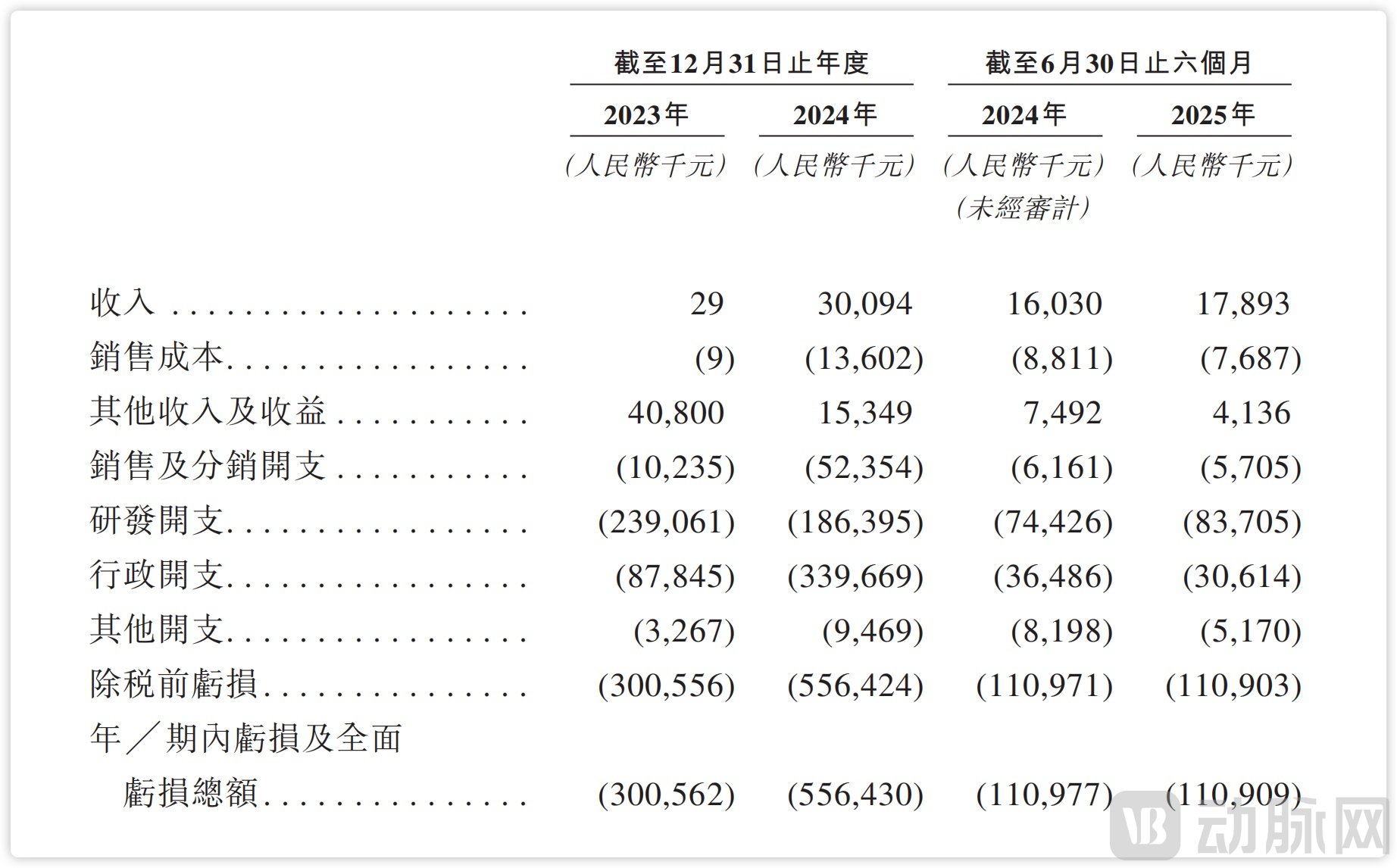

Revenue Status of Xuanzhu Biopharm in Recent Years, Source: Prospectus

Financially, since its first approved product, KBP-3571 (Anaplazole), received NDA approval from China's NMPA and was launched in June 2023, Xuanzhu Biopharm has generated total sales revenue of RMB 48 million from 2023 through 2024 and up to June 30, 2025. This preliminarily demonstrates its commercial capability.

