CSPC doesn't have to follow Hengrui

Cspc Holdings (01393.HK) has been at the center of controversy recently.

In the interim results announced at the end of August, CSPC Holdings saw a significant 18.5% drop in revenue, which stands out starkly among the top tier of domestic innovative pharmaceutical companies (Sino Biopharmaceutical +10.7%, Hansoh +14.3%, Hengrui +15.88%). This decline, coupled with the earlier "preview-style BD" announcement, clearly reveals the difficulties and anxieties CSPC is currently facing.

The decline in CSCP' performance was caused by the centralized procurement. Hengrui also experienced a similar performance hit in 2021. Times have changed, and the methods to solve problems must change as well. Following Hengrui's path won't help CSPC reach its target. This time, CSPC is preparing to make a bold bet on AI for a chance at the future.

1Centralized procurement leads to performance pressure

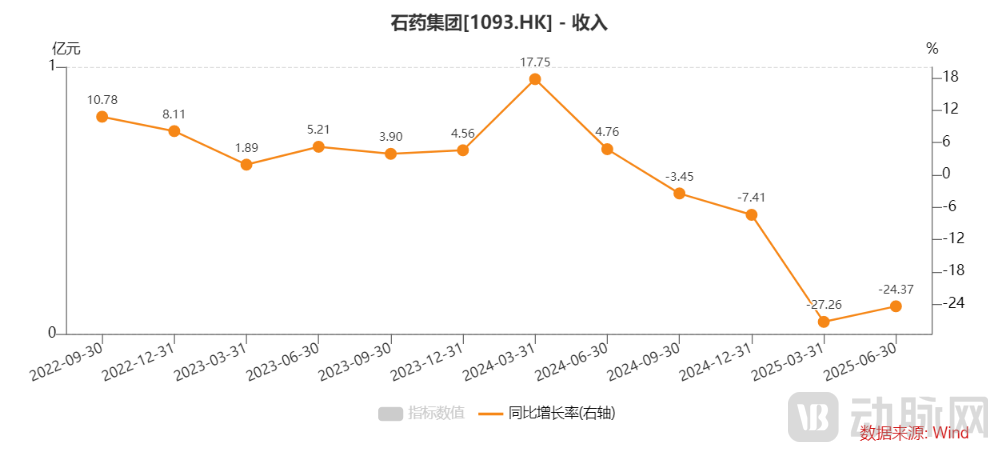

The decline in CSPC' performance has been relatively evident since the third quarter of last year. Previously, the prices of CSPC’s two products, Jinyouli and Duomeisu, were reduced by approximately 58% and 23%, respectively, in the "3+N" alliance drug procurement in the Beijing-Tianjin-Hebei region. These changes began to be implemented in various related provinces starting in March 2024, directly dragging down the revenue growth rate of CSPC in the third quarter of last year.

In the tenth batch of centralized procurement carried out at the end of 2024, CSPC was once again heavily impacted, with a total of 15 products included. The price reduction for most of these products exceeded 90%, significantly dragging down CSPC's performance.

Figure 1. Year-on-year growth rate of CSPC's finished drug revenue (Source: Wind)

Verticle line to the left (RMB 100 million), Orange line (YoY growth rate)

For example, the winning bid price of Duomeisu in the tenth batch of national centralized procurement dropped to RMB 98 per vial, with a reduction of 89%, and will be implemented in April 2025. The significant drop in product prices has put enormous pressure on sales revenue in the anti-tumor field.

Financial reports show that anti-tumor drugs became the hardest hit area for CSPC in the first half of 2025, with a decline of over 60%. Other fields also saw a decrease of around 20%, illustrating the significant performance pressure.

CSPC also has businesses in vitamin C, antibiotics, and functional foods, which grew by 21.6%, 0.9%, and 8.0% respectively in the first half of this year. These can cushion the decline in revenue from CSPC’s finished drug business. However, these three segments account for only 22.79% of CSPC’s total revenue, offering limited support to the company's overall income. More importantly, CSPC is considered a leading player in China’s innovative drug sector, making changes in revenue from its finished drug business a core focus of market attention.

