Pfizer leads the way: how U.S. MFN policy will reshape the global drug pricing strategies

Significant progress has been made in the sweeping U.S. drug price reduction initiative as President Trump's deadline approached.

On September 30, Pfizer reached an agreement with the U.S. government to lower drug prices, committing to multiple measures to reduce costs for American patients. The company will cut prices of some products by 50-80%, enabling Americans to access medications at prices comparable to those in other developed countries (known as Most-Favored-Nation pricing). Additionally, Pfizer pledged to increase investment in the United States. In return, Pfizer secured a three-year exemption from pharmaceutical tariffs. President Trump stated that he is negotiating with other drug manufacturers to secure similar agreements.

Negative sentiment stemming from the U.S. drug price reduction measures has been simmering in American capital markets. However, as the products involved in this price cut represent only a small portion of Pfizer's total revenue (for instance, Xeljanz, the arthritis medication with a 40% price reduction, accounted for just 2.2% of Pfizer's Q2 revenue this year), financial markets have interpreted the agreement positively. U.S. pharmaceutical stocks subsequently rallied following the announcement.

U.S. drug prices have consistently represented the global market's price peak, significantly exceeding those in Europe and China. Many branded medications may be priced 3-4 times higher in the U.S. than in Europe, and even over 10 times higher than in China. This pricing structure stems from the nearly complete autonomy U.S. pharmaceutical manufacturers hold in setting prices, enabling them to determine prices based on market demand, competitor drug pricing, and the demonstrated "value" of their products.

However, this pricing model is built upon the United States' increasingly fragile fiscal system and faces growing challenges. The push to lower drug prices has evolved from a political slogan into concrete action driven by fiscal realities and economic logic.

As the drug price reduction initiative advances, the industry's "high-price, high-return" business model—which has long fueled "high-R&D, high-risk" innovation—will face intense scrutiny. This development is poised to trigger ripple effects throughout the global innovative drug supply chain.

1Stakeholder Perspectives: Providers vs. Payers

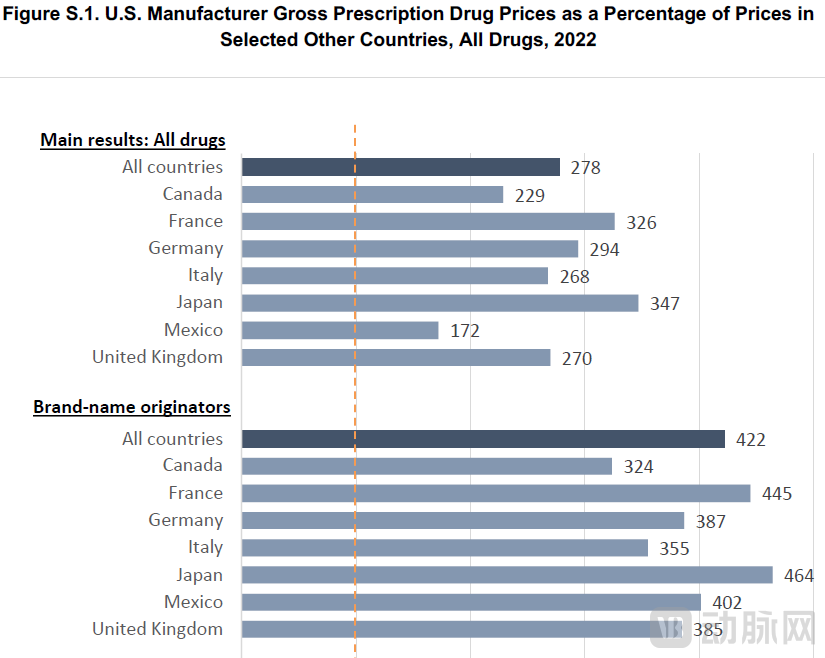

The high cost of prescription drugs in the United States has imposed a severe burden on American society. A 2024 RAND Corporation report revealed that after analyzing prescription drug data from the U.S. and comparator countries, U.S. manufacturer prices in 2022 were 278% of those in 33 OECD comparison nations. In other words, drug prices in other countries averaged just 36% of U.S. levels—slightly over one-third.

When distinguishing between brand-name and generic drugs, the disparity becomes even more pronounced: U.S. brand-name drug prices were 422% of those in comparison countries.