The true value of Xuanzhu Biopharm's listing lies in proving its ability to develop independently and in reshaping the value of its parent company, Sihuan Pharmaceutical. Sihuan Pharmaceutical's market capitalization has increased from HKD 4.9 billion at the time of Xuanzhu Biopharm's Series A financing to HKD 15 billion today. Through the IPO fundraising, Xuanzhu Biopharm also aims to further advance the commercialization of its three core pipelines.

Sihuan Pharmaceutical's spin-off of Xuanzhu Biopharmaceutical represents a strategic initiative spanning several years, aimed at unlocking substantial value.

As an established pharmaceutical company that began with generic drug operations, Sihuan Pharmaceutical actively entered the innovative drug sector as the industry gained momentum. However, the extensive funding required for innovative drug R&D necessitated reinvesting profits from its generic business into this new area. Against this backdrop, Sihuan Pharmaceutical decided to spin off Xuanzhu Biopharm for independent operation in 2018, intending to fully realize the potential value of its innovative drug business.

In retrospect, this move has proven exceptionally successful. Following its Series A financing in 2020, Xuanzhu Biopharm reached a valuation exceeding RMB 3 billion. Just one year later, upon completing its Series B financing with investors including Sunshine Insurance Group, its post-investment valuation approached RMB 7 billion—nearly doubling. During this period, while Sihuan Pharmaceutical was facing operational pressures from the decline of its generic drug business, its market capitalization stood at merely HKD 4.9 billion.

Despite these challenges, Sihuan Pharmaceutical continued to strategically consolidate promising business segments into Xuanzhu Biopharm to facilitate its financing efforts. Prior to its independent operation in 2018, Xuanzhu Biopharm had primarily focused on small molecule drugs. Subsequently, through acquisitions including Xuanzhu Biopharm Beijing, the restructuring of Combio, and technology transfers, Sihuan Pharmaceutical systematically integrated large molecule businesses and pipelines into the subsidiary. These strategic asset transfers enabled Xuanzhu Biopharm to rapidly accumulate a robust R&D pipeline, driving a significant increase in its valuation.

Following this growth phase, Sihuan Pharmaceutical initiated plans for Xuanzhu Biopharm's public listing. Meanwhile, to prevent potential hollowing out of its core business operations, the parent company proactively developed a second growth curve by strategically expanding into the medical aesthetics sector.

According to its official announcement, Sihuan Pharmaceutical stated that the spin-off will enable the company and its subsidiaries to further focus on and transition towards the medical aesthetics business, while concentrating existing capital and resources on cultivating and developing this high-growth sector along with other new ventures. In essence, the purpose of the spin-off is to reallocate resources toward the high-growth medical aesthetics segment, while allowing the capital-intensive, long-cycle innovative drug business to independently seek financing from the capital market.

Today, with its listing on the Hong Kong Stock Exchange, Xuanzhu Biopharm has reached a market capitalization of HKD 6 billion, approximately half of its parent company Sihuan Pharmaceutical's current market value. Over several years, Sihuan Pharmaceutical has successfully transformed its innovative drug R&D division from a loss-incurring unit into a valuation driver through the spin-off, while simultaneously achieving a revaluation of its own business centered on generics and medical aesthetics.

When examining Sihuan Pharmaceutical's performance in recent years, the foresight of this spin-off strategy becomes even more commendable. From 2022 to 2024, Sihuan Pharmaceutical sustained continuous losses, primarily due to significantly narrowed profit margins in its generic drug business under volume-based procurement policies, with this segment now accounting for only 58% of total revenue. Fortunately, the medical aesthetics business has developed smoothly. According to the company's financial reports, its revenue in the first half of 2025 reached over RMB 1.1 billion, with a net profit exceeding RMB 50 million, marking an exit from the three-year consecutive loss predicament.

