With JD-backed POMDOCTOR's Nasdaq debut, internet healthcare is back in favor

On October 8, POMDOCTOR made its debut on Nasdaq, thereby becoming another listed online medical services company.

Despite maintaining a low public profile, POMDOCTOR has long been a veteran in China's online healthcare sector. After its establishment in 2010, the Company was among the first to obtain China's online pharmaceutical transaction license. During the pioneering phase of internet hospitals from 2016 to 2017 in Guangzhou and Yinchuan, POMDOCTOR (then operating under the brand name "7lekang") secured corresponding licenses and began exploring online diagnosis and treatment services.

The backing of capital has injected robust momentum into POMDOCTOR's development. The Company has secured investments from industry leaders such as Buchang Pharma, JD Group, and Focus Media, as well as funding from renowned institutional investors including Sequoia Capital China, GTJA Investment Group, Greenwoods Asset Management, Step Fund, Share Capital, and Grand Yangtze Capital. These shareholders not only provide financial support but also contribute professional expertise, resource advantages, and industry experience in healthcare and technology.

By the end of 2024, POMDOCTOR had partnered with 214,000 contracted doctors. The platform focuses on chronic disease management, with key specialties in hepatology and andrology. Notably, the platform achieves a 99.5% retention rate for mature doctors. This high retention, coupled with the "doctor-led patient acquisition" model, drives strong patient repurchase rates and contributes to revenue growth.

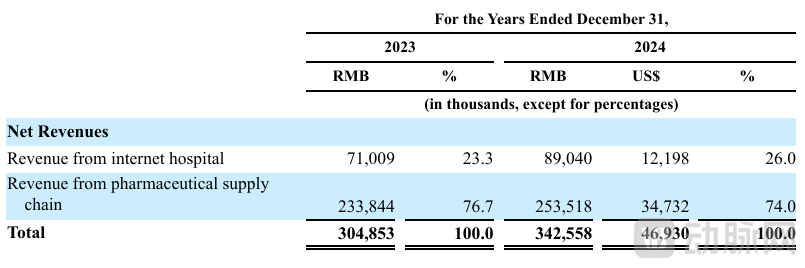

In 2023 and 2024, POMDOCTOR reported revenues of approximately RMB 305 million and RMB 343 million, respectively (unless otherwise specified, all amounts are in Renminbi), with corresponding losses of RMB 36.9 million and RMB 37.4 million. The Company's revenue primarily stems from two business segments: internet hospital services and pharmaceutical supply chain operations. While the internet hospital segment contributes a smaller portion of total revenue, it demonstrates stronger profitability. In contrast, the pharmaceutical supply chain segment accounts for a larger share of revenue but operates at lower gross margins, a characteristic consistent with traditional e-commerce platforms.

Revenue Structure of POMDOCTOR, Source: Prospectus

Coincidentally, the industry has recently witnessed accelerated movement toward public listings. WeDoctor Holding Limited updated its prospectus, while Good Doctor Cloud Healthcare (focusing on primary care internet medical services) submitted its listing application. As more internet healthcare platforms disclose their latest operational and financial data through prospectuses or financial reports, a clearer picture of the industry's current landscape is emerging. With renewed capital market attention on internet healthcare, several key developments warrant in-depth discussion.

The answer is clearly no.

Physician resources represent one of the core competitive advantages for online healthcare platforms, leading major players to prominently showcase doctor numbers across various metrics. Taking registered doctors as an example, leading platforms report figures ranging from tens of thousands to over a million, suggesting the establishment of extensive medical service networks. Even using the highest estimate of over one million, this scale already constitutes a significant portion of China's total physician workforce. However, the reality behind these numbers reveals a significant "funnel effect" between initial doctor registration and the consistent delivery of timely, effective services.

An analysis of the types of physician figures disclosed by various platforms reveals a clear, descending hierarchical structure.

The first tier comprises physicians whose information is displayed on the platform, primarily featuring basic details such as their specialties, practice locations, and available hours. These physicians do not substantially participate in online services. The second tier consists of registered and service-active physicians. These doctors are registered as platform users and utilize platform features to some extent; a subset of them have completed the multi-site practice registration, possess the qualifications for online diagnosis and prescription, and may have delivered actual services to varying degrees. The third tier encompasses actively serving physicians. Based on their qualifications, they maintain a high frequency of online consultations, actively produce patient education content, or engage in live-streaming interactions. Certainly, each tier represents an indispensable resource for the platform, playing specific roles within the business ecosystem. However, from the first to the third tier, the number of physicians drops precipitously.