Figure 1. International Prescription Drug Price Comparisons (Source: RAND Corporation)

Even when comparing solely with G7 nations, U.S. drug prices ranged from 229% (compared to Canada) to 347% (compared to Japan) of those in other developed countries.

The U.S. federal budget has maintained a long-term deficit position. In fiscal year 2023, federal revenues totaled approximately $4.44 trillion against expenditures of $6.13 trillion, resulting in a $1.68 trillion deficit—a gap demonstrating a consistent widening trend. Within this spending framework, Medicare and Medicaid expenditures collectively reached $1.56 trillion, accounting for 25.3% of total federal outlays and representing the largest component of government spending. This unsustainable fiscal pressure constitutes the fundamental driver behind the administration's vigorous efforts to control healthcare costs.

Given these fiscal pressures, the administration has prioritized drug pricing reforms. This approach presents a more tractable challenge compared to overhauling hospital care and nursing costs, as it offers greater operational feasibility by focusing negotiations on a limited number of major pharmaceutical manufacturers.

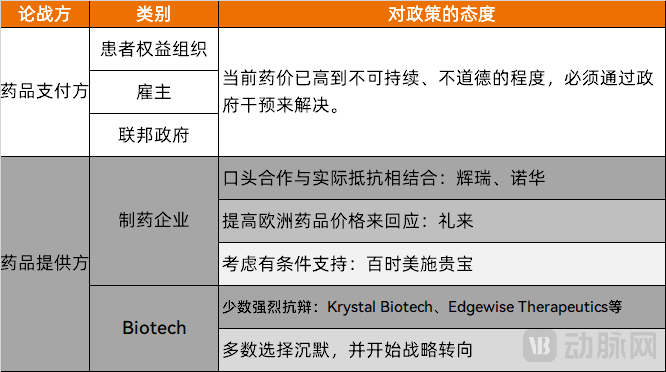

The drug pricing debate has triggered intense competition among U.S. stakeholders.

Payers firmly support price reductions, arguing that current drug prices have reached unsustainable and unethical levels requiring government intervention. This coalition includes patient advocacy groups (like AARP with its approximately 38 million members and significant political influence), employers (particularly large corporations facing rising benefit costs from drug price increases), and federal policymakers (including fiscal hawks who championed the drug price negotiation provisions in the Inflation Reduction Act).

As providers of products and technology, large pharmaceutical companies and small biotech firms maintain a conflicted stance toward price reductions.

Major drugmakers currently employ a dual strategy of verbal cooperation coupled with practical resistance. Pfizer, for instance, has limited its price reductions to products representing only a minor portion of its total revenue. In an interview, Novartis CEO Vasant Narasimhan stated the company is "working with the [U.S.] government to find constructive solutions" to lower American drug prices. Meanwhile, Eli Lilly adopted an alternative approach by raising prices of its popular weight-loss drug Mounjaro in the UK by up to 170% in August—a direct response to Trump's pricing complaints.

Bristol Myers Squibb's position presents an even more nuanced perspective. During their Q1 earnings call, the company's CEO explicitly acknowledged that the President and administration are correct to focus on the differential between U.S. and non-U.S. net pricing. However, he emphasized that the issue must be addressed "from both sides of the equation." This approach aligns with Eli Lilly's strategy—while acknowledging the price disparity between the U.S. and other markets, the proposed solution involves raising prices in non-U.S. regions rather than solely reducing American prices.

However, according to an exclusive report by Helena Smolak in Germany's Handelsblatt, Bristol Myers Squibb CEO Chris Boerner's position has since evolved. He now supports President Trump's push to lower U.S. drug prices—with the expectation that Germany and Europe will increase their spending on innovative medications in return.

Large pharmaceutical companies, with their diversified product pipelines and stronger cash flow positions, have adopted relatively measured statements. In contrast, biotech firms have responded more vehemently to the pricing pressures.

Krystal Biotech, a small company specializing in gene therapies, has seen its CEO Krish Krishnan repeatedly voice concerns in public forums and industry media. He explicitly stated that drug pricing reduction mechanisms are "the enemy of innovation" and could stifle high-risk, long-term investments. Krishnan emphasized that investors now routinely ask, "How long until your product becomes subject to price negotiations?"—a question directly impacting company valuations and fundraising capabilities. He argued that the legislation particularly disadvantages smaller firms.