With the successful IPO of Xuanzhu Biopharm, based on its HKD 6 billion market capitalization and Sihuan Pharmaceutical's 56.5% stake, the parent company's market value has rebounded to HKD 15 billion, returning to 2021 levels and achieving a post-spin-off win-win situation.

From leveraging traditional business to fund innovative drug development, to executing a spin-off listing and driving parent company transformation, Sihuan Pharmaceutical has demonstrated a systematic approach for traditional pharmaceutical companies navigating transition. While maintaining strategic focus on its core generics business and deepening its commitment to medical aesthetics, it has designed a clear capital pathway for its subsidiary—bringing it to market at an opportune time to achieve independent financing and development.

Naturally, this strategy demands significant prerequisites. First, the parent company must possess clear strategic planning, sufficient financial resources, and the capability to manage multi-platform operations. Only with these can it demonstrate both the willingness to incubate and the capacity to execute a spin-off.

Second, the subsidiary must possess genuinely promising innovative pipelines. Although Xuanzhu Biopharm's products may not appear particularly "sexy," the fact that it already had three approved products at the time of its IPO stands as solid proof of its ability to survive and develop as an independent entity after separation from the parent company.

Third, timing with capital market windows is critical. Whether on the STAR Market or in Hong Kong, policies and market sentiment are constantly shifting. Xuanzhu Biopharm's own path to listing encountered multiple challenges before ultimately succeeding.

Of course, the IPO is only a beginning. Xuanzhu Biopharm must still prove its commercial execution capabilities in the next phase.