The situation where revenue significantly declines due to products being centrally included in bulk procurement has also occurred for Hengrui.

The third batch of China's centralized procurement, the implementation of which began in November 2020, involved six of Hengrui's drugs: Capecitabine, Ambroxol Hydrochloride Tablets, Febuxostat, Letrozole, Celecoxib, and Tamsulosin Hydrochloride Sustained-Release Capsules. The inclusion of these products in the centralized procurement significantly impacted Hengrui's revenue. In addition, Hengrui’s innovative drug camrelizumab has been subject to the national medical insurance negotiation price since March 2021, with a reduction of up to 85%. This led to negative growth in camrelizumab’s sales revenue afterward, resulting in a performance trough for Hengrui in 2021.

Figure 3. Hengrui's year-over-year revenue growth rate (Source: Wind, VCBeat)

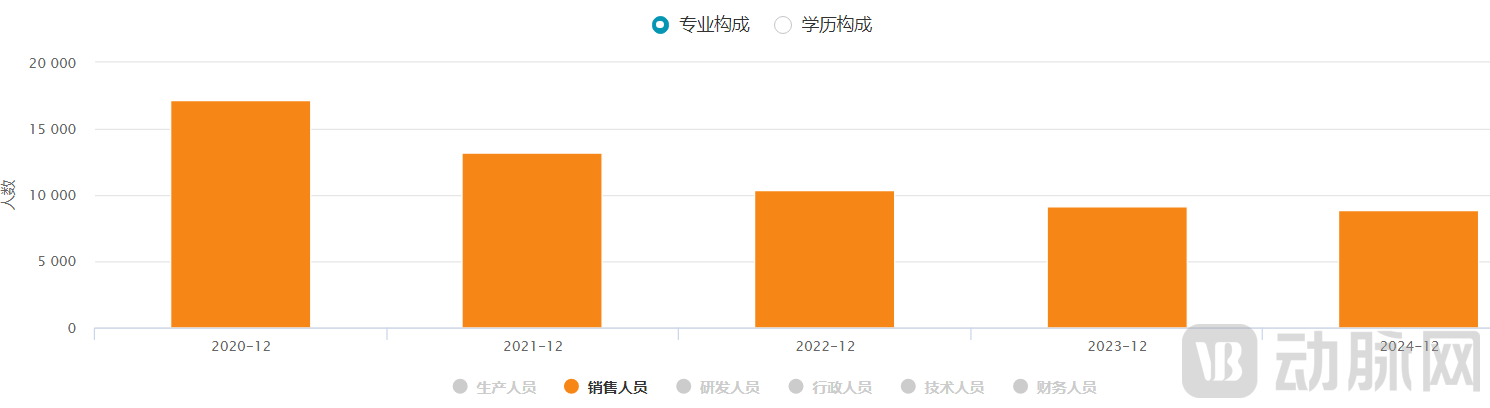

To break through its performance challenges, Hengrui has taken two major measures: first, it reduced the number of sales personnel and placed greater emphasis on R&D investment; second, it shifted from the previous flat R&D investment model to focus resources on core pipelines. By improving quality and efficiency, Hengrui gradually emerged from the performance trough of 2021 and returned to a double-digit growth track. The series of adjustments made by Hengrui in recent years have also been regarded as a typical case of large pharmaceutical enterprises overcoming difficulties.

Figure 4. Number of Hengrui Pharmaceuticals sales personnel (source: wind)

Now, the same challenge is once again placed before CSPC, but times have changed. This time, the company has chosen to bet on AI as a way to break through.

2CSPC's Path to Breakthrough

The way out for CSPC is based on its own reality.

From the 2025 interim report, we can see that nervous system drugs account for more than one-third of CSPC finished drug business, holding a pivotal position that far exceeds the oncology (10.25%) and anti-infective (16.17%) segments. Consequently, the future development of nervous system drugs is a major focus for Shiyao, and they also allow the company to differentiate itself from innovative drug companies fiercely competing in red-hot areas like oncology and immunology. The importance of nervous system drugs within Shiyao is self-evident.