Edgewise Therapeutics, another small company developing treatments for rare neuromuscular diseases, has expressed similar concerns. CEO Dr. Kevin Koch told industry publications like BioSpace that the uncertainty created by pricing policies has negatively affected the financing environment. He noted that venture capitalists must now factor in a previously non-existent risk—government price controls—making it significantly more challenging to raise capital for early-stage, high-science projects.

In contrast to the handful of biotech firms voicing strong opposition, thousands of small and medium-sized biotechnology companies in preclinical or early clinical stages have chosen silence. These enterprises are channeling all their energy into survival rather than engaging in public debates. Lacking the political capital for public statements, they are undergoing profound strategic shifts internally.

These small biotech companies have begun reducing investments in novel, high-risk targets, instead focusing on developing "best-in-class" candidates or improved formulation approaches for validated targets to mitigate commercial risk. Some have halted rare disease drug development altogether, recognizing the impossibility of recouping costs within the constrained pricing environment.

Figure 2. Summary of Perspectives from Pharmaceutical Providers and Payers

2American Financial Institutions Actively Address Risks

While stakeholders in the U.S. pharmaceutical market primarily advocate from fixed positions, financial institutions representing "smart money" maintain more nuanced and pragmatic perspectives.

Pessimists argue that drug pricing reforms will directly undermine the biotechnology sector's return on investment, triggering capital flight that could ultimately stifle innovation. In client research notes, Brian Skorney, Senior Research Analyst at boutique investment bank Baird, bluntly described drug price negotiations as a structural headwind for the industry. He contends this represents not merely a cyclical challenge but a permanent alteration to the sector's growth narrative.

Meanwhile, optimistic investment firms are actively identifying opportunities within the new landscape. These institutions primarily focus on three areas: some biotech companies now trade at market valuations below their cash holdings, providing a margin of safety; truly breakthrough therapies with demonstrated clinical value can still command substantial returns; and cash-rich pharmaceutical giants are positioned to acquire undervalued assets, creating exit opportunities for investors.

RA Capital, a leading life sciences venture capital and hedge fund, has emerged as a prominent voice for this optimistic perspective. Managing Partner Peter Kolchinsky, through his extensive writings on drug pricing reform, articulates several core arguments:

The Social Contract: He posits an implicit understanding between society and the biopharmaceutical industry: companies are granted market exclusivity and patent protection to price breakthrough therapies at levels that deliver substantial returns. These profits, in turn, fund high-risk R&D to address future health challenges. Policies that undermine this foundation, he argues, will stifle long-term biotech innovation.

Market Economics: Kolchinsky contends that government price controls represent a form of "central planning" inherently hostile to innovation, directly contradicting the market-based economic model that currently drives biomedical progress.

Safeguarding Innovation: While acknowledging the government's legitimate interest in controlling costs, he insists it must be achieved without compromising innovation in critical future therapeutic areas. He suggests focusing price negotiations on older medications that have been on the market for many years.

Peter Kolchinsky maintains that investing in the biopharmaceutical sector remains viable even within the context of drug price negotiations, asserting that emerging technologies hold "exciting" potential for addressing currently untreatable diseases.

Similarly, James Flynn, Managing Partner at investment firm Deerfield Management, continues to selectively identify opportunities. He believes astute capital can navigate the new regulatory landscape by targeting platforms and technologies that address unmet clinical needs or demonstrate potential to reduce overall healthcare costs.

Unlike the aforementioned perspectives, a larger cohort of investors is pragmatically accepting the new reality and actively adapting their investment strategies to align with the changed landscape. These investors view drug price negotiations as an irreversible political reality that must be accommodated rather than resisted. Concurrently, they are revising their investment criteria to incorporate "pricing risk" as a core evaluation metric. Additionally, they are pursuing greater diversification across geographic regions and development stages to mitigate concentrated exposure.

Omega Funds, a transnational life sciences venture capital firm, has formally integrated "U.S. healthcare pricing risk" as a modeled factor in its investment decisions. The firm now shows a preference for investing in products that can deliver attractive returns globally—across markets like Europe and Japan—even after potential U.S. price reductions.

In research provided to institutional clients, J.P. Morgan conducted a detailed analysis of varying pricing risks across product categories—such as oncology versus chronic disease therapies—and offered strategic recommendations. The firm advised clients to implement several key changes: prioritize developing products with clearly differentiated therapeutic benefits; pursue earlier commercial partnerships to share risk; and more aggressively explore commercial opportunities outside the United States.