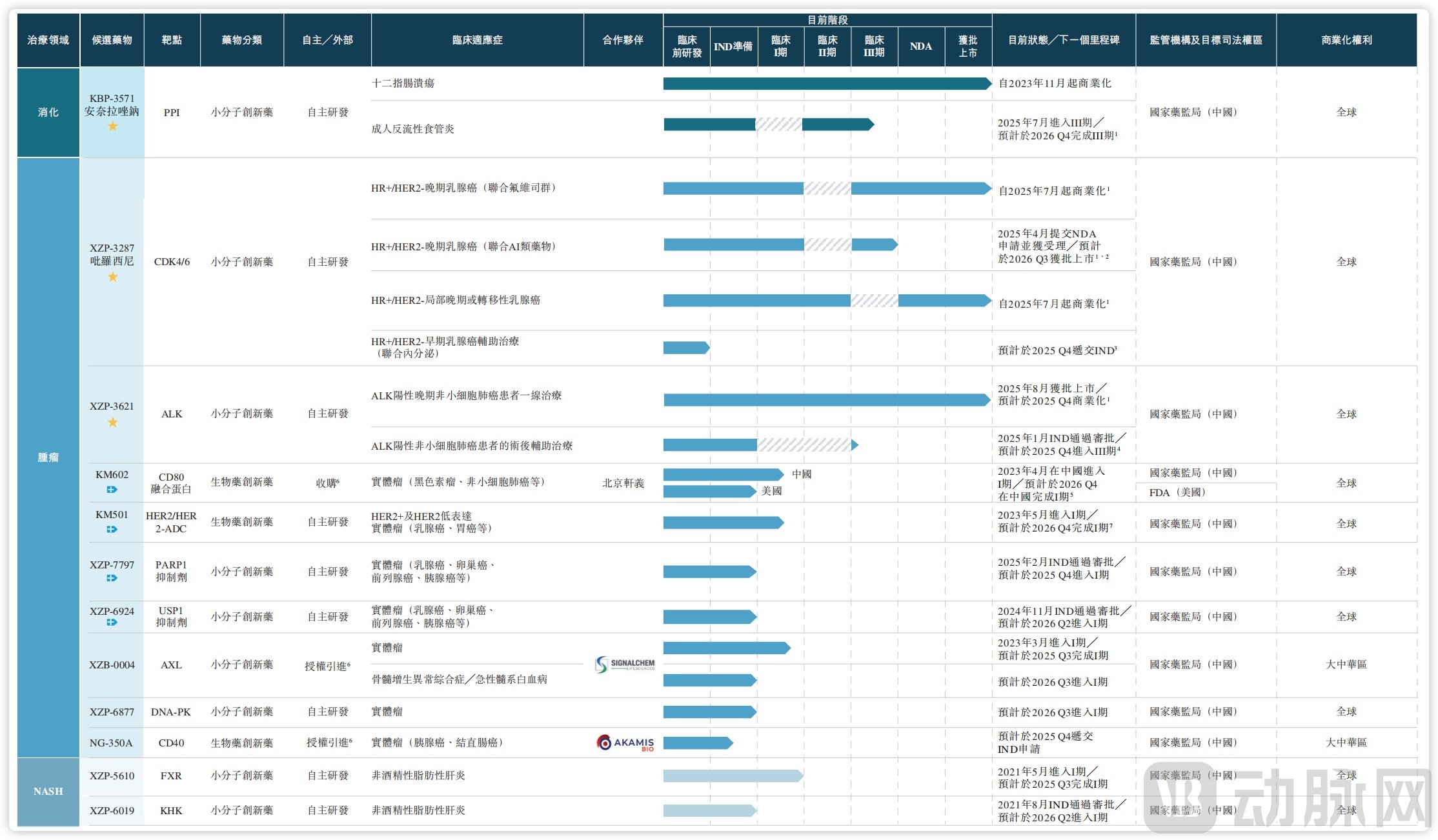

The core competitiveness of a Biotech company is primarily reflected in its pipeline. Currently, Xuanzhu Biopharm has established a pipeline matrix covering three major therapeutic areas: digestive system diseases, oncology, and non-alcoholic steatohepatitis (NASH), comprising over ten drug assets.

Among these, the following represent Xuanzhu Biopharm's core assets:

KBP-3571 (Anaplazole Sodium), an innovative proton pump inhibitor (PPI) for digestive system diseases, which has already received NDA approval.

XZP-3287 (Birociclib), a cyclin-dependent kinase 4/6 (CDK4/6) inhibitor targeting breast cancer, which has also obtained NDA approval.

XZP-3621 (Dirozalkib), an anaplastic lymphoma kinase (ALK) inhibitor for non-small cell lung cancer, which has similarly received NDA approval.

Xuanzhu's Pipeline Distribution, Source: Prospectus

Anaplazole Sodium, as a domestically developed proton pump inhibitor (PPI), was approved in 2023 for the treatment of duodenal ulcers and subsequently included in China's National Reimbursement Drug List (NRDL), becoming Xuanzhu Biopharm's first commercialized product. As of June 30, 2025, the drug has achieved sales revenue of RMB 48 million and has been introduced in over 1,000 hospitals nationwide, marking a strong start for the company's commercialization efforts.

However, the Chinese PPI market is highly competitive, with six drugs already approved and multiple generic candidates under development. In response, Xuanzhu Biopharm is actively exploring new indications for Anaplazole Sodium. A Phase III clinical trial for gastroesophageal reflux disease has already been initiated. If successful, this expansion could open access to a market encompassing tens of millions of potential patients.

Birociclib and Dirozalkib represent the twin stars in Xuanzhu Biopharm's oncology pipeline. Birociclib is a new-generation, highly selective CDK4/6 inhibitor with stronger targeting selectivity toward CDK4. CDK4 and CDK6 jointly regulate key cell cycle processes, with research suggesting that the proliferation of solid tumors like breast cancer primarily depends on CDK4. Currently, Birociclib has obtained two NDA approvals for breast cancer, covering second-line combination therapy and later-line monotherapy, and commercialization was initiated in July 2025.

Dirozalkib is an ALK inhibitor indicated for the treatment of ALK-positive locally advanced or metastatic non-small cell lung cancer (NSCLC) patients who have not previously received ALK inhibitor therapy. Xuanzhu Biopharm is also exploring Dirozalkib for postoperative adjuvant therapy in ALK-positive NSCLC patients to further expand the product's clinical and commercial value. According to MoShang Healthcare data, Dirozalkib is the ninth novel drug available in China for ALK-positive patients, indicating that the company will face intense commercial competition.

