The IgA nephropathy market: a RMB 500 million-monthly blue ocean turns red

More than 10 new drugs are set to flood the IgA nephropathy market.

In August, Everest Medicines' core product for IgA nephropathy treatment, Nefecon®, achieved shipments of over 130,000 bottles, with monthly sales revenue reaching 520 million yuan. Meanwhile, Novartis' Atrasentan and Iptacopan were approved in August and September respectively for use in IgA nephropathy in China. Otsuka Pharmaceutical's Sibeprenlimab also filed for market approval in September. Romegen announced that Telitacicept met the primary endpoint in a domestic Phase 3 clinical trial for IgA nephropathy and will apply for market approval as soon as possible.

Abruptly, the previously relatively quiet IgA treatment market became unusually lively.

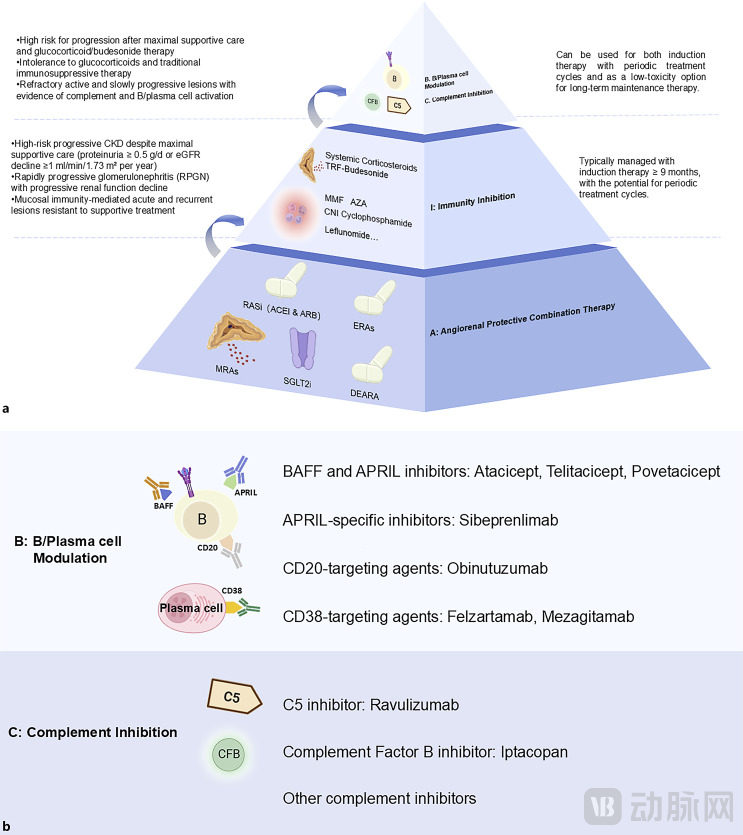

The reason for the lack of progress lies in the fact that the pathogenesis of IgA nephropathy has not been fully understood. For a long time, the treatment of IgA nephropathy has had the problem of "treating symptoms but not causes," which can only delay the progression of the disease but cannot prevent the continuous deterioration of renal function. Currently, the mainstream view on the pathogenesis of IgA nephropathy is the "four-hit hypothesis." Some research teams have also proposed the "AIBC precision treatment framework," which focuses on renal vascular protection (Angiorenal protection), Immunosuppression (Immunity inhibition), B cell/plasma cell regulation (B-cell/plasma-cell modulation) and complement inhibition (Complement inhibition)。

The AIBC Precision Treatment Framework for IgA Nephropathy, Image Source: PMC11968098

Nowadays, with the development of multiple pipelines reaching the finish line, these technical paths have borne fruit. However, the emerging blue ocean market of IgA nephropathy treatment, which has just demonstrated commercial potential, is also showing signs of turning red.

The IgA nephropathy treatment has spawned a blockbuster drug, attracting major pharmaceutical giants to accelerate their market entry.