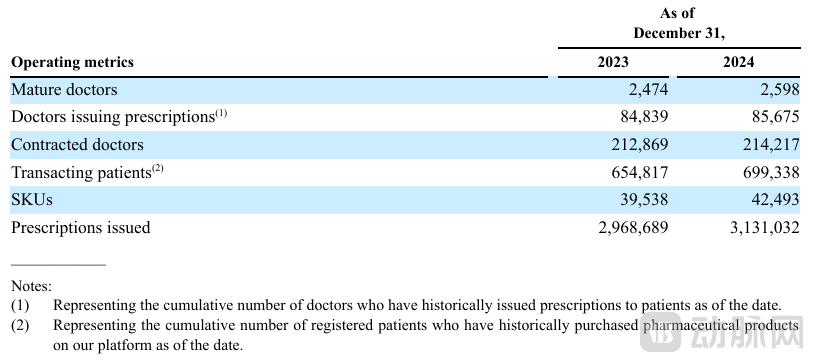

The physician profile on the POMDOCTOR platform serves as a microcosm of the industry. According to its prospectus, by the end of 2024, the platform had approximately 214,000 contracted physicians (those certified for online diagnosis and prescription issuance). Among these, 85,675 physicians had actually issued prescriptions, and only 2,598 were classified as mature physicians (defined as those who issued prescriptions for more than 20 patients within a one-month period).

Doctor Information on the POMDOCTOR Platform, Source: Prospectus

Doctor Information on the POMDOCTOR Platform, Source: Prospectus

Within the internet healthcare service ecosystem, the core value of physicians extends far beyond the singular role of "service providers." Active physicians play a pivotal role in user acquisition, patient retention, and commercial conversion for the platforms.

On platforms like POMDOCTOR, which primarily operate on a "doctor-led patient acquisition" model, doctors serve a dual function: they are both service providers and crucial entry points for patient traffic and subsequent commercial conversion. According to the prospectus, POMDOCTOR's 90-day patient repurchase rate (corresponding to the average usage cycle for prescription medications) reached 63.7% and 66.2% in 2023 and 2024, respectively. Furthermore, supported by the 99.4% user retention rate for mature doctors and the patient trust they command, the hepatology department achieved high repurchase rates of 72.7% and 73.9% in 2023 and 2024, respectively.

For platforms like Alibaba Health and JD Health that possess substantial pre-existing consumer traffic, physicians serve as the critical link for enhancing user experience and enabling traffic monetization. On these platforms, where a large user base prioritizes rapid response and service efficiency, the physicians' capacity to address user needs promptly and accurately directly influences their trust in and engagement with the platform.

Although the physician count on major Chinese online healthcare platforms has grown over recent years, this growth has markedly decelerated, and a persistent shortage of active physicians remains. Viewed from the perspective of industry maturation, shifting the strategic focus from quantitative expansion of physician resources to qualitative enhancement of their activity levels will emerge as a central imperative for the sector.

Over the past few years, discussions regarding the profitability models within this industry have largely centered on pharmaceutical sales. The prevailing view has been that the better-performing platforms rely heavily on "medication sales," a model they were expected to depend on for the foreseeable future.

Now, is "selling medication" still a viable path? The answer is: yes, but not entirely.

The root cause lies in the significant transformation currently underway in the pharmaceutical retail market. In recent years, online medication purchases have been rapidly integrated into medical insurance payment systems across numerous regions in China. Concurrently, medical insurance bureaus nationwide have launched drug price comparison tools, allowing the public to search for a medication and instantly find information on available pharmacies, their prices, and locations. Furthermore, Chinese healthcare authorities are vigorously promoting the inclusion of volume-based procurement (VBP) drugs in retail pharmacies. As these policies take effect, patients can now purchase these VBP medications at pharmacies with zero markup.

These changes all revolve around a central element: drug pricing. The public now has access to more transparent channels for obtaining medication price information, enabling them to make purchasing decisions—choosing both the channel and the platform—based on cost, often coupled with medical insurance coverage. For pharmaceutical e-commerce platforms and other retail enterprises, intense price competition on common medications has become inevitable.

For internet healthcare platforms with inherent e-commerce attributes, the revenue contribution from medication sales remains difficult to replace in the short term. However, vigorously expanding into business categories with stronger profit margins has become an imperative strategic shift.

For instance, there are enabling services developed for upstream pharmaceutical and medical device companies. These include digital marketing and academic promotion, data insights and R&D support, as well as digital tools and patient management. Among these, digital marketing is the most established segment. It involves providing tailored solutions for drugs at different stages of their lifecycle—whether to build brand awareness or to enhance medication adherence—a domain most platforms have already entered.

Given the vast repositories of real-world application data accumulated by Chinese online healthcare platforms, their potential value for product development, demand insight, and innovative payment models is significant and remains largely untapped. Platforms such as JD Health and HealthRoad have already begun incorporating Real-World Study (RWS) services as part of their strategy to monetize data assets.

Alternatively, platforms are vigorously expanding their business-to-business (B2B) segments, which involve providing medical and health solutions for employees or clients of large and medium-sized enterprises and insurance companies.

When serving corporate clients, the health management services offered by online healthcare platforms help enterprises build their "health assets." Furthermore, with proper authorization and desensitization, aggregated population health data holds significant potential for value extraction, enabling the development of more precise corporate health solutions. For insurance companies, these platforms act as providers of medical networks and risk management capabilities, empowering innovation in insurance products.