In addition, Xuanzhu Biopharm has four oncology pipelines, including KM602 and XZP-7797, which have either entered Phase I clinical trials or received IND approval. The company also has two MASH pipeline drugs in early stages, forming a strategically tiered portfolio.

Like most biotech companies, Xuanzhu Biopharm is not yet profitable. The planned HKD 700 million raised through this offering will be precisely allocated to address core needs: approximately 45% will be used for R&D expansion of the three core products, including new indication clinical trials and process optimization; 20% will be directed toward commercial capacity building, further enhancing the sales network and market education; and the remainder will support other pipeline development and general operations.

Notably, Xuanzhu Biopharm is one of the few biotech companies with three approved drugs at the time of listing. The value of an innovative pharmaceutical company ultimately depends on its pipeline fulfillment capability. With the funding secured and commercialization advancing, the future development of Xuanzhu Biopharm will likely hinge on whether the business model for its core blockbuster products can be successfully established.

The success or failure of anaplazole is likely to determine the future of Xuanzhu Biopharm. Although the company already has three approved drugs, the commercialization of the other two oncology drugs will still require considerable time, whereas the commercial scaling of anaplazole is an urgent priority. If it progresses smoothly, it can drive the development of the remaining pipelines; if not, it could slow the company's overall growth trajectory.

The use azole drugs for treating acid reflux or ulcers is widely recognized by the public, with medications like omeprazole being common household staples. Azole drugs are proton pump inhibitors (PPIs). Proton pumps in the stomach generate gastric acid, and excessive acid secretion can lead to conditions such as digestive ulcers and gastroesophageal reflux disease. PPIs work by deactivating proton pumps, thereby stabilizing gastric acid levels.