Everest Medicines' Nefecon, which follows the immunosuppressive route, became the world’s first FDA-approved IgA nephropathy drug in 2021 and was approved for marketing by China’s National Medical Products Administration at the end of 2023. Demonstrating a 66% reduction in renal function decline and delaying disease progression to dialysis or kidney transplantation by 12.8 years in Chinese IgA nephropathy patients, it was included in the KDIGO 2024 Clinical Practice Guidelines (public review draft) in 2024.

After its launch, Nefecon quickly gained market traction, achieving sales of 167 million yuan in the first half of 2024. Following its official inclusion in the national medical insurance catalog on January 1, 2025, it reached sales of 303 million yuan in the first half of 2025, marking an 83% year-on-year increase. During this period, the product was in such high demand that it experienced temporary shortages. After supply resumed in August, over 130,000 bottles were shipped in a single month, with sales exceeding 500 million yuan, solidifying its status as a blockbuster product in China’s renal disease treatment field.

Everest Medicines expects that by the second half of 2025, Nefecon will be officially included in the new KDIGO IgA Nephropathy Guidelines and recommended in China’s first IgA Nephropathy Guidelines. Therefore, the sales target for Nefecon in 2025 has been set at RMB 1.2 to 1.4 billion. By 2026, with the Gd-IgA1 diagnostic test kit enabling a closed-loop diagnosis and treatment solution, it is expected to achieve a sales target of RMB 2.4 to 2.6 billion for Nefecon.

The widespread clinical application of Nefecon has not only transformed the treatment model for IgA nephropathy but also brought new changes to the chronic kidney disease treatment market.

First is the upgrade of the treatment concept, shifting from "symptomatic control" to "causal intervention," driving the focus of industry research and development. Secondly, the market has been reshaped. As the competition for IgA nephropathy treatment drugs remains in a blue ocean market, Nefecon has quickly captured market share due to its first-mover advantage. However, this has also attracted numerous companies to enter the space, and in the coming years, a competitive landscape of "Nefecon + new biologics" will emerge.

The good days for Nefecon have just begun, and competitors have already appeared.

Novartis, the fastest mover, received approvals for its Atrasentan and Iptacopan in August and September respectively for the treatment of IgA nephropathy. These are also the second and third drugs approved domestically following Nefecon. Although they are competitive with each other, there is also potential for complementary combination use. The approval of these three drugs marks a new era in the treatment of IgA nephropathy in China.

Atrasentan was approved for marketing in the United States and China in April and August 2025, respectively. It is the first non-immunological therapy approved domestically for the treatment of IgA nephropathy and also the first and currently only highly selective endothelin A (ETA) receptor antagonist for this indication in China. Similar to Sparsentan, which has not yet been marketed domestically, it follows the renal vascular protection pathway. This is also a new drug with the potential to reshape the treatment landscape for IgA nephropathy.

In the AFFINITY clinical study of Atrasentan, the 24-hour urine protein-to-creatinine ratio (24h UPCR) in patients significantly decreased by 38.2% at 6 weeks of treatment, and by 48.4% at 12 weeks, with the effect persisting until 52 weeks, remaining at a level of 45.4%. This indicates that atulifiban not only acts quickly but also has long-lasting effects.

Data from the pivotal Phase 3 ALIGN study showed that the primary efficacy endpoint—change in proteinuria (UPCR) at 36 weeks—was reduced by 36.1% from baseline (95% CI: -44.6, -26.4; P < 0.0001), compared to only a 3.1% reduction (95% CI: -12.4, 7.3) in the placebo group, demonstrating a statistically significant difference. More importantly, the treatment effect remained consistent across diverse patient subgroups, with significant benefits observed regardless of gender, age, race, baseline proteinuria level, or renal function.

Recently approved Iptacopan, like Atrasentan, is a first-in-class drug.