Figure 3. Summary of Perspectives from U.S. Financial Institutions

U.S. financial institutions' varied reactions to the administration's drug pricing policies all stem from a fundamental recognition: these measures represent more than political rhetoric—they constitute a transformative event that will fundamentally reshape the pharmaceutical industry.

The current market divergence underscores this reality. While major U.S. stock indices hit record highs and technology stocks deliver strong performance, the XBI Index—which tracks American biotech companies—remains in depressed territory. This anomaly reflects investor pessimism regarding drug pricing reforms. Meanwhile, innovative drug sectors in A-shares and H-shares are experiencing bull markets, creating a stark contrast between different markets' performances.

Figure 4. Performance of the XBI Index (Source: East Money)

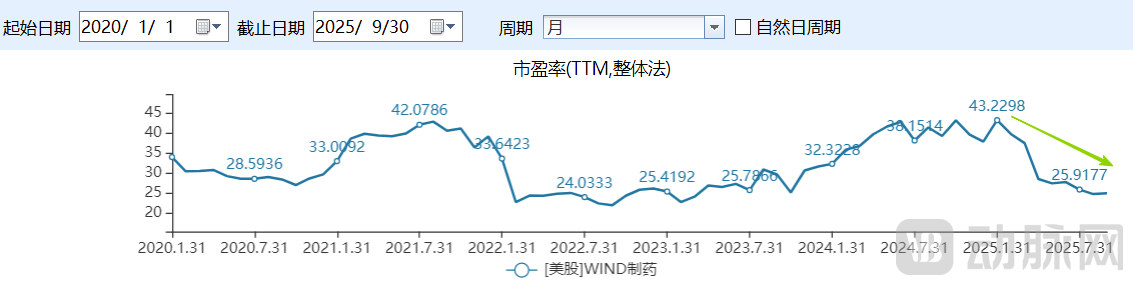

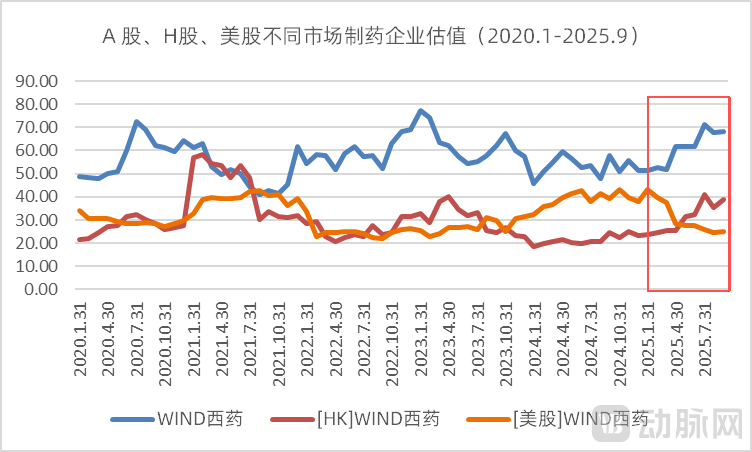

If the downturn among biotech companies can be partially attributed to competition from China's innovative drug sector, the valuation levels of U.S. pharmaceutical firms more profoundly reflect investor pessimism. According to Wind data, the current price-to-earnings ratio of U.S. pharmaceutical stocks remains at depressed levels, with a trailing P/E of just 25.03x as of September 30—approaching recent lows and showing a clear downward trajectory beyond 2025. In contrast, pharmaceutical companies in the A-share and Hong Kong markets maintained significantly higher trailing P/E ratios of 53.57x and 36.24x respectively during the same period.

Figure 5. Valuation of U.S. pharmaceutical companies (Source: Wind)

Using January 31, 2020 as the base period (with valuation levels standardized to 100), the relative valuation levels for the pharmaceutical sector in A-shares, Hong Kong stocks, and U.S. stocks reached 130.41, 179.66, and 73.54 respectively by September 30. The disparity in investor sentiment across these markets is strikingly evident. Particularly notable is the divergent trajectory after 2025, where U.S. pharmaceutical valuations moved in direct opposition to the trends observed in A-shares and H-shares.

Figure 6. Valuation of the pharmaceutical sector in A-shares, H-shares, and US stocks (Source: Wind, VCBeat)

Investors in the U.S. market are demonstrating through their actions that capital markets have already begun pricing policy risks into market valuations.