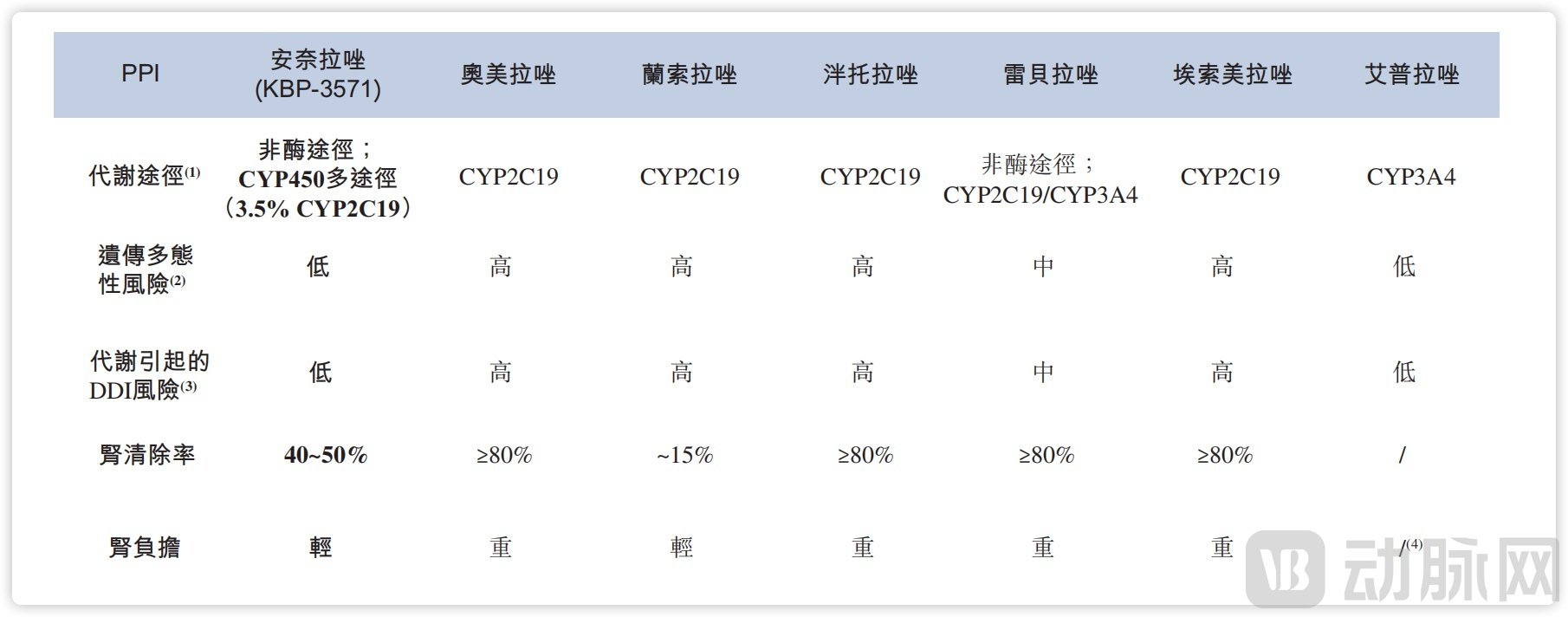

Existing PPI drugs are generally similar in their effectiveness at inhibiting gastric acid secretion. The real differentiation lies in pharmacokinetic aspects, such as metabolism duration, metabolic pathways, and impact on liver and kidney function. Currently, azole drugs are metabolized primarily via the CYP2C19 enzyme. However, in the Chinese population, approximately 15% are slow metabolizers of CYP2C19, and about 35% are rapid metabolizers. This variation can lead to unstable plasma concentrations of PPIs—either too high or too low—affecting their efficacy and safety.

