After GLP-1, what's the next blockbuster in weight loss?

In the weight loss market, following the sustained boom of GLP-1, another potential "blockbuster drug" is emerging.

In 2025, China's first compliant fat-dissolving injection—Minova Pharma's deoxycholic acid injection (Chinese brand name: 蓉芷®)—was approved for market release by the NMPA. Meanwhile, Daewoong Pharmaceutical's V-OLET injection was approved for authorized use in Boao. Both products have deoxycholic acid (DCA) as their core component, filling a long-standing gap in the Chinese market for compliant products in the field of fat-dissolving treatments.

Unlike the systemic weight loss effects of GLP-1, fat-dissolving injections primarily target localized fat reduction. The aforementioned two products are both indicated for the treatment of "double chin." Additionally, companies like Juve Star (invested in by Sisram Medical), Novotel Biotechnology (under IMEIK), Weixinkang Pharmaceutical, Huiyu Pharmaceuticals, and Cutia Therapeutics are also accelerating the development and regulatory application processes for their own fat-dissolving injections, featuring diverse technological approaches and target areas.

As aesthetic medicine demands become increasingly refined, and consumers seek safer, more effective, and convenient ways to reduce fat in the submental area, arms, waist, abdomen, and legs, will fat-dissolving injections become the next blockbuster in the weight loss market?

How popular are fat-dissolving injections, exactly?

In the past, even when only products from illegal channels or those used off-label were available on the Chinese market, many consumers were still eager to try them, risking their safety to test the injections in pursuit of an ideally contoured jawline, arms, waist, abdomen, or legs. Other consumers with greater financial means traveled abroad to receive injections of fat-dissolving products already approved in those countries.

With the launch of compliant products in China, this situation is expected to change.

In June 2025, the deoxycholic acid injection developed by Minova Pharma was approved by the NMPA, making it China's first approved fat-dissolving injection. The first commercial batches were shipped as early as July. To date, Minova Pharma has collaborated with companies like Yuansong Group, and the product has entered use in some leading medical aesthetic institutions.

In fact, as early as 2015, Kythera Biopharmaceuticals (later acquired by Allergan) had its submental fat-reducing injection Kybella approved by the FDA, making it the world's first fat-dissolving injection product.

Over the past decade, South Korea has also seen the successive launch of compliant fat-dissolving injections. Among them, Daewoong Pharmaceutical's V-OLET injection, approved in 2021, became a best-selling fat-dissolving injectable drug in the local market. It has already been introduced in 2025 at the Boao Lecheng Pilot Zone in Hainan as an authorized medical product.

In the past, liposuction was the primary option for addressing localized fat deposits such as double chin. Today, fat-dissolving injection technology offers consumers a new, non-surgical minimally invasive aesthetic alternative.

A full treatment of Minova Pharma's deoxycholic acid injection (Rongzhi®), typically comprising two injections, is priced at approximately ¥20,000. This reflects its status as China's first compliant product of its kind, its substantial R&D and clinical investment, and its unique clinical value. Its core ingredient, deoxycholic acid—an endogenous substance in human and mammalian bile—is the same as that in Kybella. It works by selectively targeting and disrupting the cell membranes of fat cells in the treated area, thereby reducing their number.

According to Ming Jian, General Manager of Minova's Marketing Center, follow-up data from existing clinical trials show results comparable to Kybella, with fat-reducing effects lasting up to 5 years—the longest period tracked to date—and on par with liposuction. Studies also suggest the product offers advantages in precisely treating delicate areas like marionette lines, cheekbones, subtle neck contours, and for overall facial tightening and sculpting.

For many consumers, the decision of whether to undergo surgery is a major consideration, which is why non-invasive aesthetic treatments have gained significant popularity.

Overall, the introduction of compliant fat-dissolving injections has filled a significant gap in China's non-surgical fat reduction market, providing both physicians and patients with a new, safe, and effective option for localized fat management.

With their advantages in safety and efficacy, compliant fat-dissolving injections should, in principle, be more competitive than illegal products. However, to truly become a "blockbuster" in the weight loss market, two core issues must be addressed: first, clearing up the market disorder caused by illegal products and building consumer trust; second, learning from the commercial failure of the world's first fat-dissolving injection, Kybella, to optimize both the product experience and commercial strategy.

First, companies must establish thorough awareness and understanding of compliant products among both physicians and consumers, navigating a market still permeated by "gray areas."