Ping An Good Doctor has conducted numerous explorations in its B2B segment in recent years, which has contributed to the company's achievement of overall profitability. Similarly, POMDOCTOR indicated in its prospectus that it is exploring a comparable model. This involves collaborating with insurance companies and employers to provide them with tailored prevention and treatment solutions.

Furthermore, actively participating in the digital transformation of regional public health systems and medical institutions represents another key strategic direction for Chinese online healthcare platforms.

For instance:

WeDoctor Holding Limited's "Digital Health Maintenance Organization" model aims to generate savings for the local medical insurance system while safeguarding the health of the resident population.

Xikang Cloud Hospital has undertaken the development and operation of internet-based nursing platforms for multiple regions.

Weimai engages in deep collaboration with hospitals to establish comprehensive whole-disease-cycle management systems that seamlessly integrate in-hospital and out-of-hospital care.

From a top-level policy perspective, these models align with the objectives of China's ongoing healthcare reform and the "Healthy China" initiative, representing a clear industry trend. However, their practical implementation presents significant challenges, testing the platforms' long-term commitment, patience, and financial resilience.

In the early years, industry focus on medical AI was predominantly concentrated on hospital-based applications such as assisted diagnosis and clinical decision support. The rapid evolution of large language models over the past two years, however, has significantly accelerated AI's penetration into the online healthcare ecosystem. Multiple leading Chinese platforms have now developed their proprietary foundation models, using them to continuously expand and deepen practical applications. AI has consequently transitioned from a supplementary technology to an essential infrastructure component, emerging as a decisive factor in determining platforms' long-term competitive advantage.

While AI's prominence in China's digital health sector is undeniable, the substance behind this momentum warrants examination. Historically, patient choice of physician was fundamentally anchored in trust towards a specific medical expert—a perception that inherently sustained the "doctor-led patient acquisition" model. This raises a critical question: when patients encounter digital human interfaces or discover their medical inquiries are being handled by AI, can that same level of confidence and therapeutic expectation be maintained?

A review of internet healthcare's achievements confirms its undeniable success in enhancing patient convenience over the past decade. However, the traditional one-on-one consultation model inherently limits the number of patients a physician can serve within a given timeframe. This inherent constraint underscores AI's significant value in boosting operational efficiency for medical practitioners.

Many healthcare professionals recognize substantial improvements in previously common inefficiencies—where lengthy waits resulted in brief consultations—with streamlined processes now evident across both online and offline channels. Nevertheless, even on efficient digital platforms, physicians still devote significant time to repetitive patient education and electronic documentation tasks.

Currently, empowering physicians with AI capabilities represents a strategic priority for nearly all online healthcare platforms. The core objective is to function as a comprehensive assistant supporting the entire clinical workflow—from diagnosis and treatment to research and academic activities. POMDOCTOR has implemented AI across its ecosystem involving physicians, patients, pharmaceutical services, and consultation/prescription processes. The company plans to further strengthen these AI capabilities to enhance efficiency in medical record retrieval and clinical decision support.

From the user's perspective, AI serves not only as a tool to enhance service experience but also as a vehicle for intelligent demand distribution. Over time, the range of services available on online healthcare platforms has grown increasingly diverse. However, not all users possess the specialized knowledge or patience to actively seek out and identify the specific medical services they require. This reality creates a clear imperative for platforms to optimize their service delivery mechanisms.

Concurrently, online healthcare platforms are positioned as crucial hubs within the out-of-hospital health market. They not only connect multiple participants—including physicians, nurses, pharmaceutical suppliers, and insurers—but also collaborate with these partners to jointly develop more personalized service models that better align with user needs.

In this process, AI's value lies in significantly enhancing the matching efficiency between healthcare resources and user needs. It empowers service providers—including doctors, nurses, pharmaceutical services, and insurers—to precisely reach their target users, while simultaneously helping users quickly identify suitable medical, nursing, pharmaceutical, and insurance services. This dual function ultimately achieves efficient alignment between supply and demand. Currently, products such as Ant Group's AQ Platform and JD Health's AI Hospital are exemplifying this strategic positioning.

Admittedly, investments in and the application of AI are unlikely to yield substantial returns in the short term. Digital humans and physician avatars cannot instantly achieve perfect realism, and some insufficiently intelligent AI may even leave users with the impression of being "artificially incompetent." However, viewed from a long-term perspective, continuously exploring and iterating AI applications will enable platforms to build technological advantages and data moats earlier, positioning them to be more competitive than those that miss this technological wave.

Indeed, as both internal and external industry dynamics continue to evolve, the core issues worthy of in-depth exploration within China's online healthcare sector extend far beyond these. The successful IPOs of multiple companies in recent years have already validated the capital market's recognition of the sector's inherent value. Moving forward, the industry will continue to face multiple tests, including policy adjustments, competitive pressures, and technological disruption. Those platforms capable of astutely identifying shifts and responding proactively are poised to secure heightened validation from both the market and investors.