3The Event of Drug Price Reduction Will Affect the Global Market

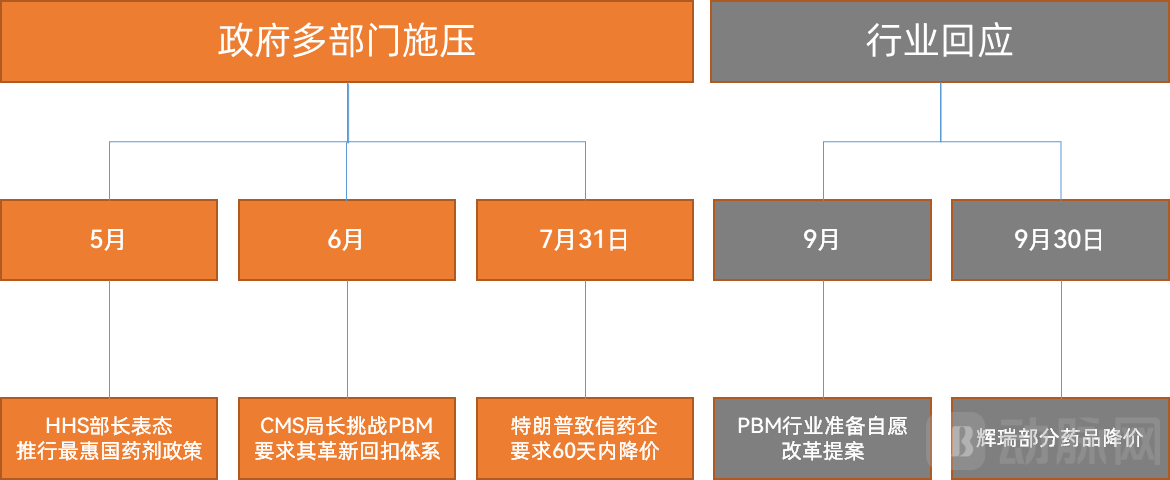

The U.S. federal government and its implementing agencies—particularly healthcare authorities—remain steadfast drivers of drug price reductions.

The Centers for Medicare & Medicaid Services (CMS), operating under the Department of Health and Human Services (HHS), serves as the core agency responsible for drug price negotiations. As the federal body managing Medicare and Medicaid, CMS functions as the primary executor and spokesperson for drug pricing policies.

As the parent department of CMS, HHS took a firm stance when announcing the implementation of the "Most-Favored-Nation" drug pricing policy in May 2025. Secretary Robert F. Kennedy Jr. stated unequivocally that Americans had for too long been forced to pay exorbitant prices for the same drugs sold at significantly lower costs overseas. He expressed the department's expectation that pharmaceutical companies would honor their commitments to lower prices for American patients, warning that action would be taken to ensure compliance if they failed to do so.

The pricing reform efforts extend beyond manufacturers to include Pharmacy Benefit Managers (PBMs). In June, CMS Administrator Mehmet Oz directly challenged the core PBM business model—the rebate system. He publicly urged the industry to self-reform, warning of government intervention if changes weren't made. This stance has already yielded tangible results: according to recent reports, the PBM industry is developing a proposal to voluntarily modify certain business practices to avoid new regulations from the Trump administration.

By July 31st, President Trump had sent letters to over a dozen major pharmaceutical companies, demanding they lower U.S. prescription drug prices within 60 days. This move marked a critical phase in the U.S. drug price reduction initiative. Calculating from this 60-day deadline, September 30th became the final cutoff date for price reductions. It was against this backdrop that the U.S. government reached its agreement with Pfizer.

Figure 7. Summary of U.S. Drug Price Reduction Events (Source: VCBeat)

For innovative drug companies, the negative impact of price reductions is always the first to materialize. Only later might potential benefits—such as market expansion, increased volume, and operational efficiency gains—begin to surface, and their realization ultimately depends on the company's comprehensive operational capabilities. As the global hub for innovative drug R&D and the largest pharmaceutical market, price cuts in the United States are poised to generate significant ripple effects, extending to other developed markets like Europe and Japan.

European governments view the U.S. drug price reduction initiative with characteristic ambivalence. As healthcare payers, they welcome the U.S. moves, which strengthen their own negotiating leverage and promise a more "equitable" global pricing structure. Yet, as host nations to a dense concentration of pharmaceutical enterprises, they are deeply concerned. They fear the erosion of their industry's most critical profit pool, which could ultimately undermine the competitiveness and innovative foundation of their life sciences sector.