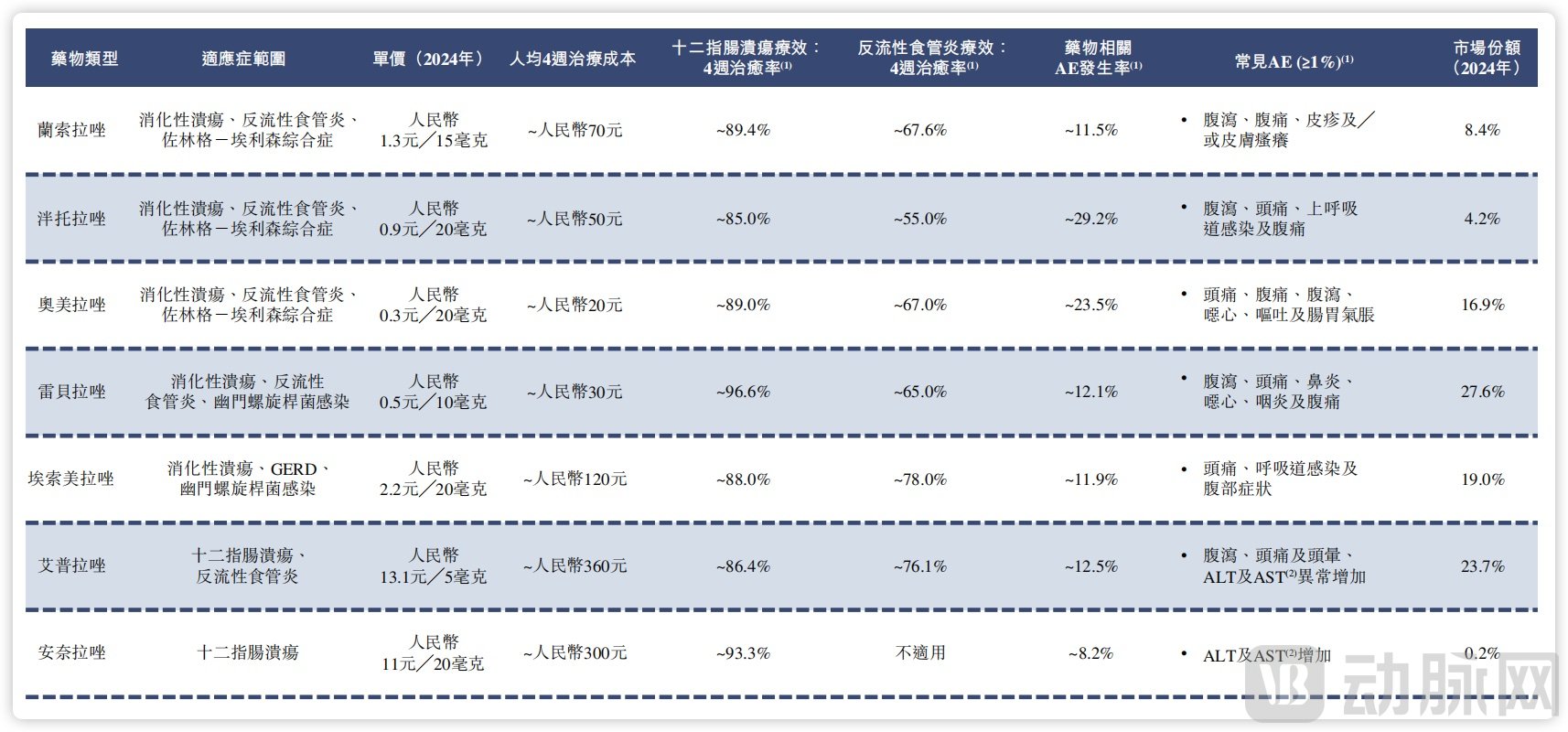

Comparison of Oral PPI Drug Safety, Source: Prospectus

The differentiated design of anaplazole lies in its modified pyridine ring structure, where the C5 methyl group has been removed. This enables a multi-enzyme/non-enzymatic, dual-pathway metabolism involving both intestinal and renal routes, significantly reducing its dependence on CYP2C19. Previous non-head-to-head in vitro biotransformation studies indicated that CYP2C19 accounts for only about 35% of anaplazole's overall metabolism.

As a result, CYP2C19 polymorphisms do not significantly influence the plasma concentration or clinical outcomes of anaplazole. In contrast, currently mainstream drugs such as omeprazole and rabeprazole exhibit renal clearance rates exceeding 80%, imposing a relatively high burden on the kidneys, whereas anaplazole has a renal clearance rate of only 40%–50%.

In a prior Phase III clinical study comparing anaplazole head-to-head with rabeprazole for the treatment of duodenal ulcers, the 4-week healing rates were 90.9% and 93.7%, respectively, and the overall symptom improvement rates for duodenal ulcers were 90.9% and 92.5%, respectively. Improvement rates for individual symptoms were similar across both groups, with no statistically significant difference in cure rates observed between the two treatments.

In summary, anaplazole offers efficacy comparable to existing drugs while establishing its key differentiated advantage in safety. This unique profile, combined with the current dynamics of the PPI market, presents a compelling new narrative for market penetration.