In recent years, technologies such as ADCs, bispecific antibodies, and CGT have gained significant attention. However, the biggest challenge for these large-molecule drugs in the nervous system field is their difficulty in crossing the blood-brain barrier to reach therapeutically effective concentrations. In contrast, small-molecule drugs can penetrate the blood-brain barrier more easily. Currently, there are significant unmet clinical needs in areas such as depression, epilepsy, Parkinson’s disease, and Alzheimer’s disease. These diseases are more likely to benefit from the advantages of small-molecule drugs in the future. Moreover, AI technology offers even greater advantages in the development of small-molecule drugs.

It is thus clear that CSPC's partnership with AI is neither a sudden impulse nor a move to ride a market trend, but a strategic decision driven by its own needs and technological development. Moreover, CSPC’s “bet” on AI is particularly resolute.

The concept of using AI to empower small-molecule drug design is being implemented by Shanghai Yishi, a subsidiary of CSPC, according to sources who know CSPC's AI operations well. They shared with VCBeat that Shanghai Yishi is a wholly owned subsidiary of CSPC Enbipu, located within CSPC’s Shanghai R&D center, and has already established a research team of several dozen members.

In the 2024 annual report and the 2025 interim report, CSPC mentioned AI significantly more times. While maintaining its "leading position in the AI pharmaceuticals field," CSPC has elevated AI to a higher strategic role: driving the transformation of China's innovative pharmaceutical companies from "product output" to "technology platform output," and shifting from being a "technology licensor" to a "global co-developer." This means that CSPC's ultimate goal is to evolve from being a provider of innovative products to becoming a solutions provider.

In order to achieve this goal, CSPC successively established cooperative relationships with XtalPi, Insilico Medicine, and Huawei Cloud after August 2023, using AI technology to assist in drug design and improve the efficiency and success rate of new drug screening.

In the design and development of small molecule drugs, AI technology has the most significant empowering effect on innovative pharmaceutical companies. Taking XtalPi's small molecule design platform as an example, this platform can generate tens of millions of molecules within one to two days, providing the possibility for further exploration of more novel drugs. Using the designed tens of millions of molecules as a starting library, researchers can use AI models to predict their drug-like properties, such as solubility and ADMET characteristics.

The development of candidate drugs is an optimization process among properties such as potency, selectivity, bioavailability, and toxicity, with significant uncertainty. Traditional methods can only evaluate certain key drug-like properties at later stages of development, often leading to suboptimal candidate molecules entering subsequent development phases, which increases development costs. With AI technology, researchers can screen out high-quality candidate molecules at the early stage of drug discovery, thereby improving R&D efficiency and reducing costs.

In addition, AI can also empower text streams and data streams, which will greatly improve the R&D efficiency of pharmaceutical companies. According to Li Xing, founder and CEO of Deep Intelligence Pharma, the AI tools they developed can participate in the entire process, including literature research, clinical trial design, data management, data programming, and the writing of regulatory submission documents. "Document generation time is reduced by over 90% while the output result reaches an accuracy of over 98%. Researchers only need to give the final approval," Li Xing told VCBeat.

At present, domestic innovative drug companies rely on "more, faster, better, and cost-effective" to participate in global competition, which means more R&D pipelines, faster R&D progress, higher R&D quality, and lower costs. In these aspects, AI technology can bring help to innovative drug companies.

3The results of the transformation become visible

More than a year after betting on AI, the results have started to show: In October 2024, CSPC signed an exclusive licensing agreement with AstraZeneca for YS2302018. CSPC will receive a total payment of up to $2.02 billion, including a $100 million upfront payment; In December of the same year, CSPC reached a global licensing agreement with BeOne Medicines for SYH2039 and will receive total payments of $1.835 billion, including a $150 million upfront payment.

Notably, both YS2302018 and SYH2039 were discovered by CSPC through its AI-driven small molecule drug design platform. This platform utilizes AI technology to analyze the binding modes of target proteins with compound molecules and optimize their design, ultimately screening for small molecule drugs with high activity and high selectivity. This highlights the value of CSPC's AI platform in new drug development.