The concerns within the German government and industry are particularly pronounced. The U.S. market serves as the most critical profit source for German pharmaceutical giants—such as Bayer, Merck KGaA, and Boehringer Ingelheim—as well as numerous specialized champions. A substantial reduction in U.S. profits would directly constrain the R&D funding available to these multinational corporations. German officials and industry leaders fear that U.S. drug price cuts could severely undermine the momentum for innovative drug development within Germany itself. If Germany-based companies face declining revenue in the U.S. market, they may be compelled to shift more R&D activities and high-value manufacturing jobs to lower-cost countries—a development that would deal a potential blow to the German economy and employment landscape.

Furthermore, the Trump administration has repeatedly criticized Europe for "free-riding" on innovative drug development. European governments now worry that following U.S. price reductions, European pharmaceutical companies will be forced to shoulder a greater share of the innovation burden.

The recent statement from Bristol Myers Squibb CEO Chris Boerner—expressing willingness to support Trump's drug price cuts if Germany and Europe increase spending on innovative medicines—precisely captures Europe's central concern. While Europe has yet to formulate a coordinated response, its fundamental dilemma lies in balancing two objectives: leveraging the negotiating advantages created by U.S. price reductions while carefully avoiding policies that might stifle domestic pharmaceutical innovation or trigger an exodus of R&D activities from the continent.

The Japanese government's perspective on the U.S. drug price reductions is distinctly pragmatic, reflecting a characteristically meticulous approach to policy management. While welcoming the U.S. moves as validation of their own pricing strategies, Japanese regulators also recognize these developments provide powerful external justification for continuing domestic cost containment efforts.

Simultaneously, authorities are acutely aware that for local innovative pharmaceutical companies like Daiichi Sankyo and Astellas—which are successfully expanding globally with cutting-edge technologies (such as ADCs and antibody therapies)—a deteriorating U.S. pricing environment directly impacts their revenue projections from overseas licensing deals or direct sales. This could ultimately undermine the motivation for these firms to sustain high-risk, capital-intensive innovation.

To mitigate the negative impacts of price reductions, Japanese regulators may further accelerate the review and approval process for genuinely innovative drugs, while granting higher premiums for therapies with breakthrough efficacy to preserve adequate innovation incentives.

Currently, developments in the U.S. pharmaceutical sector are drawing close attention from all stakeholders. Drug price cuts represent one major focus; the imposition of tariffs is another notable concern. However, the impact of tariff adjustments is far less disruptive than that of direct price reductions. Drawing a parallel to Chinese healthcare policy, imposing tariffs is analogous to adjusting drug price markup policy, whereas cutting drug prices produces an effect similar to national volume-based procurement—fundamentally challenging the long-established pricing mechanism that has sustained the U.S. market.

4The R&D of innovative drugs enters the "meticulous cultivation" era

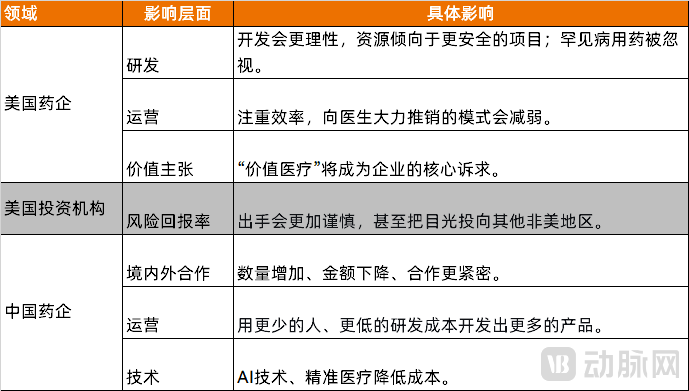

In the long term, the fundamental logic driving innovative drug development will remain unchanged despite U.S. price reductions. This continuity stems from pharmaceutical companies' core need to create enterprise value, maintain commercial competitiveness, and fulfill the societal mandate to advance medical science. However, the industry's traditional "high-input, high-output" model will gradually evolve into a more meticulously managed approach, as noted by a R&D executive at a leading Chinese innovative drug company in an interview with VCBeat.

In the U.S. market, declining product prices will inevitably compress revenue, compelling pharmaceutical firms to tighten R&D budgets and operate with greater financial discipline.