For a long time, the so-called "fat-dissolving injections" available on the Chinese market have either been obtained through unofficial channels, were approved as Class I/II medical devices for other indications, or were cosmetic-grade products misused for injection. These products have long been in circulation, while consumers lack the ability to distinguish them from compliant treatments. Some unapproved "fat-dissolving injections" have even gained significant influence, with extensive information exchange about them occurring on social media platforms.

Simultaneously, incidents of "disfigurement" caused by illegal fat-dissolving injections occur periodically. Arterial Network learned from discussions with several medical aesthetic practitioners that many doctors have treated and repaired patients with such disfiguring outcomes, leading them to hold a negative view of fat-dissolving injections as a category.

This situation—where blind trust in illegal products coexists with the outright rejection of all fat-dissolving products by some doctors and patients due to adverse events—poses a significant challenge for the promotion of compliant products.

"The primary challenge lies with the physician community," Ming Jian noted. He explained that many so-called "fat-dissolving" injections currently on the market actually work by "fat reduction," using specific ingredients to shrink the volume of fat cells. "During our promotion of the compliant product, we found that many doctors cannot distinguish between 'fat dissolution' and 'fat reduction.' Therefore, the first step in promoting the compliant product is to focus on physician education, emphasizing the product's mechanism of action and standardized injection protocols to build sufficient professional understanding among doctors."

For the consumer segment, companies need to collaborate with leading medical aesthetic institutions, specialized physicians, and social media platforms to educate the public on the fundamental differences between "fat dissolution" and "fat reduction," highlighting the safety advantages and long-term value of compliant products. This will help consumers establish correct selection criteria. Ming Jian acknowledged that this requires the participation of the entire industry to gradually reverse the negative perceptions created by illegal products and create market space for compliant fat-dissolving injections.

Secondly, it is crucial to learn from the precedent set by Kybella and optimize both the product experience and commercial strategy.

As the world's first fat-dissolving injection, Kybella was undoubtedly a star product at its launch, yet it ultimately failed to meet commercial expectations.

In April 2015, the FDA approved Kybella, developed by Kythera Biopharmaceuticals, for the treatment of moderate to severe submental fat in adults. With solid clinical data, a clear market demand, and its status as the first and only product of its kind globally, Kybella was projected to achieve significant commercial success.

Merely two months after Kybella's approval, Allergan swiftly acquired Kythera for $2.1 billion, anticipating that the product's annual sales in the U.S. would exceed $500 million.

However, Kybella's market performance fell far short of expectations. According to Allergan's financial reports, its U.S. sales dropped from $50 million in 2016 to $32 million in 2018, with the three-year total failing to reach the projected $500 million annual target. In the fourth quarter of 2018, Allergan wrote down $1.64 billion in intangible assets related to Kybella, effectively acknowledging it had overpaid by that amount in the Kythera acquisition.

Industry analysts attribute Kybella's underperformance to multiple factors, including adverse reactions, high cost, and limited impact on the dominance of liposuction. Following AbbVie's acquisition of Allergan, Kybella is no longer separately mentioned in AbbVie's financial disclosures among its portfolio of products and data.

"There is no denying that Kybella remains a groundbreaking product with epoch-making significance," stated Ming Jian. He believes that Kybella's development path also offers valuable lessons for similar products in China.

First, fat-dissolving injections require enhanced management of post-treatment adverse reactions to improve the patient experience. A major factor hindering Kybella's adoption was the significant localized swelling following injection, which lasted for a considerable time and affected consumer acceptance. To address this issue, combination therapies and optimized post-procedure care can be implemented to reduce the severity or shorten the duration of swelling, thereby improving patient comfort.

Second, it is crucial to prioritize market education and adopt a measured approach to commercialization. For a novel product, targeted education aimed at physicians, institutions, and patients should take precedence. This ensures they fully recognize the product's core value and understand that localized, short-term swelling is a normal physiological response. Concurrently, standardized protocols can help physicians build case experience. Large-scale expansion across institutions should follow only after market understanding has matured.

Third, there must be a deep exploration of the product's potential clinical applications, particularly for use in other anatomical areas. "Beyond its approved indication for submental fat, substantial research and numerous publications already exist for Kybella. Therefore, Chinese companies can collaborate with top-tier hospitals and leading experts to conduct clinical trials on safe injection techniques for multiple areas, establish treatment consensus, guidelines, and SOPs, accumulate clinical data, and explore broader application scenarios," Ming Jian added.