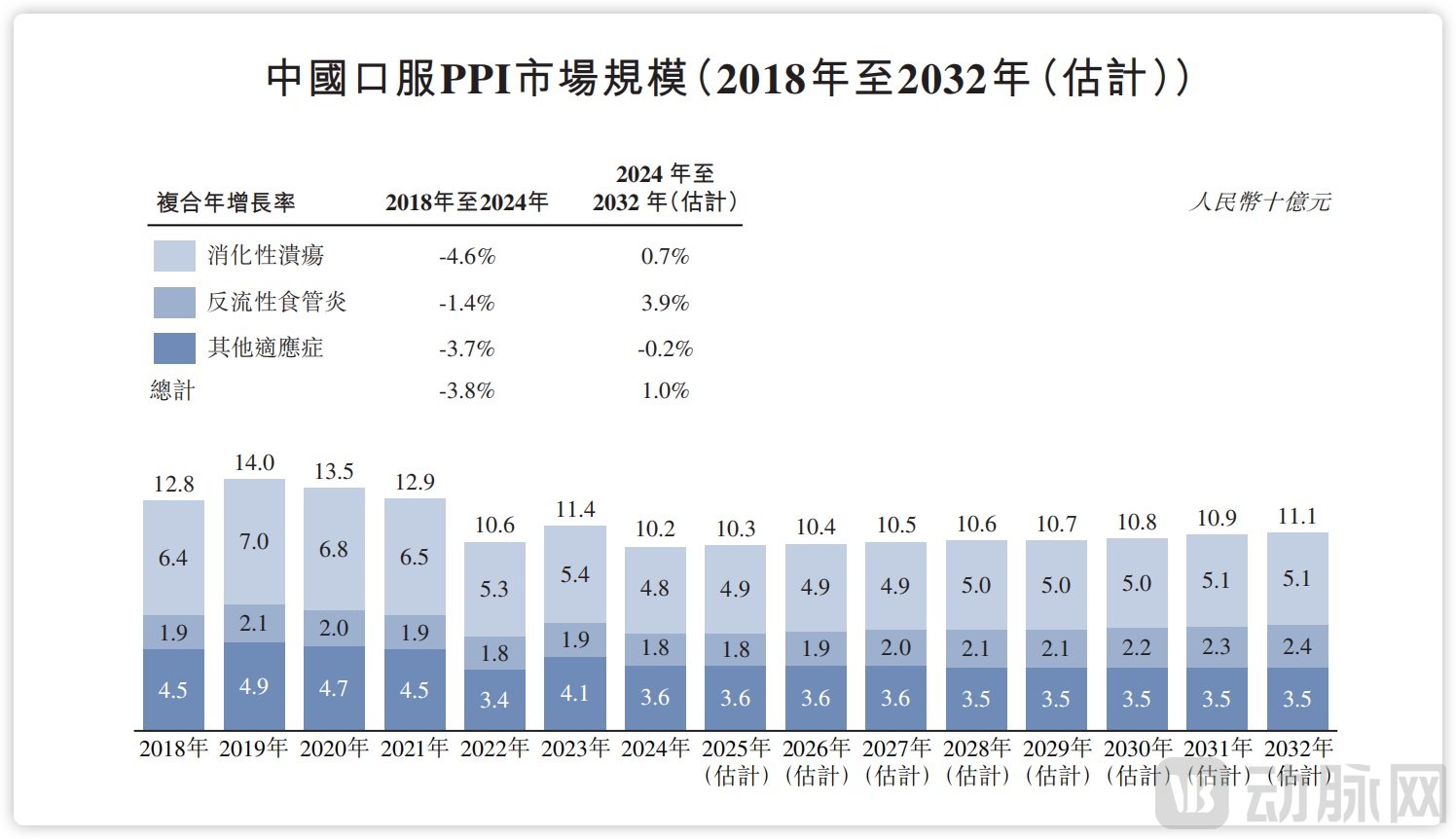

According to data from CIC Consulting, China's PPI drug market had maintained an annual scale exceeding RMB 10 billion for many years. Although overall demand remains robust, the market underwent a period of adjustment following earlier industry developments and the implementation of volume-based procurement policies. It has now evolved into a mature and stable market, representing a steady annual sales volume of approximately RMB 10 billion.

China's PPI Drug Market, Source: Prospectus

In this market, rabeprazole (27.6%), ilaprazole (23.7%), esomeprazole (19%), and omeprazole (16.9%) are the leading drugs by market share. Among these, rabeprazole and omeprazole have demonstrated particularly high compound annual growth rates in recent years, reaching 58.3% and 47.8% respectively.

Market share of PPI drugs approved in China, source: prospectus

Leveraging its safety advantages, anaplazole has the potential to capture a meaningful market share in this space, generating stable cash flow. If its additional indications are successfully expanded, it could further unlock growth opportunities. This makes the commercial performance of anaplazole a critical focus for Xuanzhu Biopharm's next development phase.

Overall, Xuanzhu Biopharm differs from typical biotech companies that often concentrate core assets in highly narrative-driven fields such as oncology or autoimmunity. Although it has two approved oncology drugs, the current key to its growth lies in a digestive disease drug—a focus that may appear less "innovative" and somewhat traditional. However, given Xuanzhu Biopharm's developmental trajectory, this may represent the most viable strategy it can execute in the short term.

Capital operations are ultimately merely tools, whose true value must be grounded in tangible products. Whether it is Sihuan Pharmaceutical's strategic execution with Xuanzhu Biopharm or earlier cases like CSPC Pharmaceutical's spin-off of CSPC Innovation Pharmaceutical, these moves have successfully transformed what were once perceived as "black holes" on the balance sheet into highlights on the market capitalization statement—though this, of course, presupposes the presence of substantive assets.