From an R&D perspective, future drug development by innovative companies will become more rational, with research budgets strategically reallocated. There will be a clear preference for investing in "safer" projects that target validated pathways with established mechanisms of action, thereby increasing the probability of success. Conversely, therapeutic areas requiring higher prices to recoup costs—such as rare diseases and niche specialties—may face neglect.

On the operational front, pharmaceutical companies will prioritize efficiency in both R&D and general operations to maximize resource utilization. Traditional aggressive marketing approaches targeting physicians will diminish, with promotion costs becoming a critical consideration. Simultaneously, U.S. healthcare payers are expected to play an increasingly influential role in drug promotion and adoption.

Of course, cost-cutting and efficiency measures represent merely reactive strategies. Innovative drugmakers can also proactively demonstrate that their treatments reduce overall healthcare expenditures, thereby securing recognition from payers. In the new reimbursement environment, value-based healthcare will become a core corporate imperative—extending beyond the development of clinically superior products.

Given the declining risk-reward ratio for innovative drug investments, U.S. investment institutions are likely to deploy capital more cautiously within the sector, potentially shifting their focus to non-U.S. markets.

As the birthplace of innovative therapies and the primary buyer of Chinese innovative drugs through license-out agreements, changes in the U.S. market will inevitably reshape the development models of China's innovative pharmaceutical sector. U.S. drug prices have long served as the benchmark for Chinese innovative drug pricing; with significant price reductions in the U.S., the pricing ceiling for Chinese innovative drugs will correspondingly decline. However, due to China's demographic advantage, the relative importance of the Chinese market within the global landscape is poised to increase.

Regarding bilateral collaborations, multinational pharmaceutical companies may tighten their budgets for asset acquisitions or partnerships to further control expenditures. This could manifest as lower deal values compared to previous transactions. Yet, to offset revenue declines from price reductions, these companies will likely seek to develop broader product portfolios, potentially maintaining or even increasing the number of partnership deals—essentially acquiring more products with less capital.

Given the characteristic efficiency, speed, and cost-effectiveness of China's innovative drug development, collaboration between Chinese pharmaceutical companies and multinational corporations is expected to intensify. To further leverage their competitive advantages in cost efficiency, Chinese firms will need to maintain their relentless drive for operational excellence—developing more drug candidates with smaller teams and lower R&D expenditures.

The achievement of this goal will require technological enablement. As one R&D management executive at an innovative pharmaceutical company noted, researchers can leverage AI to analyze vast biological, chemical, and clinical datasets, enabling more precise identification of novel targets, optimized molecular design, and prediction of clinical outcomes—significantly reducing the number of required experiments.

Compared to preclinical research, clinical trials constitute the largest portion of R&D expenditure. Moving away from a "one-size-fits-all" approach to broad patient populations, and instead using biomarkers to identify specific patient subgroups most likely to respond to a therapy—thereby enabling precision medicine—can enhance trial success rates, reduce trial scale, and accelerate regulatory approval. Furthermore, conducting clinical trials in regions with lower labor costs could also drive down R&D expenses, though this would require proactive support and facilitation from regulatory agencies.

Figure 8. Impact of the Innovative Drug Industry Chain (Source: VCBeat)

Building on China's leading position in advanced technologies, we believe the innovative drug industry chain in China will not be weakened; instead, multinational pharmaceutical companies will become more reliant on China than ever before.

However, for Chinese innovative drug companies, opportunities will not be distributed equally. Those enterprises that proactively adapt to the evolving landscape will gain significant competitive advantages, leading to a more pronounced "winner-takes-all" dynamic within the sector.

The U.S. drug price reductions represent not a temporary fluctuation but a structural transformation for the global innovative pharmaceutical industry. This transformation won't destroy medical innovation, but will fundamentally redefine its trajectory. For the global pharmaceutical sector, it marks the conclusion of the "high-price, high-investment" golden age and inaugurates an era of strategic refinement—prioritizing efficiency, demonstrated value, and accessibility.

The future landscape will become stratified rather than uniform: a limited number of genuine breakthrough therapies will continue to command substantial investment and returns, while the majority of innovations must adopt more efficient development pathways with greater focus on accessibility. For Chinese innovative pharmaceutical companies, this environment creates a pivotal opportunity to leverage their accumulated expertise, capital resources, technological capabilities, and understanding of large-scale markets to advance their global commercial standing.