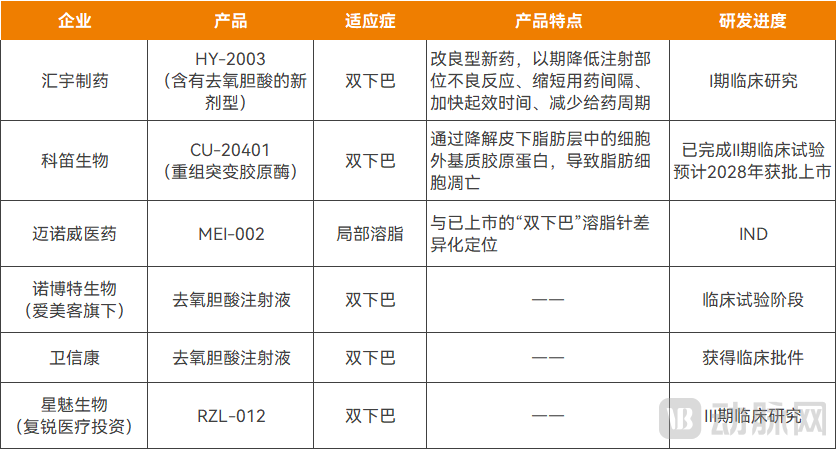

Simultaneous with the approval of the first fat-dissolving injection, multiple Chinese companies have already positioned themselves in the R&D landscape for these products. These include Juve Star (backed by Sisram Medical), Novotel Biotechnology (a subsidiary of IMEIK), Weixinkang Pharmaceutical, Huiyu Pharmaceuticals, and Cutia Therapeutics, among others. Overall, deoxycholic acid or novel formulations containing it remain the dominant approach. However, the sector is also trending towards diversified technological pathways and the expansion of indications to multiple treatment areas, with a concerted effort to achieve superior outcomes in both safety and efficacy.

Fat-dissolving injection products under research in China

Fat-dissolving injection products under research in China

For instance, Minova Pharma has another localized fat-reduction product, MEI-002, in development. Differentiated from Rongzhi® by its intended application areas, MEI-002 primarily targets larger regions such as the waist, abdomen, arms, and thighs, aiming to minimize adverse reactions even at higher dosage volumes.

Meanwhile, Huiyu Pharmaceuticals is steadily advancing its modified new drug, HY-2003, through Phase I clinical trials. This product is indicated for improving moderate to severe convexity caused by submental fat in adults. HY-2003 is a novel formulation containing deoxycholic acid, designed to reduce injection site adverse reactions, shorten dosing intervals, accelerate onset of action, and decrease the overall treatment cycle duration.

Raziel, in collaboration with Juve Star, is co-developing the fat-dissolving injection RZL-012. A Phase III clinical trial for submental fat reduction was initiated in 2025, with completion expected in 2026.

Additionally, Cutia Therapeutics' candidate, CU-20401, employs a recombinant mutant collagenase. It works by degrading collagen within the subcutaneous fat layer's extracellular matrix, leading to adipocyte apoptosis. Through technical refinement, CU-20401 catalyzes collagen degradation at a slower rate, exhibiting milder catalytic activity. This aims to reduce side effects associated with wild-type collagenase, such as bruising and pain.

The coming years are expected to see an influx of new fat-dissolving injection products. With diverse active ingredients, distinct mechanisms of action, and targeting various anatomical areas, they are poised to form a multifaceted product pipeline.

Globally, technological and product innovation continues unabated. In September 2025, the Korean biopharmaceutical company Medytox announced that its fat-dissolving product NUVIJU had been approved by the Ministry of Food and Drug Safety (MFDS) for improving moderate to severe submental fat. As the world's first cholic acid-based injectable fat-dissolver, it aims to offer advantages in bioavailability and safety.

Overall, against the backdrop of growing consumer demand for localized and precise fat reduction, fat-dissolving injections have the potential to become the next blockbuster category. This is driven by the sequential launch of compliant products, deepening market education, and an increasingly diverse range of technological approaches. However, safety, efficacy, and the related aspect of patient comfort remain paramount. Only by genuinely resolving core issues related to product experience and market understanding can the industry achieve scaled, widespread adoption.