Iptacopan is the first and currently the only approved oral complement B factor inhibitor in China, targeting the inhibition of the alternative complement pathway to reduce glomerular inflammation and complement-mediated kidney injury. After being approved for the treatment of adult C3 glomerulopathy (C3G), it has now been approved for IgA nephropathy. This precise targeted therapy can provide more effective renal protection for patients with IgA nephropathy while reducing side effects. Notably, complement B factor is currently the most crowded target in the IgA nephropathy drug development field. According to Pharnexcloud data, at least six pipelines have entered the clinical stage in China.

The global Phase 3 clinical study APPLAUSE-IgAN, published in The New England Journal of Medicine, showed that a reduction in the morning urinary protein-to-creatinine ratio (UPCR) could be observed in patients by Week 2. By Month 9, proteinuria was significantly reduced by 38.3% compared to the placebo group, with excellent tolerability and safety profiles and no observed increase in infection risk. The incidence of adverse events in the clinical trial was similar to that of the placebo group, with most being mild to moderate and reversible.

Notably, although Novartis had two new drugs approved in a month, the three drugs are more complementary than competitive in terms of their mechanisms of action. The three are expected to jointly expand the market.

For instance, Nefecon intervenes in the upstream of the disease through immune regulation mechanisms, while Atrasentan reduces proteinuria and protects renal function via non-immune pathways. The two have different mechanisms of action and are not in a simple competitive relationship; patients at different stages of the condition will have different choices. Based on previous key clinical trials, it is possible that multiple drug combination therapy regimens may emerge in the future.

Another noteworthy drug is Spebrilimab, which has just submitted its application for market approval in China. In IgA nephropathy, B cells are responsible for producing key components of circulating immune complexes—Gd-IgA1 and IgG/IgA anti-glycan autoantibodies. Both BAFF and APRIL play critical roles in B cell homeostasis and function. Current development strategies targeting this pathway include: BAFF inhibitors, APRIL inhibitors, or dual inhibitors.

Sibeprenlimab, developed by Otsuka Pharmaceutical, is a monoclonal antibody targeting the inhibition of APRIL. Its core mechanism of action involves selectively binding to and inhibiting the activity of APRIL, playing a key intervention role in the pathological process of IgA nephropathy. If successfully approved, it will become the first innovative drug in the field of IgA nephropathy treatment to target and inhibit the proliferation-inducing ligand (APRIL).

It can be seen that IgA nephropathy is no longer a "no man's land," with various emerging therapies being approved one after another, and the market is undergoing changes. At this moment, apart from multinational corporations (MNCs), domestic pharmaceutical companies are naturally not willing to lag behind.

Novartis lagged behind, while the closely following domestic pipelines quickly heated up this track.

The exciting news of Nefecon's August sales reaching 500 million has not yet faded, and within less than 20 days, Novartis has received approval for two new drugs and Otsuka Pharmaceutical has submitted a product application. At the current pace, Nefukang's first-mover advantage is expected to further expand.

Novartis' layout in the nephrology field cannot be said to be late, but it seems they got up early only to arrive late.

Iptacopan is not only used for paroxysmal nocturnal hemoglobinuria, but its nephropathy indication expansion was initiated as early as 2019. In 2023, Novartis acquired Chinook for up to $3.5 billion to obtain Atrasentan. In April 2025, Novartis announced the acquisition of Regulus for up to $1.7 billion to obtain the nephropathy drug Farabursen. Additionally, Novartis has zigakibart, a subcutaneously administered anti-APRIL monoclonal antibody for the treatment of IgA nephropathy, in Phase 3 clinical trials.

However, in Chinese market, Novartis fell behind. At the end of 2023, Nefecon and Iptacopan were successively approved in China. Nevertheless, Nefecon was approved for IgA nephropathy, while Iptacopan was approved for paroxysmal nocturnal hemoglobinuria and adult C3 glomerulopathy. In 2024, Nefecon quickly captured the market with its first-mover advantage and further expanded its volume in 2025 by being included in the medical insurance system.