Following this, the collaboration between CSPC and AstraZeneca has taken a step further. In June this year, CSPC and AstraZeneca reached a strategic partnership to jointly develop new oral small molecule candidate drugs using an AI platform, with a focus on indications such as immune diseases. The potential total value of the collaboration is $5.33 billion. Different from the previous single-product licensing model, this collaboration focuses on a series of candidate drugs targeting multiple targets and multiple indications. This also reflects AstraZeneca's recognition of CSPC' AI platform's new pipeline development capabilities.

Different from the cooperation model between AI companies and innovative pharmaceutical enterprises that we usually think of, AstraZeneca did not directly approach AI technology providers such as XtalPi and Insilico Medicine, but instead chose to cooperate with CSPC. This indicates that what AstraZeneca values is not the AI technology itself, but the product solutions brought by AI technology, namely, potential active molecules. CSPC effectively combines its small molecule development experience with AI technology, thereby better meeting the needs of multinational corporations.

This is backed by the continuous R&D investment from CSPC. In the first half of 2025, CSPC's R&D expenditure ratio has reached 20.21%, showing a steady upward trend.

Looking to the future, CSPC' prospects for transformation by betting on AI have become relatively clear, but the current pain is still unavoidable. The impact of centralized procurement on the company's revenue will persist throughout 2025 and extend into the first quarter of 2026. Thereafter, CSPC will gradually emerge from the bottom of its performance.

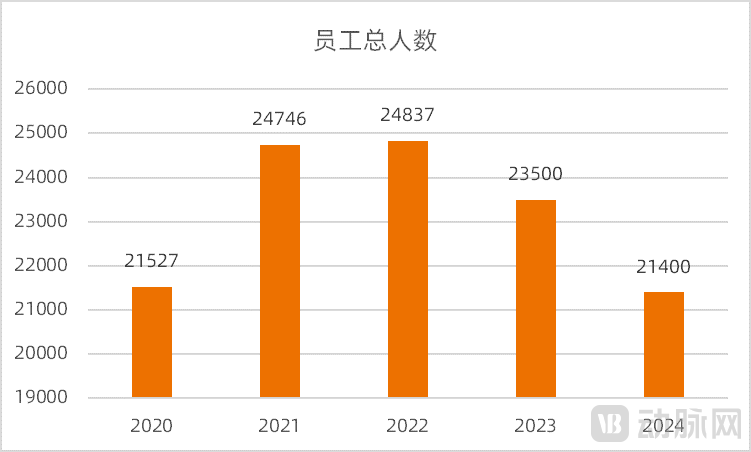

While actively transforming and expanding its revenue, CSPC is also adjusting its workforce, implementing both cost-cutting and revenue-boosting measures. Data shows that the total number of employees at CSPC began to decline rapidly from 2023, with a reduction of 1,337 people in 2023 and 2,100 people in 2024.

Figure 6. Total number of employees at CSPC (Source: wind)

Personnel adjustments have also shown positive results. In 2022, the per capita revenue of CSPC was RMB 1.2494 million, increased to RMB 1.3491 million in 2023, and further grew to RMB 1.3818 million in 2024. CSPC has become more "efficient."

How to get through the difficult period of performance adjustment? This is a test for every pharmaceutical company, whether it’s former Hengrui or today’s CSPC. However, CSPC undoubtedly has a better practical foundation. In 2021, the R&D capabilities of domestic pharmaceutical companies were relatively weak, and BD cooperation was mainly focused on license-in, with license-out accounting for only about 45%. As R&D capabilities have gradually accumulated, the pipeline value of domestic pharmaceutical companies has been recognized by multinational corporations, and license-out has become the mainstream, now accounting for over 90%.

Simply put, the innovation capability of domestic pharmaceutical enterprises has become stronger than four years ago. CSPC ranks among the top in terms of R&D strength in China's innovative drug industry, and it is only natural that CSPC will overcome its current performance difficulties through innovation. The emergence of AI will undoubtedly accelerate the realization of this goal.