Nowadays, the approvals of Atrasentan and Iptacopan for IgA nephropathy indications came less than a month apart, which is not something praiseworthy for MNCs. According to the development pace of the domestic market, Atrasentan and Iptacopan would need to wait at least until 2027 to achieve volume expansion through medical insurance, while also facing the competition from Otsuka Pharmaceutical's Sibeprenlimab.

Moreover, the pipelines of other domestic pharmaceutical companies are also accelerating.

At the end of August, Romegen announced that the domestic Phase 3 clinical study of Telitacicept for the treatment of IgA nephropathy had reached its primary endpoint, demonstrating good tolerability and safety. An application for marketing approval will be submitted as soon as possible. Telitacicept exerts systemic immunomodulatory effects by simultaneously blocking the BLyS and APRIL pathways, effectively reducing the number of mature B cells and plasma cells, inhibiting abnormal immunoglobulin production at the source, and blocking the renal damage process.

This Phase 3 clinical trial enrolled 318 adult IgA nephropathy patients who were receiving standard treatment. The trial group received 240mg of Telitacicept subcutaneous injection once a week. Results from Stage A of the study showed that after 39 weeks of treatment, compared with the placebo group, the 24-hour urine protein-to-creatinine ratio (UPCR) in the Telitacicept group was significantly reduced by 55% (P<0.0001), while also demonstrating good safety and tolerability.

As the world's first dual-target fusion protein drug targeting BLyS/APRIL, Telitacicept has shown great potential in the field of autoimmune disease treatment. Previously, Telitacicept has been approved for systemic lupus erythematosus, rheumatoid arthritis, and myasthenia gravis indications. If it is further approved for IgA nephropathy, it will further strengthen its competitive barrier.

Interestingly, Sibeprenlimab, which also inhibits APRIL to block B-cell activation, previously garnered industry attention with a 51.2% reduction in proteinuria. This time, Telitacicept has presented even better data. Additionally, the clinical study sizes of the two are comparable, providing strong statistical persuasiveness. However, their relationships with existing treatment regimens differ. From the design of their Phase 3 clinical trials, Telitacicept is used as an add-on therapy to standard treatment, while Spebrimab is more suitable for use in earlier to mid-stage disease progression.

It can be seen that with the approval of drugs such as Nefecon and Atrasentan, as well as the research breakthroughs of innovative drugs like Telitacicept and Sibeprenlimab, the treatment of IgA nephropathy is beginning to move towards individualization and precision. This allows drugs with different mechanisms to be used for patients with different phenotypes, and combination therapy may become a future trend.

Of course, there are more Chinese pipelines accelerating to catch up. Looking at the four technical pathways under the AIBC precision treatment framework, each route has pipelines that have entered the late clinical stage. For instance, Hengrui's HR19042, Shengdi Pharmaceutical's HRS5965, and Zhikang Hongren's SC0062 are all in Phase 3 clinical trials.

From the pipeline layout perspective, the IgA nephropathy treatment market is transitioning from symptomatic treatment to targeted curative therapies. Currently, the only drugs approved globally for IgA nephropathy treatment are Everest Medicines' Nefecon, BMS's Sparsentan, Novartis's Atrasentan, and Iptacopan. Although Nefecon has experienced explosive growth due to its first-mover advantage, the next generation of disruptive therapies is already on the horizon.

In the next 3 to 5 years, China's IgA nephropathy market may witness the launch of nearly 10 innovative drugs. Although Frost & Sullivan predicts that the number of global IgA nephropathy patients will reach 10.2 million by 2030, with approximately 4 to 5 million patients in China, it remains uncertain whether the market can accommodate so many new drugs. By then, it will be worth watching whether the market will shift from blue to red or if a particular drug will break through and dominate the majority of the market.